With the rapid rise in ESG funds, tackling green washing is key to ensure that the world makes real progress on sustainability metrics.

ESG investments

Environment, Social and Governance (ESG) are non-financial performance indicators used by investors in evaluating investment decisions. ESG investments are investments that seek positive returns along with long term impact on society and the environment. Socially conscious investors use ESG standards to screen potential investments by evaluating the areas shown in figure 1.

Figure 1: ESG considerations in investment decisions

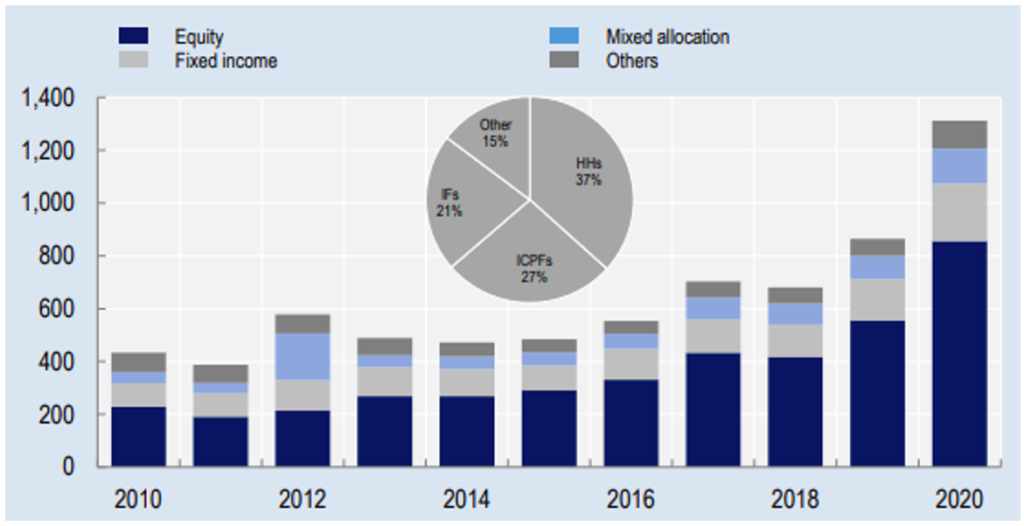

Figure 2: Assets of ESG funds over the years

(Source: Financial markets and Climate Transitions, OECD)

With the threat of climate change more imminent than ever, investors around the world have started acknowledging that environmental issues are one of the biggest risks disrupting our world today. Due to this, an increased focus has been observed in investing patterns at companies that cater to the environment, social and governance values of the investors.

As shown in figure 2, sustainable fund flows globally has been increasing since 2010. Funds that used Environment, Social and Governance (ESG) principles have received USD 51.1 billion of net new money from investors in 2020, a significant increase from USD 21 billion in 2019.

Funds, which incorporate ESG principles into their investments have outperformed non-ESG based share portfolios. Research conducted by Fidelity on the performance of ESG investments around the world between 1970 and 2014 showed that half of them outperformed the market. During 2020, BlackRock reported that more than 8 out of 10 sustainable investment funds outperformed non-ESG based funds. ESG funds had lower volatility while delivering a good return on equity and a longer lifespan, as 77% of ESG funds that started 10 years ago persisted compared to 46% of conventional funds.

This rapidly growing trend of ESG investing has encouraged businesses to integrate ESG principles into their operations to attract investments. The global effort towards sustainability has created a need for organizations to be more transparent regarding their management of environmental, social, and governance risk. Along with this, there is also an increased need for businesses to be seen as ethical in light of increasingly conscious consumer groups. The rapid need for businesses to understand and adhere to sustainability principles and disclosure requirements has led to the increased prevalence of greenwashing.

Green washing

Green washing can be defined as when companies, intentionally or unintentionally, make false or misleading claims about their sustainability efforts. Green washing includes unsubstantiated claims of products being environmentally friendly, poorly defined claims, products with hidden tradeoffs etc.

A more practical example of green washing is when companies spend significantly more resources on advertising themselves as being green than they do on incorporating environmentally sound practices.

