Background

Nepal lies at the center of two giant economies and carries a huge potential for trade and investment. The nation was sheathed under the protectionist industrial policy until 1985 when domestic firms were protected from foreign competition by imposing quotas and high tariffs. After Nepal entrenched trade liberalization in 1985, the economy sought to modernize by creating an appropriate environment for the private sector.[1]

The open industrial policy of 1992 aimed to create a competitive environment for the private sector by decreasing the intervention of the government in fixing the price of goods. The policy was formulated with the aim of making the agriculture and manufacturing sector robust to leverage the export business. Nepal exported agricultural products to India, which included rice, tobacco, jute, and vegetable oils. Moreover, various raw materials such as hides, skins, herbs, and bamboo products were also exported.

Nepal’s Trade with its Neighbors

In 1950, Nepal’s first formal trade treaty, the “Treaty of Trade and Transit” was established with India, which was renewed in 1999. After the treaty, tariffs were lowered which helped to exchange goods between the two nations. On the other hand, the “Sino-Nepal Treaty of Peace and Friendship” signed between China and Nepal in 1960 established formal trade linkages between the two countries. Having said so, China, India, and Nepal’s trade relations expand beyond commodity trading. The triplets share a long history of civilization, culture, migration, and trade.

In April 2004, Nepal became the 147th member of the World Trade Organization.[2] After being a member, Nepal gained the opportunity to leverage its trade and investment worldwide. As of today, Nepal comes across ratifying different international trade agreements. Recently, it has been a part of two big agreements, the South Asian Free Trade Agreement (SAFTA) and the Bay of Bengal Initiative for Multi-sectoral Trade and Economic Cooperation (BIMSTEC).[3]

Gaps and Opportunities in Foreign Trade

Nepal has seen a paradigm shift in trade relations to the context of social and economic aspects because of globalization, technological advances, and political interest. All of these aspects have led to a more conducive environment to promote trade in Nepal. However, external trade projects a bleak picture of the nation. After Nepal signed the WTO agreement, exports decreased from 28.3% to 6.9% in the period starting from 2004/05 to 2016/17. In the corresponding period, imports increased from 71.7% to 93.1%[4]. The trend of imports has been rising exponentially over the past two decades, which has now been a threat to the economy. Nepali products face impediments in entering the neighboring markets whereas, on the other side, there has been an erratic rise in the demand for essential commodities in the Nepali market. Therefore, export performance remains weak due to supply-side constraints and low productivity. Nepal also bears high transit costs which further reduces the competitiveness of its products.[5]

