Introduction

To boost economic activities and achieve higher economic growth, massive investment in infrastructure, technological innovation and development, machine learning, artificial intelligence, human capital, and environmental protection is required. The major sources of funds to finance such investments are taxation and public borrowing. In Least Developed Countries (LDC) like Nepal, there are limitations on raising revenue from taxation due to the low levels of income of people, low levels of economic transactions, and a possibility of increased burden on domestic economic entities. Therefore, public debt is seen as a feasible option to finance government expenditure and development projects for which the government lacks funds. Here, public debt is the total amount of debt that the government incurs to finance and meet its development budget.

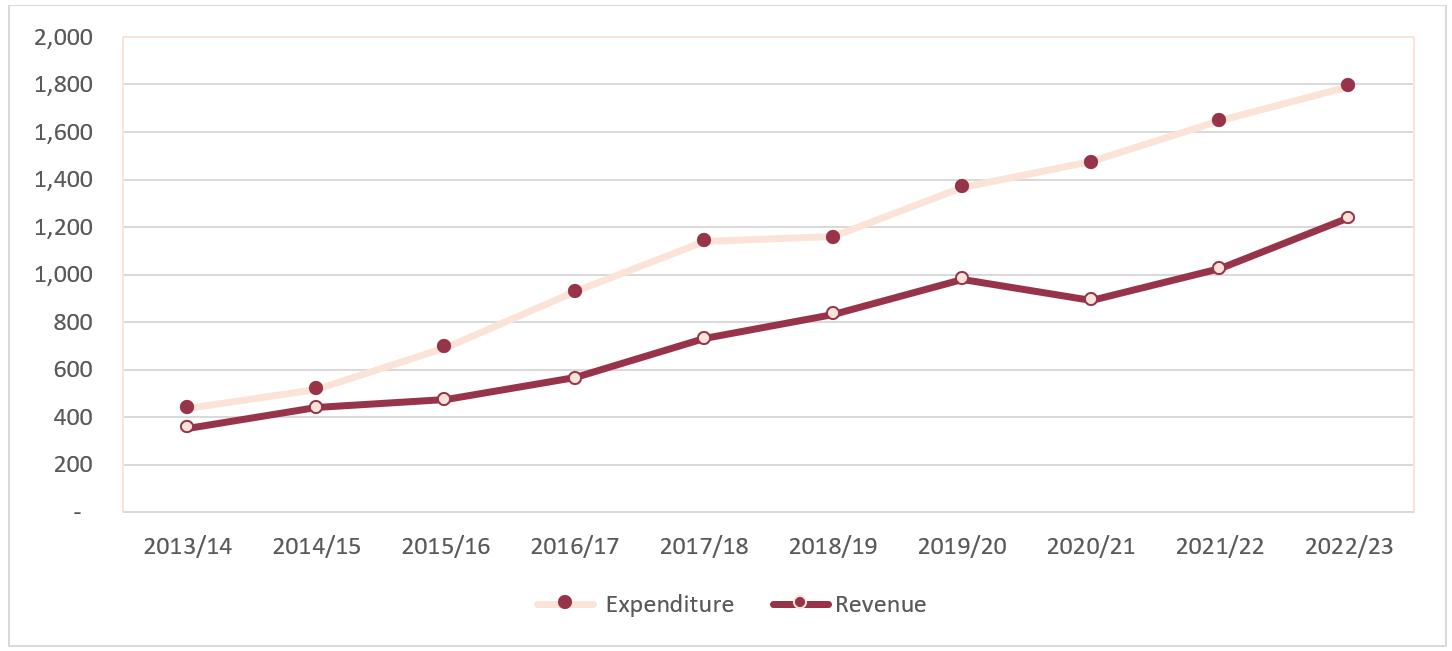

Figure 1: Estimated Expenditure and Revenue of Nepal (in NPR Billions)

Source: Budget Speech of respective year from Ministry of Finance

Moreover, Nepal’s budget deficit, which occurs when the expenses of the government exceed its revenue, has been gradually increasing over the years. In FY 2020/21, the budget deficit as a percentage of GDP was 7.1%. Deficit financing plays an important role in the yearly budget presented by the Government of Nepal, as it consists of 29.64% of the government budget. Annually, it has been increasing by 19.86% on average. Figure 1 shows a continuous and increasing fiscal deficit in Nepal, resulting in the government continuously taking loan for deficit financing.

