Concessional loan is a loan available to borrowers with more favorable terms than available in the open market. The favorable terms can include lower interest rates, longer grace and repayment periods, or relaxed collateral requirements. The Government of Nepal has been providing interest subsidies on 10 different categories of loans for the last seven years. The interest subsidy covers a certain percentage of interest rate which lowers the cost of credit to borrowers. That’s why a concessional loan is often referred to as a “subsidized loan” in Nepal. Recently, the government substantially restructured the concessional loan program. On August 11, 2025, the Council of Ministers approved the “Interest Subsidy for Concessional Loans Procedures 2025” which replaced the “Interest Subsidy for Concessional Loans Integrated Procedures 2018.” Following this, Nepal Ratra Bank (NRB) issued a circular, urging Banking and Financial Institutions (BFIs) to provide concessional loans as per the new procedures. The renewed Concessional Loan Program will run until July 16, 2030.

Previous Loan Program and Its Impact

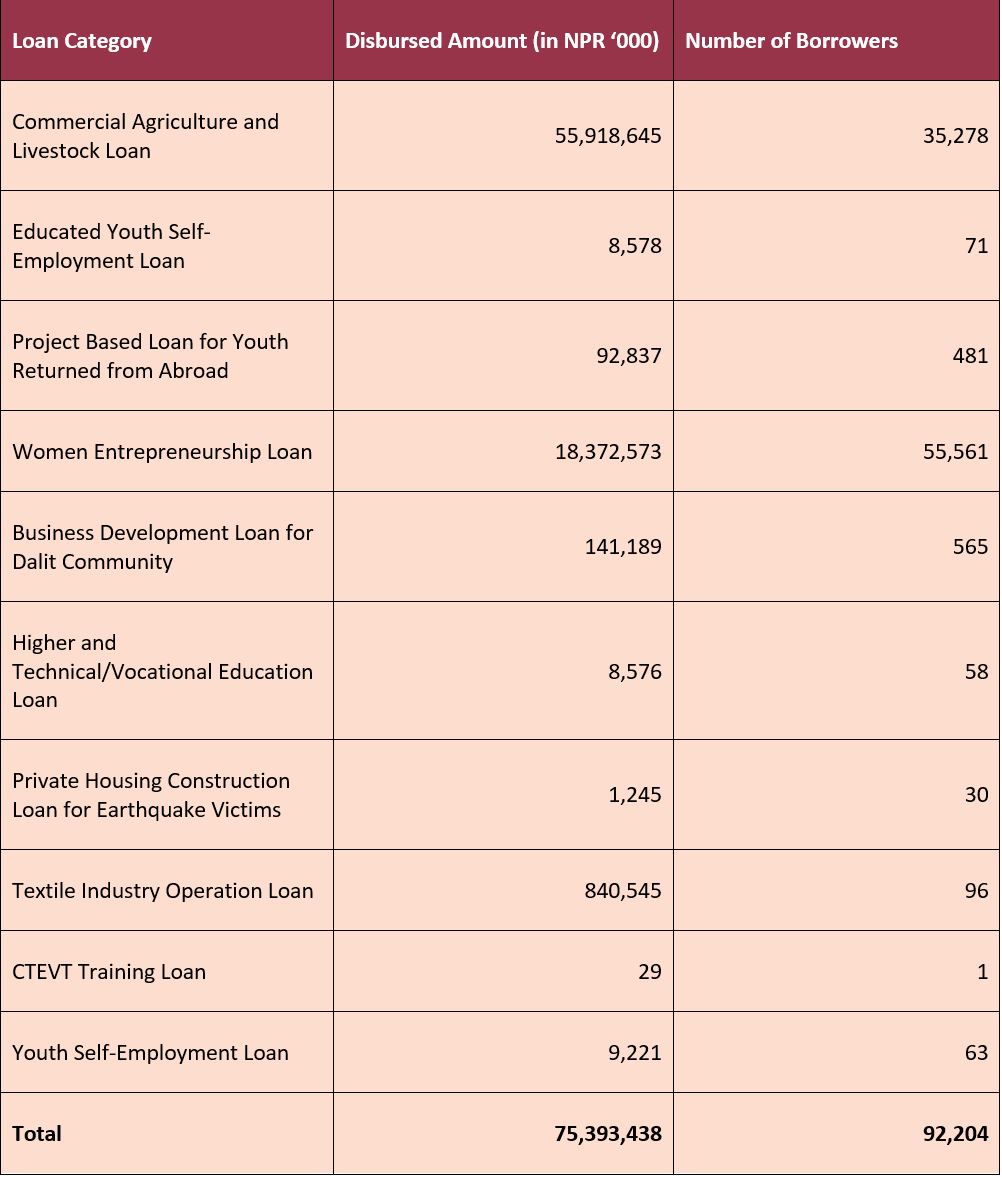

The main objective of concessional loans is to target priority sectors or groups and give them financial assistance to grow. Prior to restructuring, the concessional loan program used to offer loans in 10 different categories as shown in Table 1.

Table 1. Loan Categories with Disbursed Amount and Number of Borrowers

Source: Nepal Rastra Bank

As of September 17, 2025, NPR 75.40 billion was disbursed to 92,204 borrowers under these loan categories also shown in Table 1. The government used to provide 6% interest subsidy on Women Entrepreneurship Loan while other categories received 5% interest subsidy. For example, if a bank charges you 10% interest rate for a loan that falls under Women Entrepreneurship Loan category, the 6% interest subsidy would lower the effective interest rate to just 4%. It means you have to pay only a 4% interest rate on your loan. To cover these interest subsidies, the government spent NPR 28.49 billion. The finance ministry has opened a Subsidy Reimbursement Account at NRB where the ministry deposits the subsidy amount. At NRB, BFIs can quarterly apply to reimburse the interest subsidy which they have provided to the borrowers. However, the ministry had not reimbursed around NPR 10 Billion interest subsidy for the last 2.5 years. As a result, BFIs did not disburse concessional loans suffering loss. Some