It is widely believed that China dominates Foreign Direct Investment (FDI) in Nepal. For instance, in 2021, Xinhuanet reported that “China remains the largest source of FDI for Nepal for 6 consecutive years”. However, a closer examination of foreign investments in Nepal paints a more nuanced picture. This research article examines Nepal’s FDI figures in three-folds. First, it goes directly to the source of this belief by looking at the Department of Industry (DOI) data between 2004 to 2023 and ranking countries based on FDI commitments to Nepal. DOI’s annual publication “Industrial Statistics” provides data on approved FDI commitments by country of origin and provides a sectoral breakdown. Second, it evaluates the actual total FDI stock in Nepal up to 2022 and the relative sectoral contributions using Nepal Rastra Bank (NRB) data. NRB’s annual “Foreign Direct Investment Survey” gives a snapshot of the actual FDI stock by country of origin. Third, it contextualizes China’s FDI in Nepal within South Asia. The United Nations Conference on Trade and Development (UNCTAD) provides FDI statistics at the global level for cross-country comparisons.

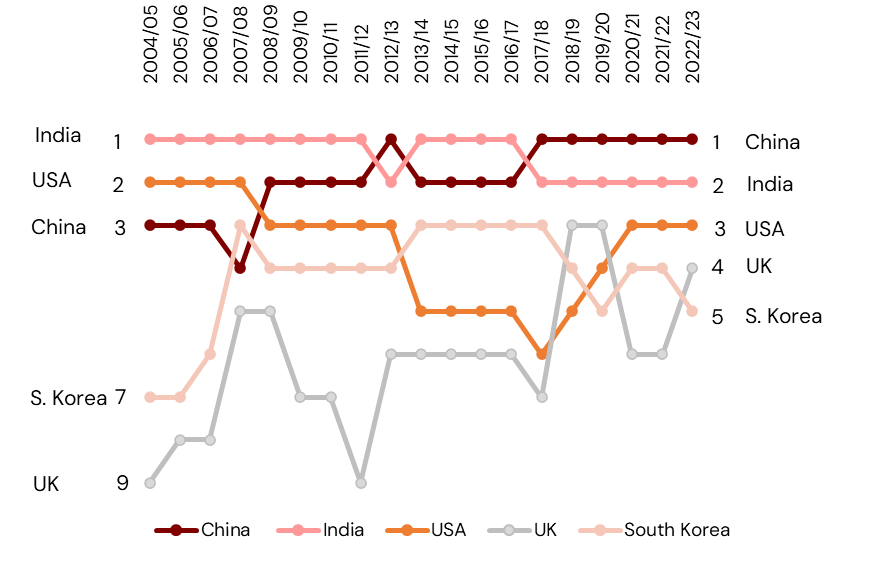

Neighborhood matters, as is evident in the case of FDI in Nepal. Historically, Nepal has relied on its neighbouring countries – India and China – as the largest sources of FDI. Figure 1 shows China, India, along with the USA, the UK, and South Korea having an enduring investment interest in Nepal, with the former two showing stability and the latter three showing more variability. The mid-2010s witnessed a significant transition as China’s increasing influence surpassed that of India, initially observed in 2012 and consistently evident from 2017 onward. As seen in Figure 1, China’s increasing FDI commitments has shaped the impression of its dominance in Nepal. Moreover, this aligns with the larger global trend of China emerging as one of the top global investors; for instance, China ranked as the third largest investor after the US and Japan in 2022. As China increasingly asserts its presence in the global order, China’s engagement in Nepal has also become more conspicuous.

Figure 1. Ranking of Top Countries by Approved FDI in Nepal’s Industries

Source: Dataset compiled from Industrial Statistics, DOI.