While public debt is an important source of income for the Nepali government and is important for a developing nation like Nepal, relying heavily on borrowing can be costly and risky.

Trends and Current Debt Situation in Nepal

Historically, Nepal has been borrowing domestically and internationally to meet its development requirement; the Government of Nepal raised its first internal loan in 1951, and its first external debt in 1963. The external loan is the highest source of deficit financing, followed by internal debt and change in cash reserves, respectively.

Due to an increase in expenditure demands of post-earthquake reconstruction and federalism, government borrowing has increased significantly in recent years. In five years to 2020/21, total public debt increased by 148%. At the end of the fourth quarter of 2021/22, the total government debt reached NPR 2,011.95 billion, out of which external debt consisted of NPR 1025.84 billion and internal debt consisted of NPR 986.10 billion. External debt increased by 5.47% and internal debt increased by 12.16% as compared to the third quarter.

The total debt-to-GDP ratio, which is a metric comparing country’s public debt to its total economic output for the year, gives an overview of how capable a country is in paying its debt. It is an indicator of how much debt a country owes and how much it produces to pay off of its debt. The debt-to-GDP ratio of Nepal at the end of the fourth quarter of FY 2021/22 was 41.47%, where the external debt-to-GDP ratio was 21.14% and the internal debt-to-GDP ratio was 20.32%. This is a sharp increase as compared to the FY 2018/19, when the total public debt was estimated to be 30.1% of GDP, out of which the external debt to GDP ratio was 17% and the domestic debt to GDP ratio was 13.1%. The debt to GDP ratio has exceeded the periodic targets of the Sustainable Development Goals and the final 2030 target of 35%.

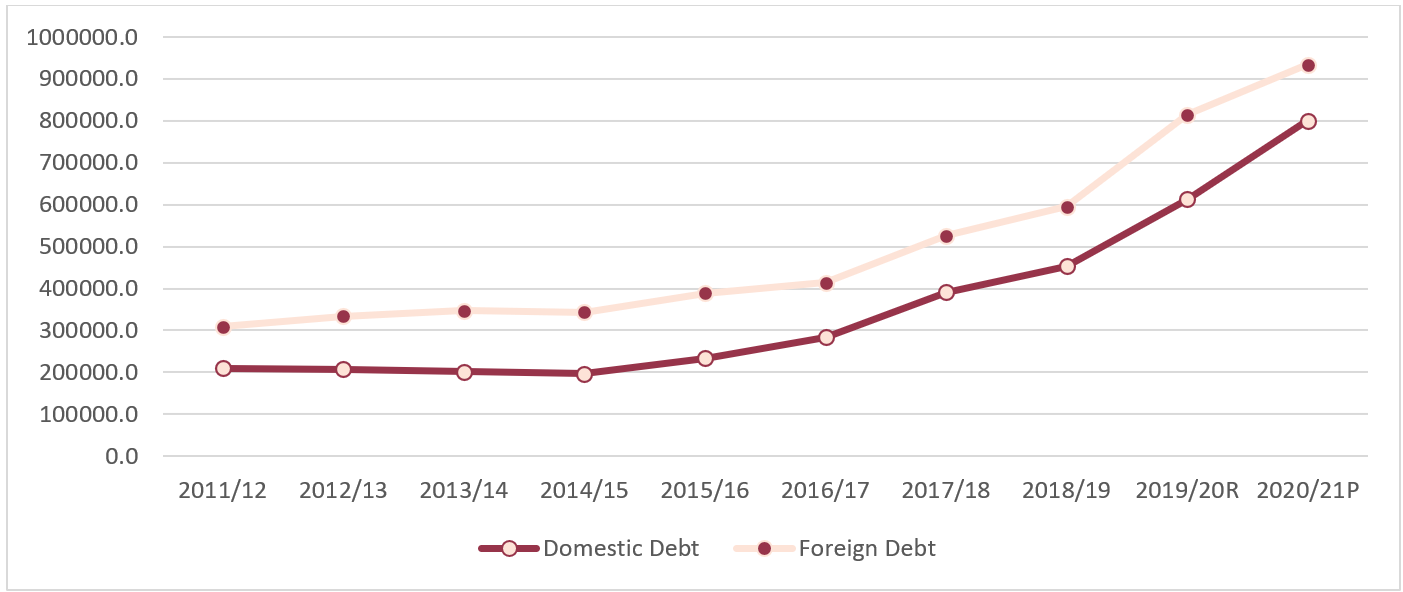

Figure 2: Outstanding Domestic Debt and Foreign Debt of the Government of Nepal (in NPR Millions)