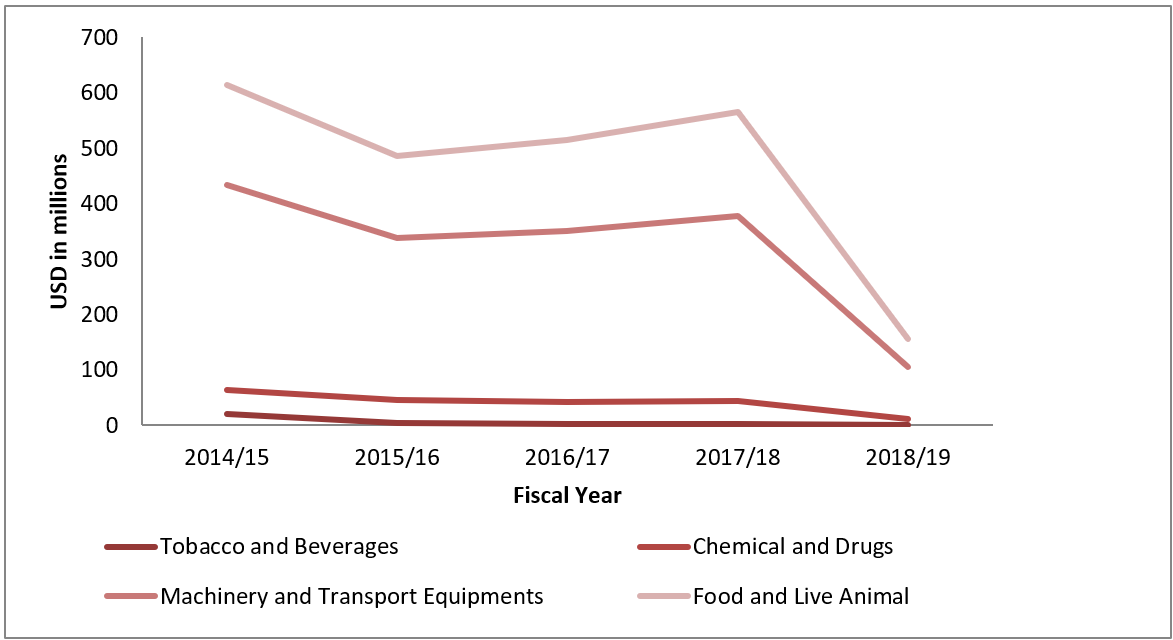

Figure 1: Commodity-wise Export Trend

(Source: Quarterly Economic Bulletin, Nepal Rastra Bank)

Figure 1 illustrates that food and live animal items are exported on a large scale in comparison to other items shown. The supply of tobacco and beverages is the lowest in terms of volume. Overall, the export share of all the items has significantly decreased over the years.

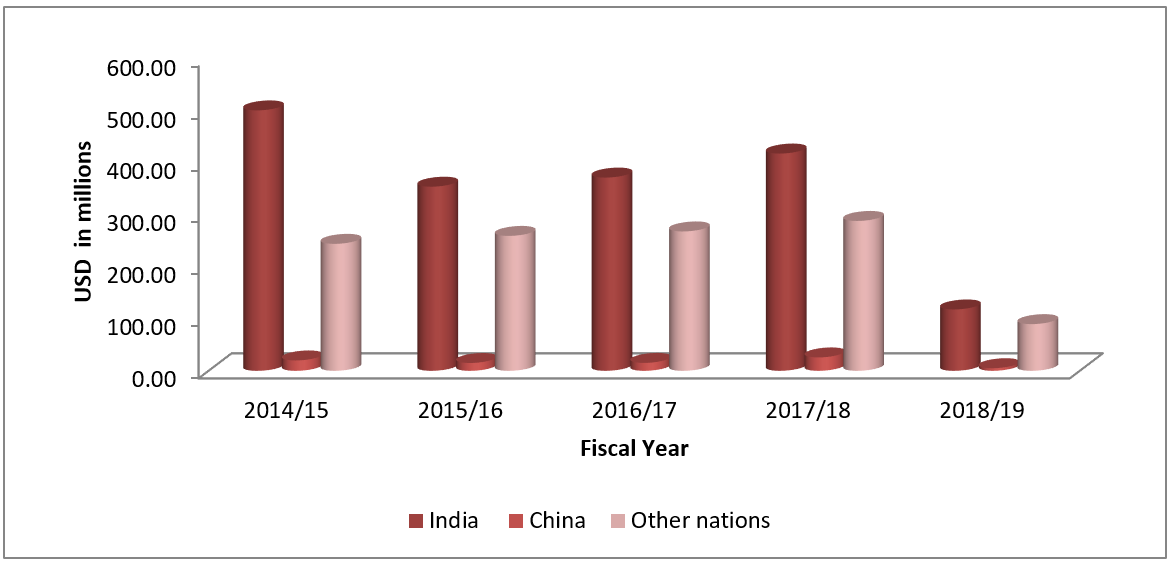

Figure 2: Nepal’s Overall Export Scenario

(Source: Quarterly Economic Bulletin, Nepal Rastra Bank)

Figure 2 represents the volume of exports from Nepal to foreign nations beginning from the fiscal year 2014/15 to the period 2018/19. Overall, the trade status presents the idea that Nepal supplies maximum goods to India. India received the highest amounts of supplies from Nepal in the fiscal year 2014/15. In the fiscal year 2017/18, India imported USD 2.9 million worth of bran, USD 44.07 million worth of cardamom, USD 42.22 million worth of jute products, and USD 43.09 million worth of juice from Nepal. Nepal’s export to China, another pertinent trading partner, in the corresponding period is negligible compared to India.

