To curve the recessionary trend in Nepal, solutions should stem at the government level. The path to recovery is possible if the government focuses on strengthening fiscal policies and applying fiscal stimulus wherein the Nepal Rastra Bank (NRB) mobilizes monetary policies and encourages businesses, and manufacturers, – strengthening Nepal’s exports in international markets.

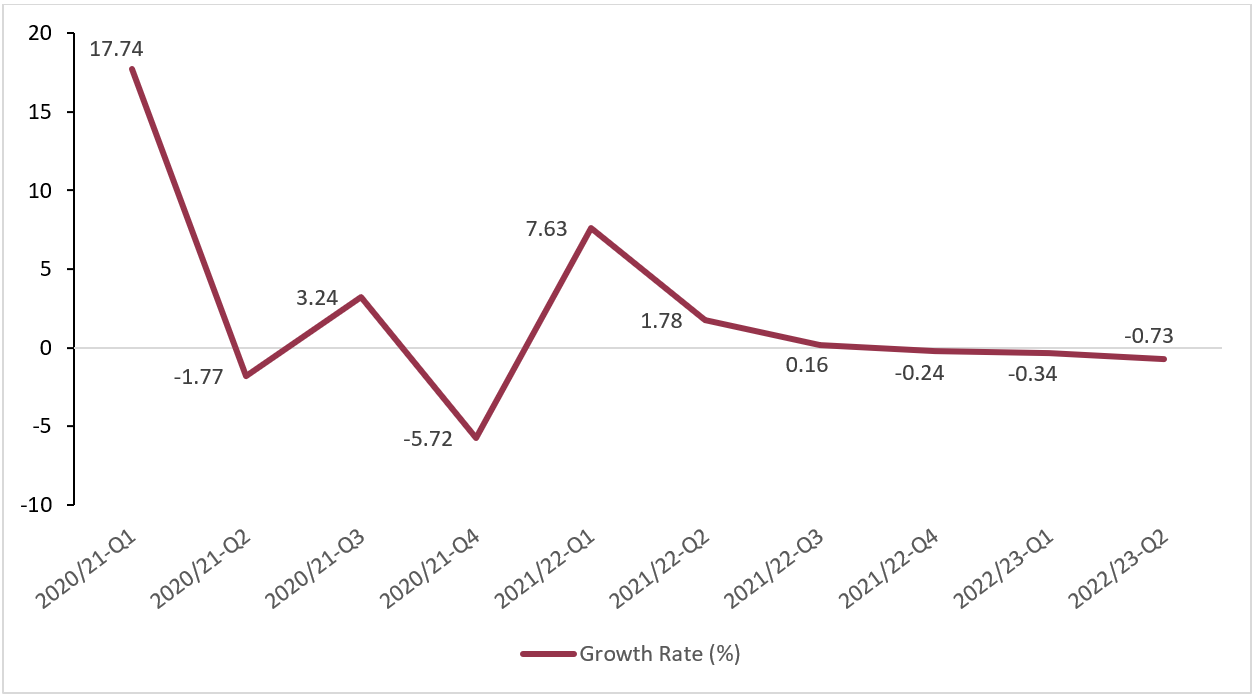

The National Statistics Office (NSO) has projected the growth rate of the second quarter to be (0.73%), negative for three quarters in a row (as referred to in Figure 1). This, by international standards, is a recession in the country. A common rule is that two consecutive quarters of negative Gross Domestic Product (GDP) growth means recession. The recessionary trend is growing and it is shown by various indicators like inflation, the government deficit, and the country’s net exports. The Consumer Price Inflation (CPI) based inflation is 7.76%, the trade deficit is 17%, and government spending is NPR 943.05 billion compared to the revenue which is NPR 683.81 billion, according to the Current Economic and Financial Situation of Nepal report. To curve the recessionary trend in Nepal, solutions should stem at the government level. The path to recovery is possible if the government focuses on strengthening fiscal policies and applying fiscal stimulus wherein the Nepal Rastra Bank (NRB) mobilizes monetary policies and encourages businesses, and manufacturers, – strengthening Nepal’s exports in international markets.

