This time, the government’s flagship event aims to target not only foreign investors but also domestic investors and non-resident Nepalis (NRNs). The NRN association has begun disseminating the NRN card entitling NRNs to various investment incentives. Additionally, 11 laws are slated for amendment to address project implementation challenges. The long-awaited legislative changes in Nepal’s FDI and investment policies were accelerated to fit the summit’s timeline.

Introducing the Investment Landscape

As the anticipation builds for the Third Nepal Investment Summit (NIS) being held in April 2024, the Government of Nepal is geared up to showcase projects and opportunities to convince investors and bring in foreign direct investment (FDI). Acknowledging that it lacks enough internal resources for development, Nepal’s economic journey hinges significantly towards FDI. FDI can be a vital source of investment in the economy and therefore, through investment summits and policy reforms, the Nepali government aims to convey its potential as an investment-worthy country to investors worldwide.

Unveiling the Past

In 2017, Nepal’s inaugural Investment Summit marked a pivotal moment as the country transitioned into a federal system under the new 2015 constitution. The summit had high anticipation. It was able to grab the attention of 16 companies from six different countries, therefore securing foreign investment commitments of nearly USD 13.51 billion, predominantly from China in hydro and cement plants. The commitment was more than half the country’s estimated GDP of FY 2016/17 AD. The FDI however did not increase as per commitments made during the summit.