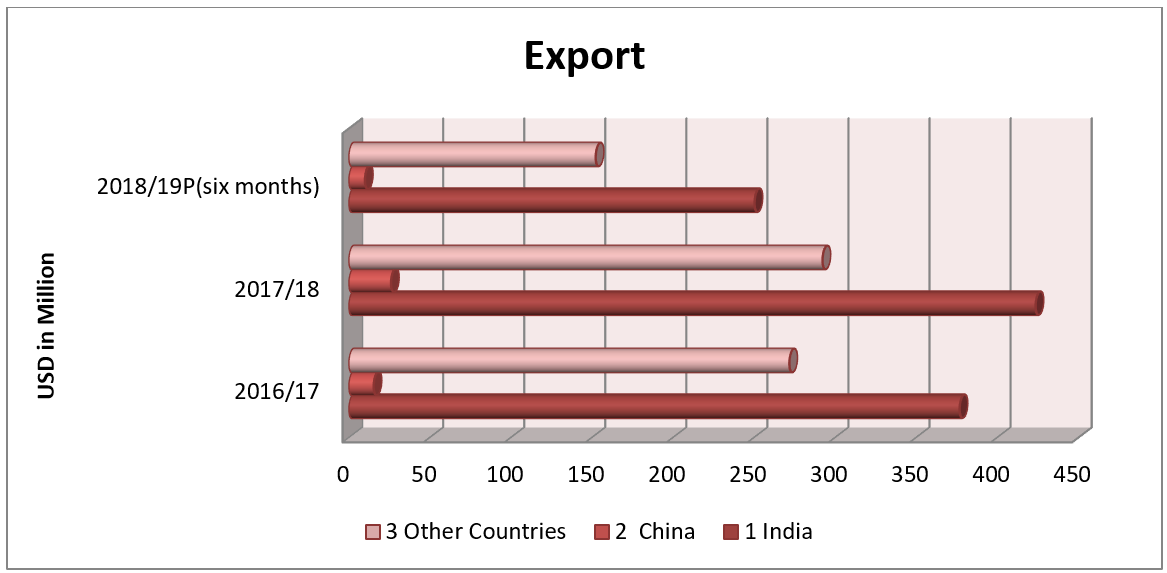

Figure 3: Current Trade Scenario

(Source: Current Macroeconomic Situation Based on Six Months table, Nepal Rastra Bank)

After the advent of federalism in Nepal, the trade deficit has aloft further. In the fiscal year, 2016/17 Nepal exported commodities amounting to USD 376.94 million to India, USD 15.47 million to China, and USD 271.90 million to other countries. Similarly, in the fiscal year 2017/18, Nepal exported USD 423.8 million in goods to India, followed by USD 26.18 million to China, and USD 292.36 million worth of goods were exported to other countries. As per the recent macroeconomic data unveiled by NRB, in the past six months of the fiscal year 2018/19, Nepal exported USD 250.44 million in goods to India. Nepal exported USD 152.44 million worth of goods to other nations which is higher than the goods exported to China in the first six months of 2018/19. Nepal managed to export only USD 10.10 million volumes of goods to China.[6]

Indeed, the Trade and Export Promotion Centre (TEPC) statistics state that Nepal experienced a trade deficit of NPR 454.47 billion in the first four months of the fiscal year 2018/19[7]. If the current trend of import continues, Nepal might be facing a huge risk of the collapse of the foreign exchange reserve system. Accordingly, the nation could be in a state of emergency where Official Development Assistance (ODA) would be the only means of surviving the economy. ODA would be a significant support to import the goods that are prominent for the regulation of the economy.[8] To tap the opportunities and avoid erratic economic shocks, it is imperative that the USD 30 billion economy should emphasize creating a business-friendly environment and unfold its economic potentialities by addressing its export impediments, which have been a major backdrop in setting the foot front in the global market.

