In the realm of Fintech, while emerging economies like Nepal have made strides in adopting technologies like payment gateways, cashless payments, and online banking, the global landscape of financial technology encompasses a diverse range of innovations. These span the integration of banking data with third-party financial services, the application of Artificial Intelligence and big data analytics to discern consumer behavior patterns for credit risk assessment and enhanced services.

The term “Fintech,” an abbreviation for Financial Technology, initially referred to the technological systems that strengthened the operations of financial institutions like banks and corporate entities. However, this definition has evolved significantly in recent times, now encompassing a broader spectrum of economic sectors that leverage technological advancements to enhance the efficiency of financial institutions. Nepal’s journey towards integrating technology into its financial sectors began with NABIL Bank (formerly known as Nepal Arab Bank) introducing credit cards in 1990. Despite the rapid penetration of easy internet access and smartphones in the Nepali market, the adoption of electronic payment technologies remained relatively sluggish until the mid-2010s. The outbreak of the Covid-19 pandemic acted as a catalyst, spurring both demand for and adaptation to technologies such as mobile banking, QR payments, and cashless transactions. This marked the inception of the Fintech revolution in Nepal, driven by the swift actions of banks to integrate mobile banking services, Payment Service Providers (PSPs), and Payment Service Operators (PSOs), alongside the increasing trend of e-commerce in the country.

Fintech: Global and Nepali Scenario

In the realm of Fintech, while emerging economies like Nepal have made strides in adopting technologies like payment gateways, cashless payments, and online banking, the global landscape of financial technology encompasses a diverse range of innovations. These span the integration of banking data with third-party financial services, the application of Artificial Intelligence and big data analytics to discern consumer behavior patterns for credit risk assessment and enhanced services, and the use of blockchain for secure transactions and agreement validation.

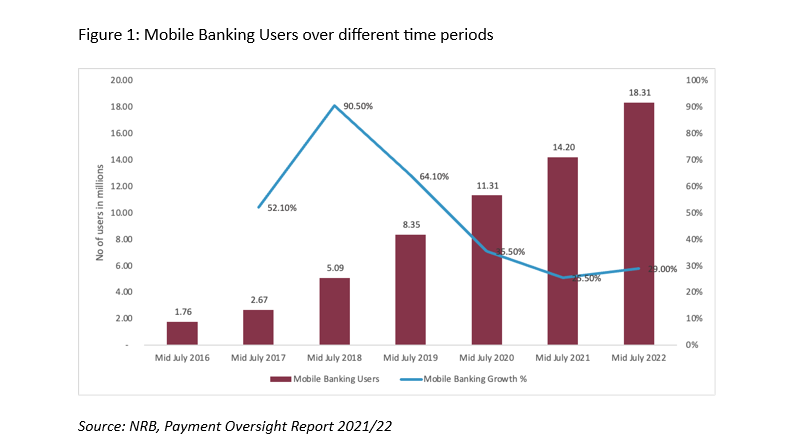

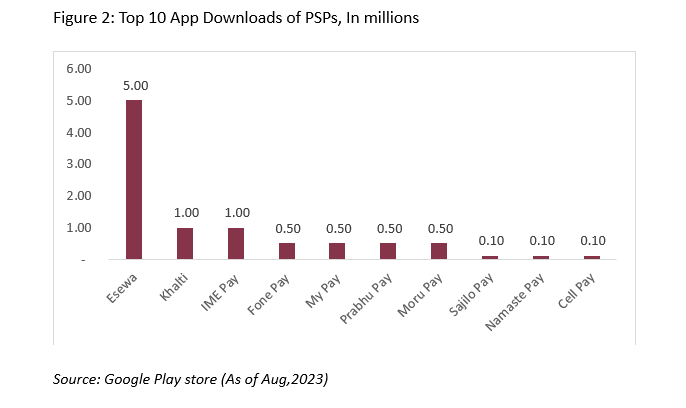

The Nepal Financial Inclusion Report 2023 by the IFC reveals a substantial growth in the adoption of fintech among Nepali consumers. Over eight years, mobile banking users grew at an impressive Compound Annual Growth Rate of 58.14%, reaching 18.31 million users, or 62.8% of the population in mid-July 2022. QR-based payments also experienced a surge, with transaction volume increasing from Rs. 7.76 billion in 2022 to Rs. 20.77 billion in mid-March of 2023. Notably, government revenue collection has seen a digital shift, with 30% attributed to digital payments and 90% of transactions executed digitally. The widespread adoption of Payment Service Providers (PSPs) applications, downloaded by over 10 million users, has facilitated utility payments, purchases, subscriptions, and more. These apps enable seamless money transfers and have boosted ecommerce and merchant payments. Commercial banks like NIC ASIA and Machhapuchhre have introduced innovative voice-based QR payments, benefiting visually impaired users.