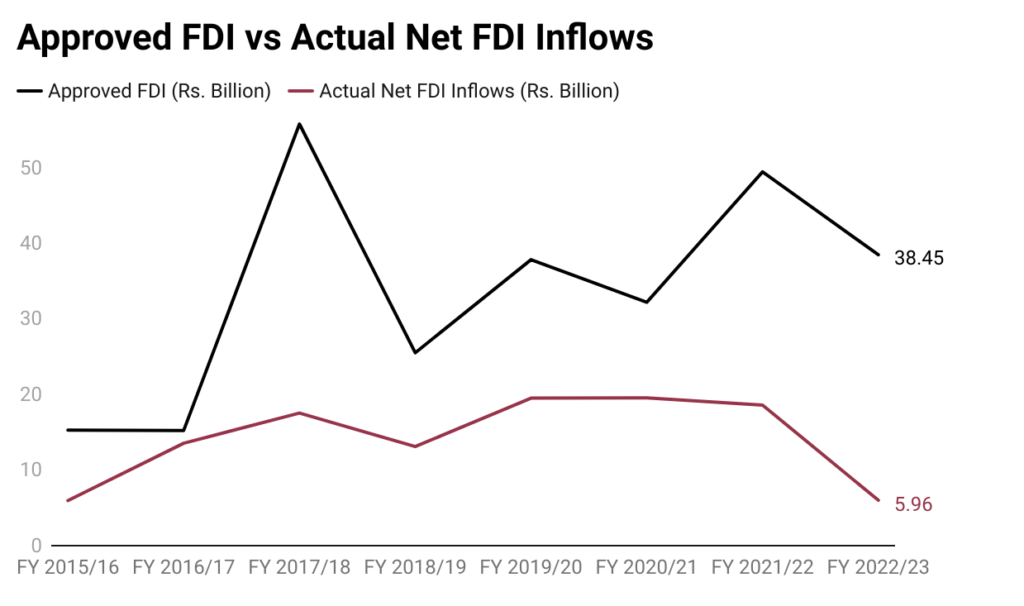

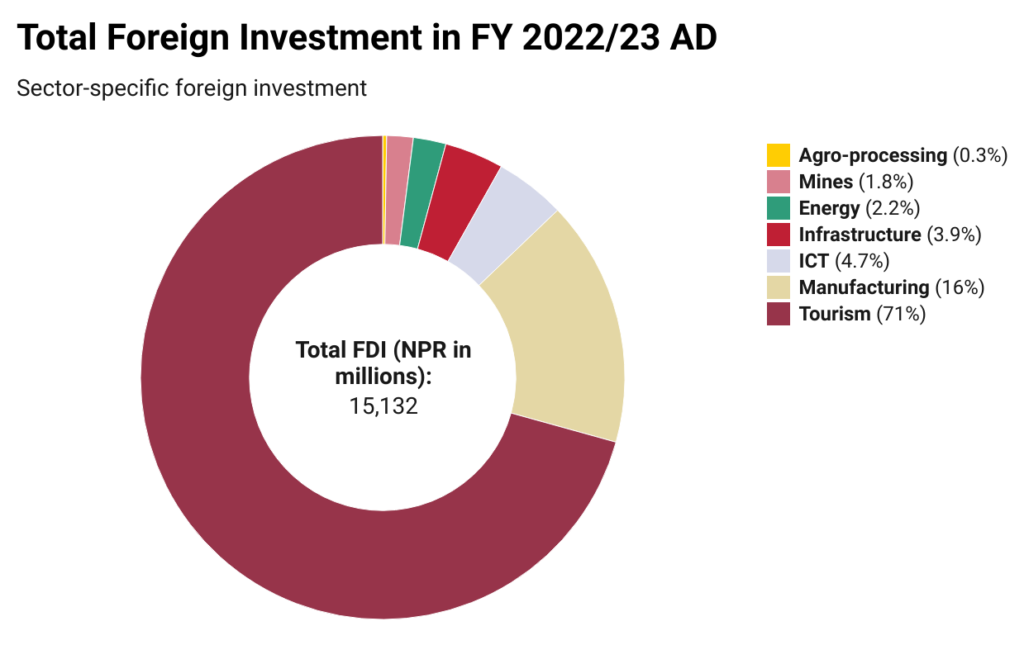

Building on the momentum, the 2019 summit was meticulously planned with substantial policy reforms in the Foreign Investment and Technology Transfer Act (FITTA), Companies Act, Special Economic Zone Act, and Labor Act along with the formulation of a Hedging Policy to address investment-related obstacles. Government agencies pledged to act as facilitators with less bureaucratic red tape. Among the 50 projects showcased by the Investment Board, 15 project investment agreements were signed, totalling USD 12 billion. It included Nijgadh International Airport, Kathmandu Outer Ring Road Project and others in hydroelectricity and agriculture. However, FDI inflow fell short by 30% compared to the committed USD 17 billion. Notably, in FY 2022/23 AD, while the total investment commitment was NPR 38.45 billion, the actual FDI inflow amounted to NPR 5.96 billion indicating a gap in promises and reality. This calls for a question: Is the ease of doing business in Nepal subpar, or are the paper reforms insufficient to convince investors?

Source: Industrial Statistics, Department of Industry and Annual Report, Nepal Rastra Bank

Navigating the Present

Source: Invest in Nepal 2024

This time, the government’s flagship event aims to target not only foreign investors but also domestic investors and non-resident Nepalis (NRNs). The NRN association has begun disseminating the NRN card entitling NRNs to various investment incentives. Additionally, 11 laws are slated for amendment to address project implementation challenges. The long-awaited legislative changes in Nepal’s FDI and investment policies were accelerated to fit the summit’s timeline. Another major reform is regarding viability gap funding (VGF), hedging and Nepal’s country rating regulation. The government has been organising pre-events and bilateral meetings with potential investors globally to ensure alignment in the actual inflow and commitments. Some other instances of investment-friendly reform include the following:

- Opening FDI for travel agencies

- Simplified dividend repatriation

- Allowing 70% FDI in ride-sharing services

- Relaxed export restriction for SEZ-established industries (from 60% to 15%)

- Ability to mortgage up to 50% of the land for loans

- Online mechanism for the automatic approval of FDI up to NPR 500 million.

- Reduction of the minimum FDI threshold from NPR 50 million to NPR 20 million

- Elimination of the minimum threshold for approval of FDI in IT-based industries

- No approval is required for the reinvestment of income generated from foreign investments

The foreign investment projects in Nepal are plotted in the map below:

Source: Invest in Nepal, 2024

Forging the Way Forward Amidst Challenges

Since NIS 2024 is about to take place at a time when there are governance challenges with the change in government just two months before the summit, doubts are hovering. The investors might also be discouraged by the recent exits of major investors like Axiata (the parent company of NCELL) and Habib Bank (one of Nepal’s long-standing FDI partners for three decades), which could amplify Nepal’s struggle to attract foreign investments.

Bureaucratic hurdles remain a significant barrier despite the state-of-the-art policy reforms on paper. Implementation efforts could be improved. For instance, land acquisition issues in projects like the Huaxin Cement plant, Dhading and Hongshi Shivam Cement plant, Nawalparasi have led to disputes and time/cost overruns. Furthermore, even with initiatives like the Single Window System and online registration, investors are still burdened with the inconvenience of submitting physical documents through multiple channels. Even with the Investment Board solely dedicated to hand-holding and facilitating the investors, navigating the system remains daunting.

Looking forward, doubts have emerged regarding the summit’s relevancy due to changes in government. The newly formed government and the investment summit committees carry a heavy responsibility on their shoulders to ensure the summit retains its significance and effectiveness.

Shaping the Future

Public Private Partnerships (PPP)

NIS 2024 is onboarding the private sector to explore potential projects and embrace the mantra of Public-Private Partnerships (PPPs) modelled projects. With the enactment of the PPP Act in 2019, significant success has been demonstrated in PPP-modeled projects, especially hydropower. For example, Gautam Buddha International Airport (GBIA), constructed by Northwest Civil Aviation Airport Construction Group from China, was fully operational in May 2022, marking it a PPP success. Similarly, the Arun III Hydroelectric project, developed by SJVN Arun-3 Power Development Company Pvt. Ltd. (SAPDC), an Indian government subsidiary, has reached a 70% completion milestone as per the timeline. This showcases another successful collaboration between the government and private sector in realizing transformative projects. Other anticipated PPP projects are Nijgadh Airport and, the Kathmandu-Terai fast track among many more. PPPs hold tremendous opportunities for the nation as well as stakeholders.