Hurdles and Proposed Reforms

| Hurdles | Proposed Reforms |

| · Trade and transit cost (including exit and entry charges) is charged higher by the neighboring customs.

· Trading across the border is difficult as Nepali cargos consume a longer time to enter and exit. · Longer transportation time damages seasonable and perishable goods. |

· Transit procedures should be simplified by easing the trade flow at the border. Also, appropriate measures should be adopted to control the trade cost through diplomatic interventions.

· Transit procedure of Nepal’s cargo should be prioritized. · Yards for containers and warehouses should be added to the existing ports. · Administrative barriers at the border should be minimized. |

| · Agriculture sector faces a high cost of production and fails to meet international standards.

· Manufacturing sector faces a technology hitch and a shortage of skilled labor.

|

· The government should prioritize promoting Nepali products and services that have a comparative advantage over others and introduce flexible policies to accelerate its production.

· Goods processed should match the quality of international standards. · There should be the provision of distribution of commercial agricultural toolkits such as equipment and fertilizers to the agricultural units located throughout the three tiers of the nation. · The country must generate employment opportunities to retain labor for the domestic market. · There is a necessity for appropriate reformations to control the mass labor out-migration. |

| · Weak Road networks create delays in trading across borders.

· Open border induces a flow of Indian goods at a cheaper price and aggravates the smuggling of goods through unofficial routes. |

· The time taken for transshipments can be reduced in Kolkata, and Haldia ports with a better cooperation policy with India. Such policies will also support reducing transit costs.

· Checking and clearance on the border should be properly monitored by the Electronic Cargo Tracking system to ensure that only legal goods are flowing in and out of the border. |

| · Lack of investment climate | · Creating an investment-friendly environment by promoting the role of small and medium enterprises.

· Collaborating with the private sector body while formulating economic policies and developing an industrial base for capital formation. |

Outlook:

The prolonged period of trade deficit has hiked tensions in the nation and poses a considerable risk to the nation’s economy. In order to avoid severe disruption to the national value chain, the deeply embedded dependency on imports should be reduced. The trade imbalance in the nation should be controlled by focusing on the rise of productivity by recalibrating the capital of manufacturing industries.

[1]“A Review of Industrial and Trade Policy in Nepal: Research Brief”, SAWTEE. Accessed 13th March 2019

[2] Ibid

[3] ibid

[4] “Nepal Trade Policy Review: Report 2018, Ministry of Industry Commerce and Supplies”. Accessed 7th March 2019

[5] Purushottam Ojha, “Non-tariff barriers facing South Asia: Case of Nepal”, Accessed 10th March 2019

[6] “Nepal Rastra Bank: Current Macroeconomic and Financial Situation of Nepal”. Accessed 14th March 2019

[7] Rising imports Cause Trade Deficit in Nepal.30 November 2018. https://www.nepalisansar.com/business/rising-imports-cause-trade-deficit-to-nepal/

[8] Government taking steps to address the rising trade deficit, 18 December; https://thehimalayantimes.com/business/govt-taking-steps-to-address-rising-trade-deficit/

Aashna was associated with Nepal Economic Forum (NEF) in the year 2018 until mid-2019 as a Research Fellow. During her tenure, she contributed to work in the multi-disciplinary areas of research and policy analysis carried out by NEF. She assisted in organizing two of our most notable events – The Himalayan Consensus Summit and Kantipur Conclave. Aashna also devoted her time as a supporting author to our nefport series and had some of her columns published on neftake.