Figure 1

The seasonally adjusted growth rate of the country’s quarterly GDP by economic activities (in %)

Source: National Statistics Office

Understanding Key Reasons for Recession in Nepal

Identifying the core challenges hindering Nepal’s growth is necessary to rectify them. In Nepal, the recession is a result of a combination of internal and external factors. The internal factors contributing to the recession in Nepal encompass government policies, including fiscal and monetary measures, as well as the challenges posed by frequent changes in government, inadequate infrastructure, and reliance on remittances. The external factors are the effects of the COVID-19 pandemic, geo-political conflicts, and external debts.

Internal Factors

To manage the foreign currency imbalance, Nepal’s Monetary Policy for 2022–2023 was characterized by higher interest rates and a smaller money supply – which showcased a contractionary approach. While the deficit has declined through this strategy, it has also caused inflation to further rise. In addition, consumer spending has stagnated, altogether pushing toward a recessionary trend. Recessionary patterns are much more prominent because government spending has been diverted towards administrative spending (32%) instead of productive areas like education and health, where spending is 12% and less than 10%, respectively.

Overall, sporadic changes in consumer spending patterns and legislation along with the shuffling of leadership roles continue to contribute to off-tracking the economy. The last two years have witnessed disorder in the government making policymaking and policy enforcement an exceedingly challenging exercise.

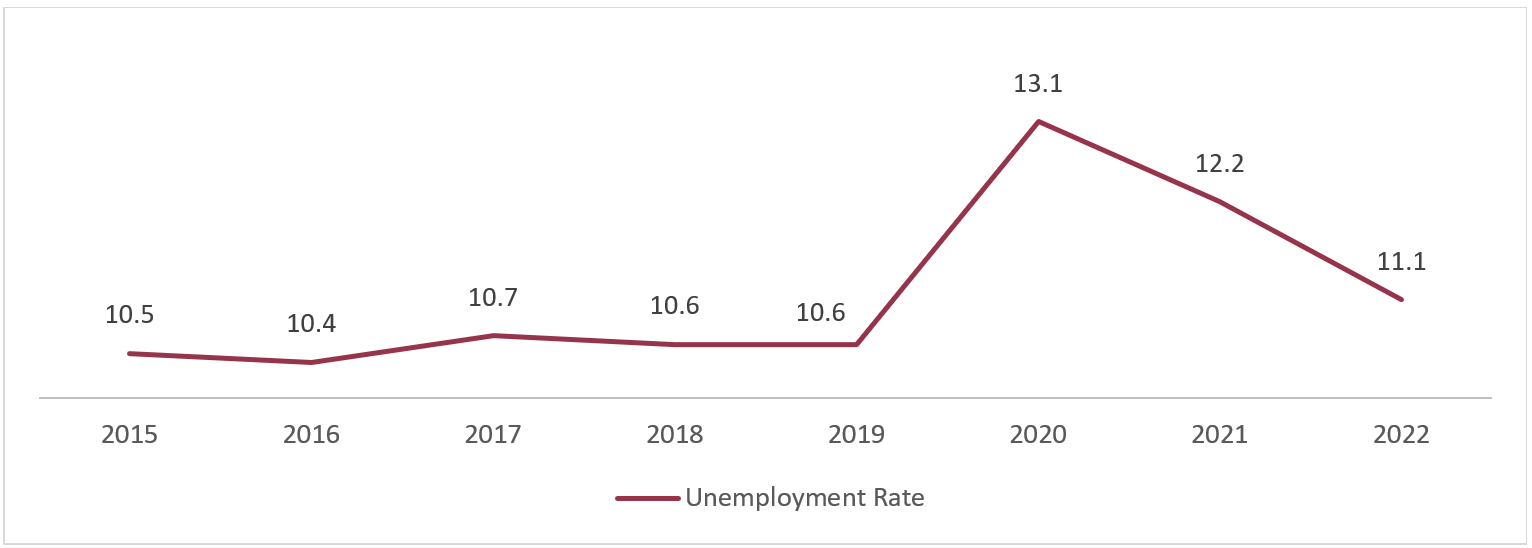

Figure 2 Unemployment Rate of Nepal (% of the total labor force)