Sector-specific Investment Promotion

Each sector has unique requirements and the policy should be crafted accordingly. For instance, the FDI threshold may restrict the manufacturing and service industry as it demotivates small investors. Similarly, to optimally utilize electricity potential, the Nepal Electricity Authority (NEA) has recently agreed to buy electricity from smaller investors up to the capacity of 10 MW. This initiative immediately prompted 89 small investors to sign contracts with NEA amounting to an additional 395 MW of electricity in national grid. Also, there are prospects for a sustainable energy mix with solar energy, and hydrogen energy. These signify the potential for sector-specific investment opportunities. Yezdi Nagporewalla, the CEO of KPMG in India also suggests Nepal focus on sector-specific investment promotion for better utilization of potential and therefore, economic development.

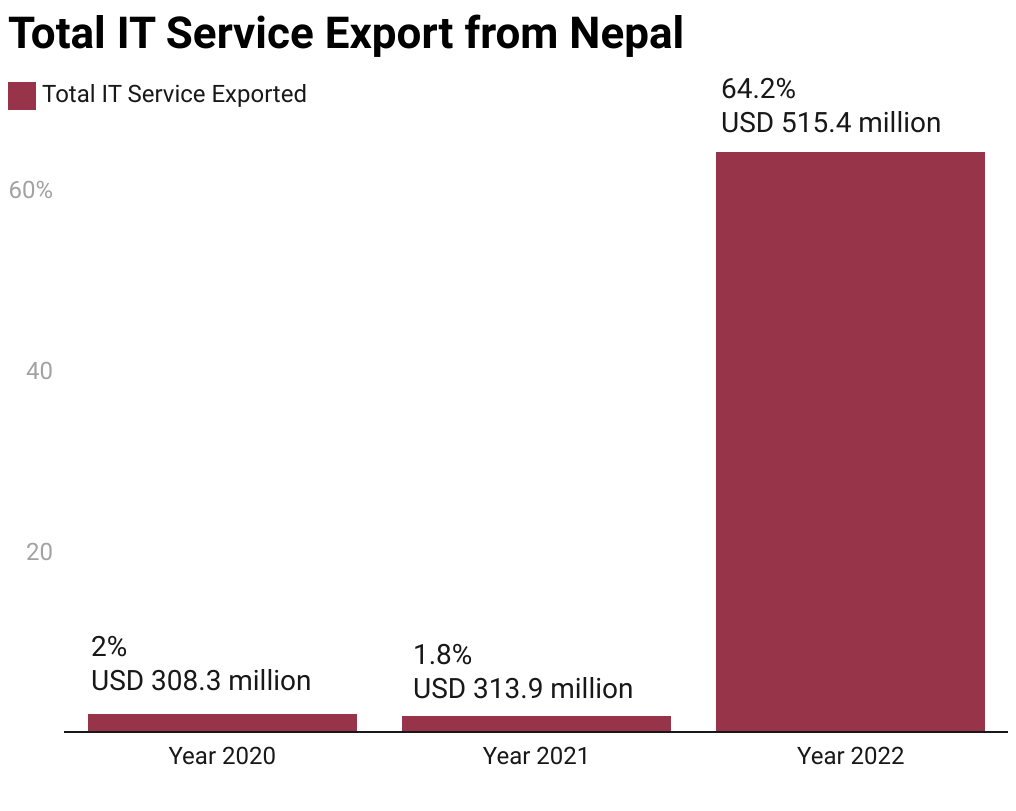

Furthermore, the potential investment sectors were encapsulated in the acronym ‘TEA’- Tourism, Energy and Agriculture. The evolving landscape has transformed it into ‘ICE TEA’ – Information, Communications and Technology and Exports – TEA. Recent findings from IIDS highlighted that Nepal’s Information Technology (IT) service exports marked an annual growth rate of 64.2% in 2022 as shown in the figure below. The growth rate in IT companies was 80.5%. In response to this mushrooming potential, the minimum FDI threshold for ICT has been eliminated. Therefore, IT-friendly incentives could prove profitable.  Source: Unleashing IT, IIDS, 2023

Source: Unleashing IT, IIDS, 2023

Source: Industrial Statistics 2022/23, Department of Industry

My take

Nepal has been making progress in becoming self-sufficient in cement and selling more electricity alongside having relevant policy reforms. While the country has shown resilience in many aspects, it is clear that merely hosting investment summits and introducing targeted policies is not enough to attract sustainable FDIs. The verbal assurances from the authorities must translate into tangible practices to instil confidence. Investors are seeking predictability and our current business scenario screams unpredictability. In essence, while challenges persist and not all promises may materialize immediately, a steadfast commitment is a must. Simplifying provisions for investment facilitation, project implementation, operations and profit repatriation would best serve investors. Hopefully, the summit can prove to be a testament to Nepal’s resilience and determination in the face of persistent challenges.

Bibhuti Kharel graduated with a Master's degree in Business Administration (Project Management) from Kathmandu University. She is keen about socioeconomics and sustainability. Currently, she works as a Research Fellow at Nepal Economic Forum (NEF), building on her prior experience as a Project Development Intern in the Investment Board of Nepal.