Introduction

In recent years, a noteworthy trend in the financial world has been the remarkable rise in the popularity of cryptocurrencies. Cryptocurrencies, characterized by their decentralized nature and lack of government regulation, have presented unique challenges in terms of oversight and security. In response to these challenges, governments have begun exploring the creation of their own digital currencies. These government-issued digital currencies aim to bring regulatory control to the digital financial landscape, ensuring a higher level of oversight and safety for users. This proactive approach seeks to strike a balance between harnessing the benefits of digital currency and mitigating potential risks associated with unregulated cryptocurrencies.

Central Bank Digital Currencies (CBDCs) represent digital versions of a nation’s official currency, issued and guaranteed by the central bank. Unlike cryptocurrencies, CBDCs maintain a stable value, directly pegged to the country’s fiat currency. These digital currencies function as a digital equivalent of physical money, facilitating transactions electronically. Various CBDC models exist, encompassing account-based and token-based approaches. CBDC initiatives are motivated by several objectives, such as enhancing the efficiency and security of payment systems, fostering financial inclusivity, stimulating competition and innovation, enhancing transparency in financial transactions, reducing the reliance on foreign currencies, lowering maintenance costs, and reinforcing financial stability.

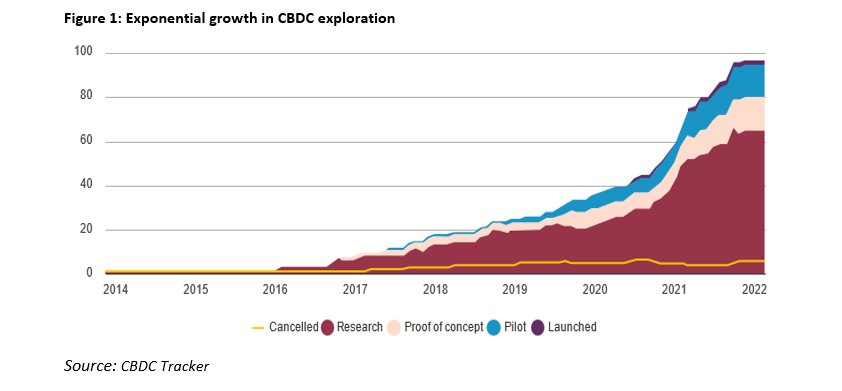

Central Bank Digital Currencies (CBDCs) are gaining global popularity, with 130 countries, representing 98 percent of the world’s GDP, actively investigating the potential benefits and challenges associated with CBDC implementation. The Asia-Pacific (APAC) region has the largest number of countries that have CBDC pilots launched, including Japan, South Korea, China, Hong Kong, India, Singapore, Thailand, Malaysia, and Australia. The APAC region is also involved in several cross-border CBDC projects within the region and across regions. The Middle East and North Africa (MENA) region has several countries actively investigating the potential benefits and challenges associated with CBDC implementation. One of the notable CBDC explorations in the region was a joint effort between the United Arab Emirates and Saudi Arabia called Project Aber. The European Central Bank (ECB) is also exploring the possibility of issuing a digital euro.

Among the G20 nations, 19 are in advanced stages of CBDC development, with 9 of them already in pilot phases. Over the past six months, nearly every G20 country has made substantial progress and allocated additional resources to their CBDC initiatives. Furthermore, 11 countries within this group have successfully launched digital currencies, with China’s pilot program, reaching 260 million users, being tested in over 200 scenarios, including public transit, stimulus payments, and e-commerce.