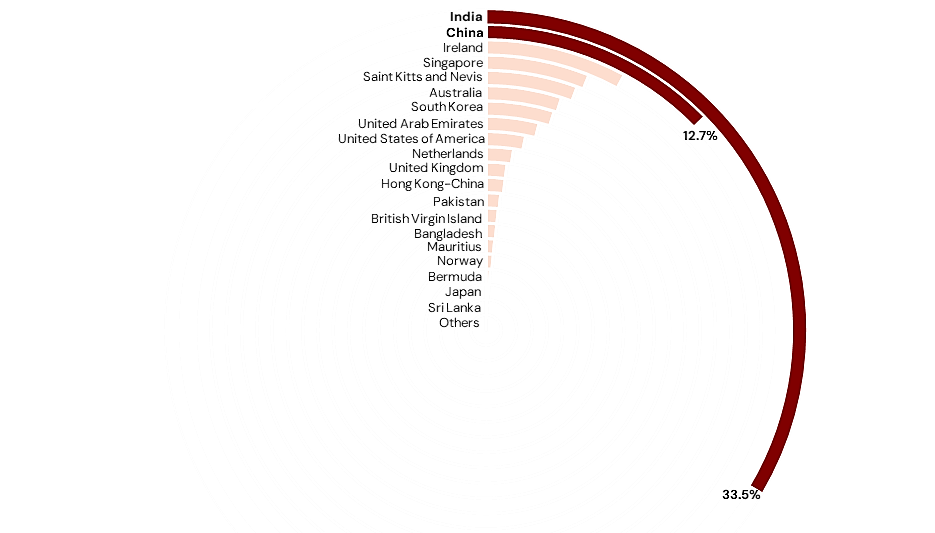

While China may appear to be the predominant source of FDI, a closer examination of the actual FDI inflow stock reveals a different picture. Figure 2 presents inward FDI stock by country of origin upto mid-July 2022 and reveals geopolitical as well as financial motives of FDI inflows through three key observations. First, India holds the largest share of FDI stock in Nepal, totaling NPR 88.5 billion, while China ranks second with NPR 33.4 billion. Second, China’s investment dominance is a recent but rising phenomenon. Third, apart from its neighbours, Nepal also received FDI originating from offshore tax havens, including Ireland, Singapore, Saint Kitts and Nevis, Netherlands, Hong Kong, British Virgin Islands, Mauritius, and Bermuda.

Figure 2. Breakdown of Countries’ Contributions to Nepal’s Actual FDI Inflow Stock upto mid-July 2022