BFIs were charging the market interest rate to borrowers, promising borrowers to return the subsidized amount after they receive the reimbursement from the finance ministry. On September 22, 2025, the finance ministry of the interim government released NPR 9.80 billion to reimburse the pending interest subsidy of the last seven quarters. It has given huge relief to BFIs and borrowers.

Commercial Agriculture and Livestock Loan accounted for 74% of the total loan disbursed while Women Entrepreneurship Loan accounted for 24%. The remaining 2% was disbursed in the rest of eight loan categories. Commercial Agriculture and Livestock Loan can increase agricultural productivity. The access to cheap credit allows farmers to invest in improved seeds, high quality fertilizers and modern technology that boost their farm production. Uprety (2022) found that the concessional loan improved the agricultural productivity in Dhunibeshi Municipality by around 3872 to 3896 kg per ropani per year. Similarly, Women Entrepreneurship Loan can empower not only women but also the entire economy. Khanal and Khanal (2024) surveyed 60 women entrepreneurs in Banke district who borrowed concessional Women Entrepreneurship Loan and found the loan increased their revenue, created new job opportunities and also helped to scale their businesses. Even though Commercial Agriculture and Livestock Loan and Women Entrepreneurship Loan have been effective, the concessional loan program should reduce its concentration in these two loans and also prioritize other categories.

The New Loan Program’s Policies

According to the Office of the Auditor General’s annual report for FY 2023/24 AD (2080/81 BS) , NRB conducted an internal study on effectiveness of concessional loan program through a consultant. The consultant examined 31,664 borrowers and found that 7% of the borrowers misused the fund, 6% borrowed multiple concessional loans, and 11% were suspected of misusing the fund. Similarly, 25.6% of Commercial Agriculture and Livestock Loan borrowers were found to misuse the concessional loan. Instead of using funds for designated activities, borrowers were found using the subsidized loan to buy real estate, automobiles, financing foreign jobs, or settling their previous loans. Some borrowers also register business in the name of women to receive the women entrepreneurship loan. The delay in interest subsidy reimbursement and misuse of the concessional loan program were the main basis to restructure the program.