Retail vs Wholesale CBDCs

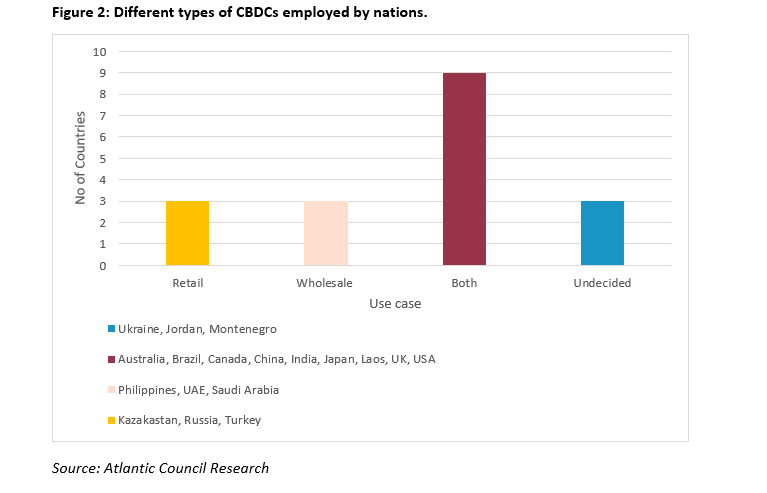

CBDCs come in two primary categories: Wholesale and Retail. Wholesale CBDCs target interbank settlements and large-scale financial transactions among institutions. They excel in handling massive, infrequent transactions like settling securities trades and interbank fund transfers. Retail CBDCs, conversely, cater to the general public and institutions, facilitating numerous small-value transactions, essentially serving as digital cash. This form of CBDC can advance financial inclusion by providing easy access to central bank money for those without traditional banking services, yet it also raises privacy concerns due to its widespread public use.

In this context, a third category known as Hybrid CBDCs emerges, combining features from both wholesale and retail CBDCs. Hybrid CBDCs offer a versatile approach that can boost financial inclusion by providing secure digital currency for individuals while simultaneously enhancing the efficiency and security of financial institutions and markets. This innovative middle ground within the CBDC spectrum aims to strike a balance between accessibility and privacy, potentially revolutionizing the digital currency landscape.

Nepal’s journey into the realm of CBDCs begins with a comprehensive research phase. The Nepal Rastra Bank (NRB), is actively studying the feasibility and implications of introducing CBDCs into its financial ecosystem. This research involves a deep dive into the technical, economic, and regulatory aspects of CBDC adoption. NRB recently is planning to take a significant step by establishing a dedicated division within its Payment Systems Department. The primary objective behind this move is to pave the way for the potential introduction of digital currency in Nepal in the near future. NRB’s strategic plan includes initiating a pilot testing phase for the CBDC within the next eighteen months. This development was influenced by a concept paper on CBDC that the central bank published in August 2022. In response to the feedback received on this concept paper, NRB is actively working to create the necessary mechanisms and infrastructure for the eventual launch of digital currency in the country. As part of this effort, the NRB study emphasized the importance of establishing a distinct organizational structure and a specialized team to drive forward the CBDC project.

The NRB has urged lawmakers in Nepal to amend the Nepal Rastra Bank Act and the Banks and Financial Institutions Act to include provisions related to digital currency issuance. The NRB emphasizes that for the CBDC initiative to move forward, a change in the legal framework is necessary. Once these legal amendments are in place, a clearer path for CBDC implementation will emerge. The NRB is keen on exploring CBDCs as they have the potential to enhance cross-border payment efficiency. Initially, the possibility of using a Wholesale CBDC is being considered, although the final decision will depend on recommendations from relevant institutions. The NRB believes that the success of CBDCs hinges on public and business adoption, with CBDCs being used for settling transactions, much like traditional banknotes or commercial papers.

The introduction of a CBDC in Nepal offers several opportunities and challenges. On the positive side, CBDC has the potential to enhance payment access for Nepal’s unbanked population, bolster the resilience of the payment system by reducing cash reliance and improving cross-border payment efficiency, while also lowering currency management costs for both the central bank and financial institutions. Furthermore, CBDC can play a pivotal role in promoting financial inclusion, streamlining transparent welfare distribution, and combating financial crimes such as money laundering and terrorist financing. However, significant challenges must be addressed, including the need for legal reform to empower the central bank for CBDC operations, conducting a comprehensive feasibility study to assess economic, technical, legal, operational, and scheduling aspects, initiating a public awareness campaign for public acceptance, substantial investments in upgrading Nepal’s system infrastructure, and ensuring interoperability with domestic payment systems to facilitate access to the Indian rupee, requiring coordinated efforts between Nepal and India.

In conclusion, while implementing a CBDC in Nepal holds great promise for financial accessibility, resilience, and transparency, it also presents significant challenges. Addressing legal barriers, conducting thorough feasibility studies, and gaining public support are crucial for realizing CBDC’s full potential. Additionally, investing in infrastructure and achieving interoperability with neighboring nations are essential for successful implementation. Nepal’s careful consideration of CBDC’s advantages and complexities will shape its financial future.

Sanjit Tuladhar is a beed at beed Management and a Research Associate with Nepal Economic Forum (NEF). Sanjit holds a Bachelor’s in Business Studies from Tribhuvan University and is in the final stages of completing his Master’s in the same field. His work focuses on delivering actionable insights through strategic initiatives and dynamic sectoral studies that drive sustainable economic growth in Nepal and beyond.