While Nepal’s fintech adoption is impressive, the NRB’s Financial Access report from mid-June 2020 highlights that only 67.3% of the population held a bank account. Traditional methods like cheques and cash deposits continue to handle a significant portion of transactions, indicating areas for further development.

Key Players Shaping Nepal’s Fintech Landscape

Several key stakeholders have played pivotal roles in propelling Nepal’s Fintech revolution:

- Government Entities: Nepal Rastra Bank, as the central banking authority, has been instrumental in fostering the new regulations and guidelines for FinTech industry to develop in Nepal. The Payment and Settlement Act introduced by NRB in 2019 provided the legal basis for the development, expansion, promotion, monitoring, and regulation of the payments, settlement, and clearing systems in Nepal.

- Corporate Banks: The majority of commercial and corporate banks in Nepal promptly responded to the demand for digital banking, offering customers user-friendly mobile banking features including mobile recharge and bill payments.

- Payment Service Operators (PSOs): Currently, Nepal boasts 10 registered PSOs, with Fonepay and ConnectIPS emerging as highly popular choices. Fonepay, developed by F1Soft Technologies, integrates with numerous banks to provide digital banking networks and transaction settlements. Similarly, ConnectIPS, launched by Nepal Clearing House Limited, empowers banks to independently verify consumer accounts and link them to the application portal for seamless inter-banking and payment services.

- Payment Service Providers (PSPs): Nepal currently houses 27 registered PSPs. Meanwhile commercial banks, development banks, and finance companies have obtained licenses to operate as PSPs. While PSOs like Fonepay and SmartQR facilitate most mobile banking applications, PSPs like Khalti, eSewa, and ImePay have gained prominence with their digital wallet applications. These platforms empower users to conduct banking transactions, digital payments, bill payments, e-commerce transactions, and more through a unified application.

- FinTech Alliance Nepal: Recognizing the significance of the Fintech revolution, key players in Nepal’s market have established the FinTech Alliance. This entity actively expands its network to connect corporate investors, including private equity and venture capital firms, with Fintech giants and startups in Nepal, fostering the exchange of innovative ideas and development within this domain.

Challenges and Future Outlook

Despite Nepal’s strides in integrating technology into its financial landscape, numerous challenges must be addressed to achieve global Fintech inclusion. The Nepali government has deemed blockchain technology and cryptocurrency illegal, citing concerns over escalating outward remittances and high-risk transactions. This stance contrasts with international banking sectors that are embracing blockchain technologies to optimize cross-border payments, streamline trade finance through smart contracts, and revolutionize conventional banking practices through secure and decentralized frameworks. Additionally, Nepal faces a scarcity of skilled human resources to develop Fintech technologies. While Nepal’s IT service industry is thriving, many IT graduates and experts seek opportunities abroad. Even those working within Nepal tend to opt for freelancing contracts with foreign agencies or predominantly engage with companies outsourcing work from Western countries. To drive Fintech innovation, stakeholders need to recognize the potential of Nepali IT experts and leverage these resources to drive technological advancement within the Fintech sector.

As we discuss further about the challenges of FinTech growth in Nepal, it is also important to address the fact that a significant population of Nepal lack financial literacy. A survey conducted by NRB in 2022 reports the aggregate nationwide financial literacy to be just at 57.9%. The exponential growth of technology poses risks such as identity theft and online scams towards such population group. In comparison with other countries, Nepal is in dire need to accelerate concerted campaign aimed at enhancing awareness regarding both banking and non-banking establishments.

NRB published a concept report in 2022 regarding Central bank digital currency. This is an effort by NRB to research on implementing digital currency as already initiated and implemented by many other countries. Its intention is to establish policy goals in improving payments access, promoting financial inclusion, safeguarding the central bank’s monetary sovereignty, enhancing the efficiency of the cross-border payment systems, promoting financial transparency and improving monetary policy transmission mechanism. Likewise, NCHL also recently signed a MoU with Indian payment systems to enable cross border payment removing a significant barrier that Nepal has with foreign payment gateways. Also, with growing popularity of Open banking in global space, NCHL is also implementing National Payment Interface (NPIs) which allows multiple financial organizations to share transaction and banking details through API (Application Program Interface) calls without having to perform any physical visits to these institutions.

Conclusion

In summary, Fintech holds promising prospects in Nepal, with government and private entities tirelessly striving to address local demands and open new avenues in this domain. The growing demand for digital solutions among Nepali society has significantly propelled the inclusion of Financial Technology. Nonetheless, Nepal needs to address challenges obstructing Fintech’s progress and sustainability. This involves independently promoting and implementing Fintech companies and their applications(services). This step will advance Nepal’s technological adaptation in line with global context, fostering financial inclusion and the digital economy.

Udita Mulmi is a fellow at Nepal Economic Forum (NEF). She had previously held a key role as a Business Development Supervisor and Relationship Manager at NIC Asia Capital Ltd. She currently seeks opportunities to expand her knowledge on national and international economic landscapes.