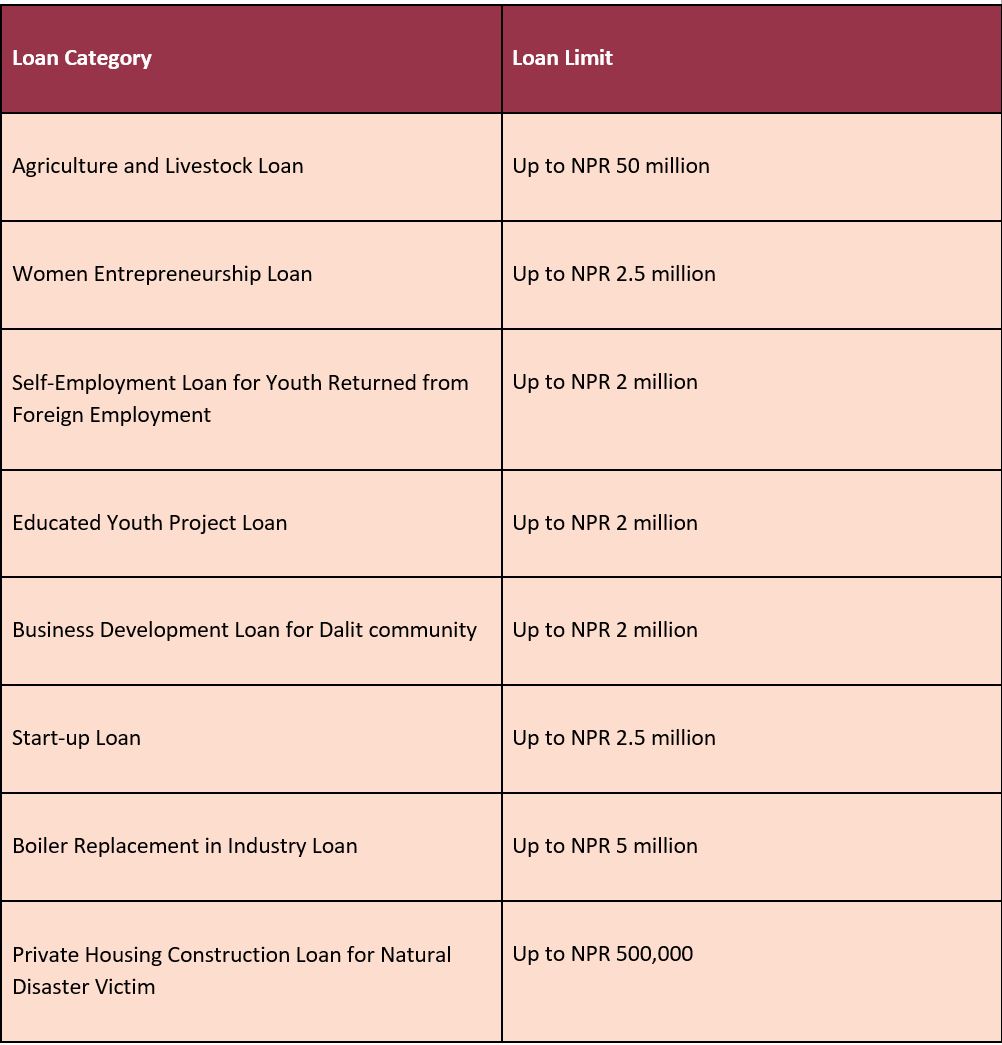

The renewed concessional loan program now provides loans under 8 different categories. It eliminated the previous 4 categories and added 2 new categories. Table 2 shows the loan categories with maximum possible loan disbursement amount.

