Foreign Direct Investments in Nepal are regulated mainly by the Foreign Investment and Technology Act (FITTA) of 2019, along with additional provisions applicable from the Public Private Partnership and Investment Act, Labor Act, and the Companies Act.

FITTA was first introduced in 1992 and later revised in 2019. Under FITTA, the minimum threshold for foreign investment in Nepal is NPR 50 million. The FITTA 2019 allows companies with foreign investment to borrow from foreign banks and financial institutions if approval from Nepal Rastra Bank (NRB) and recommendation from concerned ministry is received. The Act has also clarified on the existing provisions of dividend repatriation, profits, earnings, and proceeds which are subject to the approval of regulators. A 2021 revision to the FITTA requires foreign investors in Nepal to bring 70% of their proposed investment before commencement of operations, and another 30% within the next two years.

The Public Private Partnership and Investment Act stipulates investments up to NPR 6 billion to be approved by the Department of Industry, whereas investments above NPR 6 billion needs to be approved by the Investment Board of Nepal. This act is also applicable to foreign direct investments.

Status of Foreign Direct Investment in Nepal

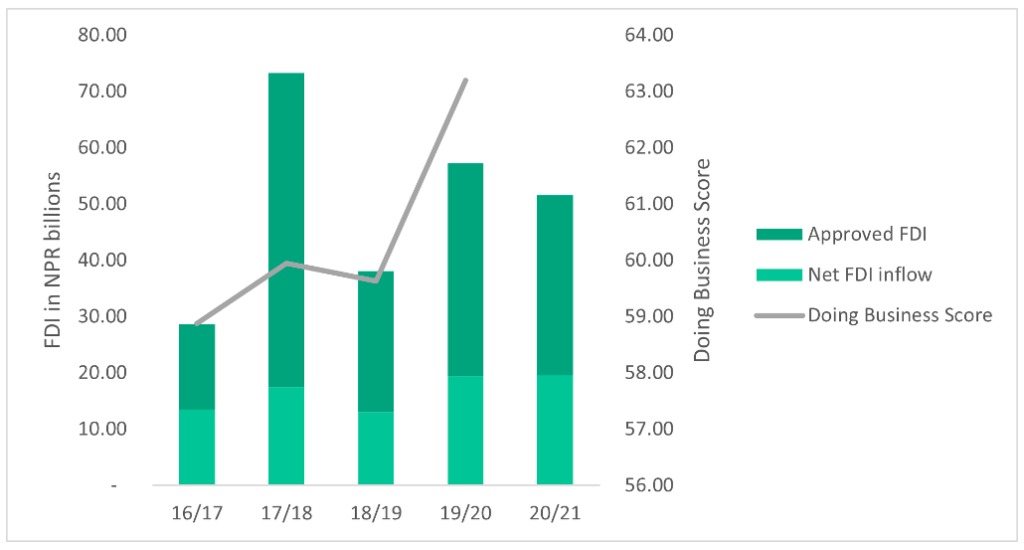

The approved FDI represents an intent to invest, but as seen in Figure 1, these investments do not match the inflow of FDI. Net FDI inflow, total inflow of FDI minus repatriation, represents 57% of the approved amount on average in all 5 years. This discrepancy exists because of the significant time lags between approval and actual investment.

The introduction of FITTA in 2019 increased approved FDI by 51.3% and net FDI inflow by 49.2% in the fiscal year 2019/20 compared to the previous fiscal year. Despite the approved FDI is lower at 2019/20 compared to 2017/18 by 32.2%, FDI inflow increased by 11.3% for the same period. The 2021 revision of FITTA, as mentioned above, might close the gap between the approved FDI and actual FDI inflow in the country.

The Doing Business Index published annually by the World Bank measures the ease of doing business in 190 countries in areas such as starting a business, access to credit and contract enforcement to name a few. Nepal’s overall score in the index reduced by 1.53 points in 2017, increased by 1.07 points in 2018, again decreased by 0.32 in 2019, increasing significantly in 2020 by 3.57 points. The significant improvement in ranking of 2020 might be attributed to the revision of FITTA and introduction of Public Private Partnership and Investment Act and Special Economic Zone Act in 2019.

Figure 1: Approved FDI, Net FDI inflow and Doing Business Score over 5 years (Source: NRB and World Bank)