P = Provisional Estimated

R= Revised Estimated

Source: Current Macroeconomic and Financial Situation Tables Based on Annual data of 2021.22-1 from Nepal Rastra Bank

Table 1: Annual Growth Rate of Outstanding Debt of the Government of Nepal

| Year | Growth Rate |

| 2011/12 | 18% |

| 2012/13 | 4% |

| 2013/14 | 2% |

| 2014/15 | -2% |

| 2015/16 | 15% |

| 2016/17 | 12% |

| 2017/18 | 31% |

| 2018/19 | 14% |

| 2019/20R | 36% |

| 2020/21P | 22% |

P = Provisional Estimated

R= Revised Estimated

Source: Calculated based on NRB’s data on the outstanding debt of the Government of Nepal

Over the period of FY 2011/12 to 2020/21, the public debt of the Government of Nepal has been significantly increasing (Figure 2 and Table 1). Between FY 2011/12 and FY 2019/20, the Compound Annual Growth Rate (CAGR) of the public debt of Nepal was 7%. The reason behind the increasing public debt of Nepal is the significant increase in the size of the budget over time; the expenditure of the Government of Nepal has been increasing, and the expenditure of the government is higher than its revenue (Figure 1).

Implications

Increasing public debt is a peculiar problem for debt management and poses a challenge to the economy. A study on the effect of public debt on Nepal’s economic growth discovered that government borrowing has mostly been funded on unproductive sectors, resulting in the government’s lack of money and having to take out an additional new loan to pay off the old loans. Further, this has resulted in an increase in the total outstanding public debt and its interest but no improvement in the debt repayment potential.

Moreover, while the country is borrowing more for deficit financing, a large portion of the government’s budget is being used for debt principal repayment and interest payment. While the government is estimated to earn NPR 1.24 trillion in revenues in FY 2022/23, it plans to pay 15% of its estimated revenue to foreign and domestic creditors. Overall, this negatively impacts the government’s ability to finance development activities within the country.

It is also important to analyze the debt situation of the country with regard to the foreign exchange reserve. A country needs to pay off its external debt with its foreign exchange reserve. While external loans are cheaper than domestic loans, external loans carry risk of foreign exchange fluctuations. The debt liability in the domestic currency terms of Nepal is on the rise due to the depreciation of the Nepali rupee against the US dollar. The outstanding debt-to-foreign exchange ratio, which was 26% in 2016/17, increased to 57% in 2020/21[1]. The depleting foreign currency reserve, and the increasing government borrowing from external creditors, could make debt payments in foreign currency increasingly difficult. This could push the country into the vicious cycle of borrowing more to pay off the existing external debt.

Conclusion

Currently, the government has taken many steps to decrease borrowing and increase the foreign reserve exchange of the country. For instance, the recently enacted Public Debt Management Act has capped external debt at one-third of the previous fiscal year’s GDP to curb the rising debt. Moreover, with the new law, the government can raise a maximum internal loan of NPR 256 billion for the current FY 2022/23. These policies are expected to discourage the government from borrowing recklessly and encourage it to make timely debt payments in order to be able to borrow more.

In addition to introducing policies to help reduce the Government of Nepal’s debt, the country needs to also use the borrowed money effectively. Currently, borrowing has mostly been utilized in unproductive sectors. To be able to repay the loans in the long term, the Government of Nepal should use the borrowed money to create a sustainable economy by investing in productive sectors with high levels of efficiency. This is especially more relevant now as Nepal is preparing to graduate from the LDC group in 2026, due to which Nepal may lose its benefits of a lower rate of interest. Therefore, to avoid further increasing Nepal’s debt burden after LDC graduation, the country should strategize and use the borrowed money more efficiently.

…

[1] Based on calculations from preliminary data on foreign debt and gross forex reserve provided by NRB

Aarya Rijal is a recent graduate with a B.A. in Economics from Union College, USA. Her key interests are in corporate finance, macroeconomics, and international economics. Before joining NEF, Aarya worked as a student data analyst and a research assistant at Union College. She is currently working as a fellow at NEF.