Table 2. Categories of Loan Under New Concessional Loan Program

Except for Agriculture and Livestock Loan, the maximum loan limit of previous categories has increased. However, the government has decided to provide only a 3% interest subsidy on all the categories. Once approved, borrowers can receive the interest subsidy for up to 5 years.

Challenges of the Current Concessional Loan Program

The restructured concessional loan program, while notable, has a few challenges which need to be addressed in its early stage. This will guarantee the program’s reach to targeted groups and its overall effectiveness. In particular, There are three major challenges in the current concessional loan program:

Awareness and Access

Many people are not aware about the availability of a concessional loan program and the process to receive it. Out of 104 samples, Uprety (2022) found 25.53% of the respondents had no information on subsidized loans. Such information asymmetry needs to be addressed to make the program more inclusive. Uprety (2022) also pointed out that smallholder farmers have poor access to the subsidized Commercial Agriculture and Livestock Loan while large-scale farmers are reaping the benefits of this program. Similarly, Pradhan et al. (2019) observed that smallholder farmers do not have clear business plans, face collateral issues, and find the loan acquisition process to be lengthy with extensive paperwork. These hurdles prevent them from accessing the subsidized loan. In addition, Uprety (2022) found that people from rural areas lack access to concessional loans compared to people from urban areas. There has not been much effort to increase awareness and access of the program among the targeted group of people.

Requirement of Extensive Documentation

In Nepal, BFIs provide concessional loans who later reimbursed the interest subsidy from NRB. Currently, Xecuring a concessional loan from BFIs is time-consuming and complex, as it involves a lot of paperwork. For example, BFIs need information about the collateral and its valuation, business plans, insurance, bank statements, tax clearance, and many more documents to process the loan. This is reasonable from the BFIS’ viewpoint as they want to minimize the risk by preventing loan defaults. However, the extensive documentation requirement has become a hurdle for potential borrowers which discourages them from applying for the loan. Uprety (2022) found that 74% of the concessional loan borrowers from their sample claim the loan procedure to be lengthy, involving extensive paperwork. Among 104 samples, he also found that 68.57% have never applied for subsidized loans, thinking it’s a hassle to receive the loan. Therefore, BFIs need to ease the loan process with minimal documentation requirements.

Sufficient Monitoring and Supervision

Monitoring and Supervision is one of the key challenges of the concessional loan program. It determines whether the funds are used for designated activities or not. Under the new procedure, there are stricter regulations for monitoring and supervision of the program. According to the “Interest Subsidy for Concessional Loans Procedures 2025,” BFIs are required to monitor the effectiveness of concessional loan programs. They need to submit information about the amount of concessional loan disbursement to NRB on a monthly basis. Previously, they had to submit this on a quarterly basis. They also need to inspect the utilization of loans at least twice a year and submit the report to NRB. It used to be optional before. On the other hand, NRB is responsible for both the onsite and offsite monitoring and supervising the concessional loan program to prevent its misuse. It also publishes the names of borrowers who have borrowed more than NPR 10 million as a concessional loan on its website. For effective monitoring and supervision, both NRB and BFIs should be accountable.

Conclusion

There are substantial changes in the new concessional loan program. It reduced the number of loan categories and subsidized interest rate while increasing the loan limit. We found raising awareness on concessional loan program among the targeted group of people, simplification of the documentation requirements, and effective monitoring and supervision can result in successful execution of the program and prevent the misuse of the fund. The concessional loan program can increase domestic production, generate new employment opportunities, and promote entrepreneurship if implemented effectively.

Pawan Raj Dallakoti holds a BA in Liberal Arts with a concentration in Japanese Business and the Global Economy from Doshisha University, Japan. He also studied for a year at the School of Political Science and Economics, Waseda University as an exchange student. He is currently a Research Fellow at the Nepal Economic Forum (NEF). Prior to joining NEF, he interned at the National Policy Forum (NPF) and the SAARC Secretariat. His research interests lie in evidence-based policymaking in agriculture, energy, and environment.