Source: NRB, Survey Report on Foreign Direct Investment in Nepal 2021/21

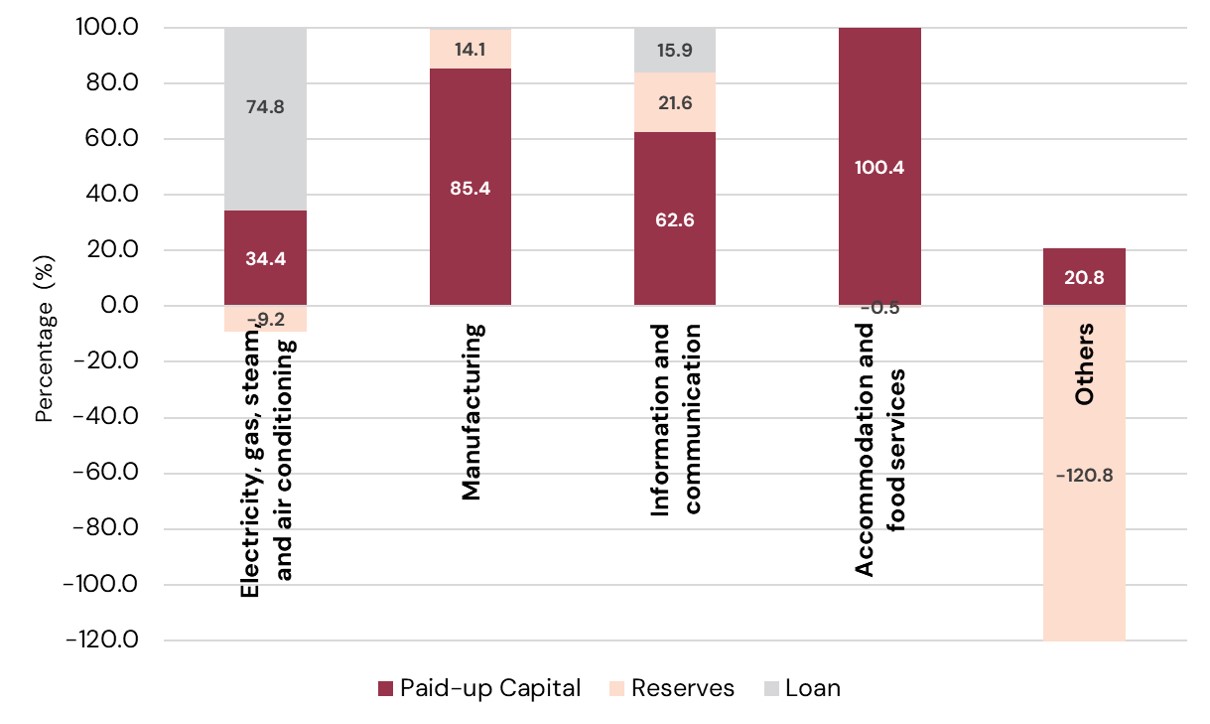

Chinese investment in Nepal prioritizes infrastructure across four strategic sectors: energy (69.9%), manufacturing (44.8), telecommunication (4.8%), and hospitality (2.8%). The ‘Others’ category is marked by significant negative reserves that results in its negative FDI stock of -22.3%. Furthermore, Figure 3 reveals different investment strategies within China’s total FDI stock in Nepal upto 2022. The capital-intensive energy sector, including electricity, gas, steam, and air conditioning, relies heavily on debt financing with 74% of its FDI coming from loan. In contrast, the manufacturing sector and the hospitality sector show strong equity investment, with 85% and 100% of their FDI, respectively, coming from paid-up capital. Emerging sectors like information and communication use a mixed strategy to balance innovation and risk, with 62% in paid-up capital, 21% in reserves, and 15% in loans. Another notable trend is that most Chinese private investments are concentrated in smaller-scale FDI projects. Three Chinese private investments—Hongshi-Shivam Cement, Huaxin Cement, and Himalaya Airlines—each exceed USD 100 million. Additionally, the opaque ownership structures and lack of transparency have blurred boundaries between state-owned enterprises (SOEs) and private entities, which adversely affects perceptions of Chinese investments in Nepal.

Figure 3. Sector-wise Breakdown of China’s Actual FDI Stock in Nepal upto mid-July 2022

Source: NRB, Survey Report on Foreign Direct Investment in Nepal 2021/21

Source: NRB, Survey Report on Foreign Direct Investment in Nepal 2021/21

Chinese investment in Nepal trails South Asian counterparts. Comparing China’s FDI in Nepal vis-à-vis other South Asian countries helps us to see the bigger picture of where Chinese FDI is being directed in the region. Nepal’s relationship with China is less dependent on financial indebtedness and more so on geopolitical strategic interests. Since 2015, China-Pakistan Economic Corridor (CPEC) has attracted at least USD 25 billion (NPR 3.31 trillion) Chinese investment for Pakistan’s economic development and military cooperation as part of the BRI initiative. Bangladesh has attracted over USD 9.75 billion (NPR 1.29 trillion) Chinese investment, particularly to its transportation sector, between 2009 to 2019. Sri-Lanka has received USD 12.1 billion (NPR 160.34 billion) Chinese investment for its infrastructure projects between 2006 to 2019. This suggests that while China’s engagement is contextual, it favors supporting infrastructure projects to deepen economic cooperation as well as counter India’s hegemony in South Asia. Furthermore, not only are Chinese investments in Nepal relatively lower in terms of scale but also Nepal owes far less debt to China compared to other South Asian countries like Pakistan, Bangladesh, and Sri Lanka.

The question is not just of who invests in Nepal but, more importantly, how much investment is actually coming in and how that investment is being used. While Nepal has built economic cooperation with its development partners, such as China, India, USA, UK, and South Korea, the current state of actual foreign investment in Nepal falls short of the desired levels. Since the early 2000s, remittances to Nepal have outpaced the combined influx of ODA and FDI. Such a trend contrasts with the conventional global scenario of FDI typically leading resource flows to low and middle-income countries. The fact of the matter remains: Nepal needs to attract more productive FDI into its priority sectors.

This working article serves as part of the ongoing Nepal-China 101 research study being carried out by Nepal Economic Forum.

Chandani Thapa works as the Coordinator at Nepal Economic Forum and beed at beed management. She holds Master's in Economics (with specialization in World Economy) from Jawaharlal Nehru University and B.A. (Honours) in Economics (with a minor in Mathematics) from Delhi University. Applying the toolkit of economists, Chandani strives to create a positive impact while advancing her capabilities in research, academia, and policymaking.