Reliance on Remittance

Remittance has become an increasingly important aspect of Nepal’s economy, with millions of Nepali citizens working abroad and sending money home to their families. In recent years, remittance has contributed significantly to the country’s GDP, accounting for 20.76% in FY 2021/22. It has also played a crucial role in poverty reduction and increasing household income with one-in-three households in Nepal receiving remittance. In the first eight months of FY 2022/23, remittance inflows increased by 25.3% to NPR 794.32 billion.

However, there are also concerns about the long-term sustainability of remittance inflows and their impact on the country’s overall economic development. An increasing number of Nepalis seek approval for foreign employment, with 544,320 Nepalis leaving the country for foreign jobs within eight months of the current fiscal year. A majority of the remittance sent back is used for household consumption needs and to repay debts.

The government has recognized the potential that the diaspora and remittance hold, and has attempted to mobilize it through investments. An example is the Foreign Employment Saving Bonds (FESB)—a long-term debt security issued by the government to target the earnings of the Nepali diaspora for mobilizing capital for nation-building. However, it is yet to engage a significant amount of the diaspora despite having been issued for over a decade.

Consistent Under-subscription of FESBs

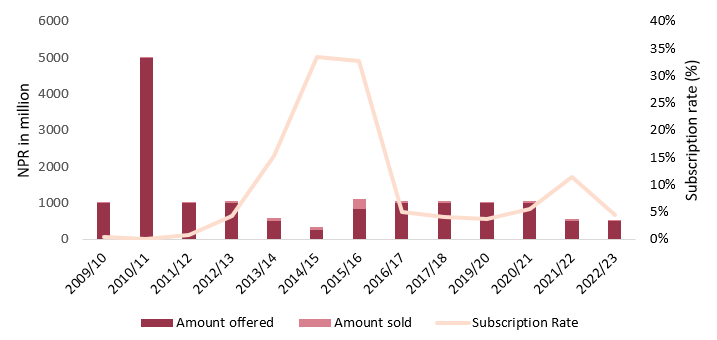

In the Annual Budget of July 2009, the then-Finance Minister Surendra Pandey announced a program to utilize remittance and invite investment from the diaspora. It was followed by the Nepal Rastra Bank (NRB) issuing the first FESB in June 2010 by floating NPR 1 billion with an interest rate of 9.75% for five years. However, only bonds worth NPR 4 million were sold. The trend of heavy under-subscription has continued in every issue to date, putting the average subscription rate of FESB at just 5.22% in 2023. The latest issue was in 2023, wherein, the NRB floated NPR 500 million worth of bonds at 12.5% for five years. However, the subscription was worth only NPR 22.4 million (Figure 1: Subscription trend of FESB).

Figure 1: Subscription trend of FESB

Source: Nepal Rastra Bank, Time Series data of Foreign Employment Saving Bonds Issued, March 2023

Issues of the FESB

Similar diaspora bonds have been successful in many other countries in financing various development projects and funding the economy in times of need. However, Nepal has continuously been unable to engage its diaspora population. Despite this, no thorough study has been conducted to identify the reason or possible avenues to increase the interest of the migrant worker population.

A reason for the disinterest in the bond could be the low confidence in the government. A majority of the people are migrating to foreign lands to search for opportunities they could not access in Nepal. While FESBs are said to be used for the development of various infrastructure projects, they are not issued in the name of a particular project, which makes their expected use unclear. With multiple projects getting delayed for years due to poor preparatory work and having low capital expenditure, migrant workers have reasons to believe sending money directly to their families would be a better choice.

Nepal’s constantly depreciating currency could be another deterrent for migrant workers as FESBs are issued in Nepali rupees. Not having issues in multiple currencies, unlike other countries like Ethiopia and India, opens the investor to forex risk as the rupee depreciates against the currency the migrants use, and they receive their returns in Nepali rupees. Further, the minimum amount of purchase has been set to NPR 10,000, and they are not as liquid as other assets considering Nepal’s underdeveloped secondary market for bonds. While the interest rate on FESBs is higher than other bonds, people can get comparable returns through long-term fixed deposit accounts. Furthermore, the NRB does not provide bonds with various maturities with all FESBs maturing in five years, which coupled with the illiquidity, could be serving as a deterrent.

The lack of promotion that the bonds receive has been most widely critiqued for the lukewarm response of the diaspora. Not having enough publicity translates into a majority of the diaspora not even being aware of the bonds. Further, the bonds also have a short period of sale with the first issue in FY 2009/10 lasting from June 30 to July 12. It has increased since then, having a subscription period of almost a month in 2016. The latest issue had a subscription period of 20 days, opening on February 26, 2023, and closing on March 17, 2023. However, this has also failed to make a significant impact on the number of buyers. The subscription period may still be too short for migrant workers to procure the needed funds. FESBs also had a very limited target in its first issue in FY 2009/10, excluding migrants in India and Organization for Economic Cooperation and Development (OECD) countries. The NRB tried to have a more inclusive target audience by allowing families of migrant workers to purchase the bonds from the remittance in 2011 and allowing Non-resident Nepalis (NRNs) in 2012. While they have marginally raised subscription rates, the bonds are still undersubscribed by a huge amount.

Building a Better Image

Diaspora bonds have been successful in many countries. Israel’s success in this area can be attributed to the crucial factors of “trust and emotional ties” and “limited forex risks.” For Nepal to effectively engage its migrant workers from abroad, it is essential to establish a strong foundation of trust with the diaspora community to ensure their investments are being utilized effectively. Furthermore, addressing the forex risks involved is critical and requires the implementation of a reliable hedging mechanism. Lastly, Nepal must conduct an official study to determine the reasons for the previous failures of FESBs to allow the government to make the investment climate more favorable for NRNs. Particular focus should be given to the bureaucratic processes NRNs need to go through. These changes are required for the FESBs to be able to include and utilize the diaspora in the nation’s development.

Sukeerti Shrestha holds a Bachelor's degree in Business Administration (Finance) from Kathmandu University. She is passionate about development economics and sustainability, with a keen interest in community-inclusive policy making. Currently, she works as an Aspiring beed at beed Management, building on her prior experience in management consulting and social enterprises.