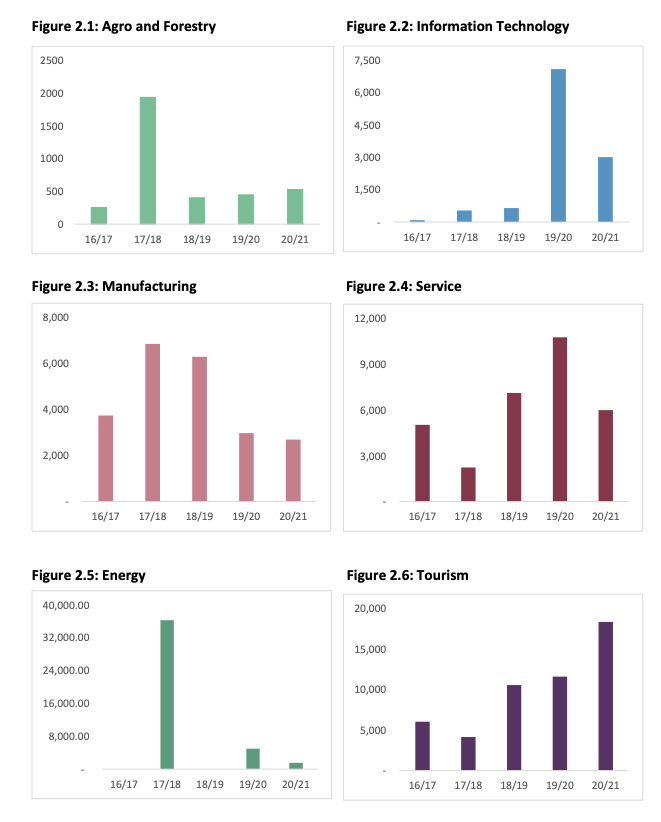

The Department of Industry classifies FDI approved by Nepal into Agro Forestry, Information Technology, Manufacturing, Service, Energy and Tourism. The Information Technology sector has experienced the highest Compounded Average Growth Rate (CAGR) of 141.23% over a period of 5 years, followed by Tourism sector at 32.14%, Agro and Forestry sector at 19.84%, and the service sector at 4.5%. The manufacturing industry has experienced a negative CAGR of 7.87%. Since the CAGR is an average, the FDI in different sectors are not growing at a uniform rate as seen in Figure 2. NPR 36.25 billion worth of FDI was approved in the energy sector in 2017/18, which reduced to zero in 2018/19 and experienced a fall of 86.3% in 2019/20.

Figure 2: Approved FDI by sector over 5 years (figures in NPR millions) (Source: Industrial Statistics, Department of Industry)

Constraints in Foreign Investment in Nepal

While the introduction of FITTA has improved the environment for foreign direct investment in Nepal, some of the many remaining constraints are explored below.

Lengthy approval process: Approval of foreign direct investment is to be received from multiple authorities which makes the process costly and time consuming. The Single Window System provisioned by the revised FITTA has not been fully implemented. The registration of foreign companies can be made online through the Office of Company Registrar’s website, however, additional physical copies of documents are frequently requested.

Limits on Foreign Borrowings: A limit of LIBOR + 5.5% is imposed on interest rates that can be charged by foreign lenders to all sectors. This might not adequately reflect the risks associated with certain sectors.

Further, NRB does not allow payment of foreign borrowings if there are outstanding loans to foreign banks. This might cause hesitancy among foreign lenders as they perceive lending to Nepal as a protentional risk. Foreign lenders are unable to increase interest rates to adjust for, such risks due to the interest rate limit. Thus, Nepal might not receive foreign investment in the form of debt.

Repatriation of profits: Repatriation requires approval from multiple agencies such as Nepal Rastra Bank along with relevant government departments and in some cases, also department of industry. For investments in the telecommunications sector, approval from Nepal Telecommunications Authority is required, while the approval from the Ministry of Finance is needed for investments in joint ventures.

Certification of income tax payment of royalties must be submitted to the Department of Industry. The involvement of DoI in what should be the responsibility of revenue collection agency causes unnecessary bottleneck for repatriation of FDI.

Even though repatriation is low compared to the inflow of FDI, the time-consuming approval requirement might discourage foreign investors.

Lack of risk management products: Nepal lacks the risk management products required to hedge the interest rate and foreign currency risks associated with foreign investment. This problem is especially evident in large hydropower and infrastructure projects which receives foreign investment in the form of debt. The revenue of such projects is denominated in NPR and debt repayment is to be made in foreign currency. Since Nepal Electricity Authority (NEA) has stopped signing Power-Purchase Agreement (PPA) in dollar denomination, a lack of hedging instrument for a depreciating Nepali Rupees has significantly decreased foreign investment in the energy sector as seen in Figure 2. Due to a lack of agreement on hedging premium, the newly introduced hedging regulation has failed to address this problem.

Sub-par copyright laws: Nepal’s Copyright Act does not meet the international standards of intellectual property rights. Brand names and trademarks of well-recognized brands are constantly infringed upon by making slight changes the letters, while maintaining the color scheme or logo. Multiple cases of trademark infringement by the Multinational Companies (MNCs) have been filed, however, actions against such cases are limited. Nepal does not recognize patents awarded by other nations. A low enforcement of copyright laws and protection of intellectual property rights discourages new MNCs to enter Nepal.

Foreign direct investment is especially important now for an import dependent Nepal with a widening trade deficit, and declining foreign reserves. Creating a facilitating environment for FDI is important to promote and encourage production within the country. Stakeholder consultations are required to address specific provisions in the regulations that are constraining foreign investment. However, simply promoting FDI in traditional industries is not enough. A world that is increasingly impacted by climate change, promoting FDI in green and sustainable businesses should be prioritized and reflected in policies.

Sneha Shrestha is an ACCA affiliate with interests in business valuation, financial planning, mergers and acquisition, and strategy consulting. She has previously worked in audit and accounting for few years before joining Beed. She is currently working as a beed fellow at beed management.