Source: World Bank

External Factors

External factors have also been a significant contributor to the recessionary pressure on Nepal. The interconnectedness of economies means that a global recession affects various aspects of Nepal’s economy, such as trade, investment, and overall market conditions. These adverse external conditions have added to the challenges faced by Nepal and have significantly contributed to the recessionary trend. One of the major catalysts for the economic downturn is COVID-19. The COVID-19 caused widespread disruptions across various sectors. The implementation of lockdown measures resulted in the closure of businesses, industries, and manufacturers, leading to a significant decline in economic activity. Furthermore, the restrictions imposed on international travel and trade had a detrimental impact on remittance inflows from abroad, which is a crucial source of income for many Nepali households. The importance of remittances for Nepal’s economy is highlighted by the fact that the ratio of remittances to GDP is 23.23%. The impact was so significant that Nepal touched a negative growth rate first time since 1983. The economic growth of Nepal dipped from 6.7% in 2019 to -2.4% in 2020. The unemployment rate too peaked at 13.1% in 2020 and till today hasn’t leveled up to pre-pandemic levels adding to the recessionary woes.

Another external factor exacerbating the recession in Nepal is the ongoing Russia-Ukraine conflict. The conflict has brought an upheaval across the world and particularly affected Nepal due to its import-based economy and reliance on resources from Russia and Ukraine. The conflict has led to a global increase in the price of goods imported from these countries, including electrical equipment, industrial raw materials, and parts for airplanes and helicopters. The exports from Nepal have been seriously impacted as well – as stated by the Export Council of Nepal, 20 to 50% of Nepali export has been affected by the crisis. The export revenue of Nepal has also declined by 33% in the third quarter of 2022/23.

Furthermore, Nepal’s large external debt portfolio, which reached USD 8.7 billion in September 2022, poses a significant burden on the country’s economy. The inability to clear such a substantial debt at once, coupled with limited revenue generation, has further exacerbated the recession. The accumulation of debt not only constrains economic growth but also increases the vulnerability of the economy to external shocks, further hindering Nepal’s ability to recover from the recession.

Measures to Mitigate the Recessionary Trend

Problems are vast and need more than just a short-term boost to revive the economy to normalcy. As discussed earlier, the start of the recovery process should emerge at the government level through the use of fiscal policies. The measures noted below can aid the recessionary trend:

- Economic Reforms and Fiscal Stimulus: To boost economic activity and regain consumer confidence, the government should implement targeted fiscal stimulus measures. This could entail raising government spending on infrastructure initiatives, encouraging private investment, and helping the afflicted industry. Long-term economic growth can also be aided by enacting fundamental economic changes including lowering restrictions, enhancing the business climate, and encouraging entrepreneurship.

- Monetary Policy Modifications: The direction of Nepal’s economy must be determined by reevaluating the country’s current monetary policy. The current policy, which is characterized by tightening controls like raised interest rates, a smaller money supply, and limitations on the outflow of foreign currency, has made some success but also had a detrimental effect on businesses as seen by the weak economic development. A more accommodating monetary policy can aid in the economy’s short-term growth and the process of recovery.

- Economic Diversification: To lessen Nepal’s strong reliance on a few industries, such as remittances and agriculture, economic diversification is crucial. The sensitivity to external shocks can be decreased by promoting sectors with growth potential, such as manufacturing, tourism, and information technology. This can be accomplished by employing tactics for export promotion, programs for skill development, and focused financial investments.

- Improving Credit Access: Improving SMEs’ (small and medium-sized enterprises) access to credit is essential for promoting economic growth. Investment, entrepreneurship, and job creation can be boosted by putting policies into place that make it simpler to access credit, encourage financial inclusion, and support the growth of a strong and inclusive financial sector.

- Infrastructure Development: Investing in the infrastructure of the transportation, electricity, and telecommunications sectors can boost the economy. Production can be increased, connectivity to the global market can be improved, and investment can be recruited by investing in modern, effective infrastructure. Infrastructure projects can be efficiently financed and carried out with the help of public-private partnerships and foreign direct investment.

Thus, for the government to curb the recessionary cycle, it needs to identify and mitigate the short and long-term impacts of internal and external factors that cause the economy to slump. A comprehensive and integrative strategy to overhaul the economy using monetary and fiscal policies to support the industries and services while attracting foreign direct investments (FDIs) may seem like the secret potion to improve situations, however, the road to recovery is paved with multi-layered challenges and disruptions. The new budget and other government initiatives do attempt to move in the right direction, signaling the potential for Nepal to overcome the recessionary trend but concerted and dedicated efforts are required from all stakeholders – international and national alike.

Adarsha Subedi is an Economics undergraduate currently enrolled at Kathmandu University School of Arts. He has a keen interest in international, development economics, public policy, and economic theory. He is an intern at NEF.