Green washing gives a false impression of being on track in terms of climate change ambitions and targets which hinders the actual ESG and climate progress. It can result in loss of investor confidence in ESG investing. Increased prevalence of greenwashing might also discredit the sustainability movement completely. It also misleads consumers into believing that a product is ethical when the opposite is true. While marketing campaigns designed to highlight a company’s, ethical policies can enhance reputation and brand image, the increase of unsubstantiated claims and greenwashing tends to have the opposite effect.

Green washing is not a new phenomenon. Funds that claim to incorporate ESG principles into their investments have long been accused of holding shares of unsustainable and unethical industries such as fossil fuel companies, weapon manufacturers and mining companies. Russia’s invasion of Ukraine has also brought into light USD 8.3 billion worth of Russian government bonds and shares of Russian companies held by ESG funds. With the war escalating, funds have started to unwind Russian bonds and shares from their portfolios.

Morningstar Inc, an independent research and rating agency, recently removed ESG tags from over 1200 funds, with a total of USD 1 trillion in assets, which claimed to consider ESG factors into their investment process but did not integrate them in a definitive way in their investment selection. A report by InfluenceMap has found that 55% of funds marketed as low carbon, fossil fuel free and green energy had exaggerated their environmental claims, and 70% of funds with ESG goals did not meet their targets.

Ongoing efforts to tackle green washing

The increasing investments in ESG funds have attracted the attention of regulators, who have taken actions against companies to protect investors from false or misleading ESG claims. Further, standard setting bodies have taken this increased interest in ESG to standardize ESG ratings and improve their reliability. The efforts that have been undertaken globally to tackle greenwashing are as follows:

- Regulatory actions

DWS Group, a German asset manager, was investigated by German and US officials after a whistleblower’s accusations of the company exaggerating its green investments. The German officials reported that ESG factors were only considered in minority investments of DWS, which is contrary to the DWS fund’s sales prospectus. Further, the US Securities and Exchange Commission (SEC) fined BNY Mellon Investment Advisor and sued Vale, SA for misstating ESG investment policies and making false ESG disclosures. European regulators have uncovered several instances of unsubstantiated ESG claims in France, Britain, Sweden, Netherlands, and Switzerland. The French regulators have also forced managers to drop ESG labels after finding cases of green washing.

- Regulatory efforts

In order to prevent misleading claims by USA based ESG funds, the SEC has proposed changes in regulation and increase the requirement of disclosure for such funds. A recent change to the Name Rule will require funds with ESG in their name to clearly define the term and ensure that 80% of investments of the fund fall within that definition.

Further, The Sustainable Finance Disclosure Regulation (SFDR) aims to avoid greenwashing of financial products in the European Union. It requires comprehensive sustainability disclosure which covers a broad range of ESG metrics at both entity level and product level. ESG funds have been categorized into those that actively promote environmental and or social characteristics and those that have sustainable investment as their main objectives, both of which are subject to higher disclosure requirement.

While separate efforts have been made across the globe, harmonization of climate change disclosure related standards and development of new green frameworks could be the key to avoiding green washing. A common disclosure requirement across all jurisdictions would help tackle green washing consistently while easing disclosure burdens on multinational companies.

- ESG ratings

ESG ratings are widely used by investors to integrate ESG principles into their investment strategies. Different ESG rating providers apply ESG metrics using different sources and types of data, parameters, weightings, and assumptions, hindering their comparability. The International Organisation of Securities Commission (IOSCO), the global standard setter for securities market regulators, suggested improvements in reliability of raw ESG data, transparency in ESG methodologies, and reliability in ESG ratings and data products. The IOSCO has also recommended ESG ratings providers and entities subject to ESG assessment to improve information gathering processes, disclosures and communication between each other. These improvements will help make ESG ratings and data more rigorous and transparent.

Private sector investments in sustainable and ethical business practices are one of the key drivers of a sustainable and greener future that the world has envisioned. With the rapid rise in ESG funds, tackling green washing is key to ensure that the world makes real progress on sustainability metrics.

Sneha Shrestha is an ACCA affiliate with interests in business valuation, financial planning, mergers and acquisition, and strategy consulting. She has previously worked in audit and accounting for few years before joining Beed. She is currently working as a beed fellow at beed management.