Minister of Finance Barshaman Pun presented the fiscal budget of the FY 2024/25 on May 28, 2024, which totaled to NPR 1.86 trillion—an increase of 6.2% compared to the NPR 1.75 trillion from the FY 2023/24. However, the budget in the previous year was slashed to NPR 1.53 trillion following mid-term review. Relative to that, the increase in the budget for this fiscal year is 21.56%. However, the trend of reducing budget in the mid-term review is the long-standing tradition of Nepal.

The Government of Nepal (GoN) has estimated an economic growth rate of 6% for the upcoming fiscal year, and the inflation at 5.5%. While the budget for FY 2023/24 had also set similar expectations, Nepal is estimated to achieve only around 3.9% of growth. Minister Pun has declared the year 2081-82 as the year of economic reform and listed five objectives of the budget, five priorities area and five different strategies in this budget. Some of the key programs and highlights of the budget are studied in this article.

Government Expenditures and Revenue

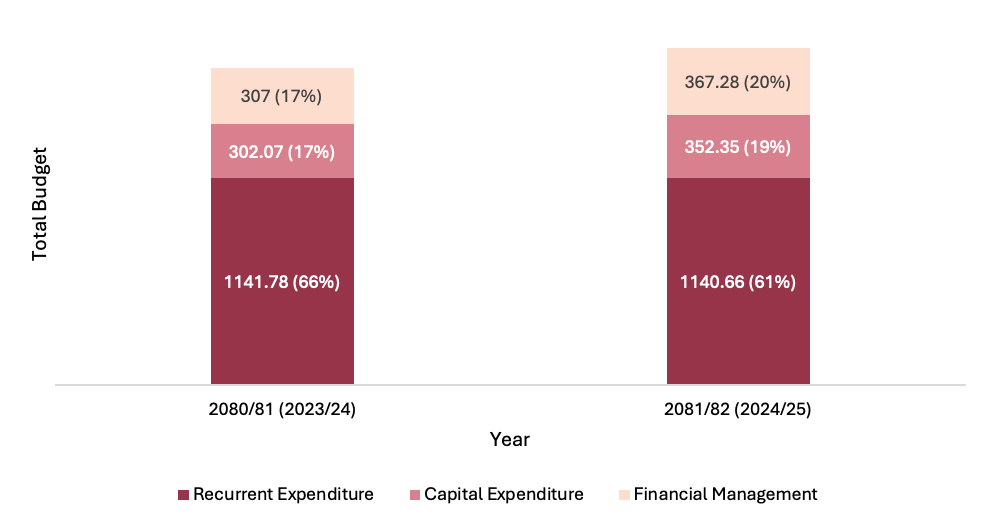

Out of the allocated budget of NPR 1.86 trillion, the recurrent expenditure accounts for NPR 1.14 trillion, capital expenditure accounts for NPR 352.35 billion, and the remaining NPR 367.28 billion is allocated for financial management. This distribution has been illustrated in Figure 1. The amount allocated for recurrent expenditure has decreased by over NPR 1 billion from the previous budget. Meanwhile, the amount allocated for capital expenditure and financial management has increased by NPR 50 billion and NPR 60 billion respectively.

Figure 1 – Fiscal Budget presented by GoN in NPR Billion

Source: Budget Speech 2024/25, Ministry of Finance, Government of Nepal

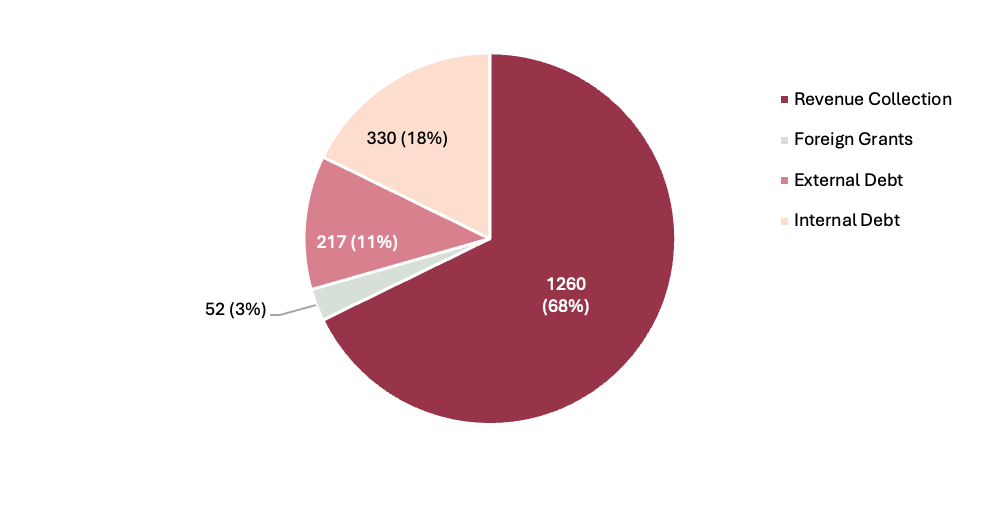

The government has targeted the revenue collection of NPR 1.26 trillion for the FY 2081/82—an increase of NPR 12 billion from the target set in FY 2023/24. Similarly, the government has set the target of foreign grants of NPR 52.33 billion, and external debt of NPR 217.67 billion. The revenue collection target of NPR 12.60 billion looks challenging, given the current circumstances. Economic activities have slowed down because of the economic downturn around the world. The government has also increased the proportion of internal debt by over NPR 90 billion compared to the previous year and has set it to NPR 330 billion. Although financing budget deficit by using the debt is a norm in most countries, the government should also have a concrete plan for its repayments. Moreover, with only 18.94 % of the budget allocated for capital expenditure for the next fiscal year raises concern about ballooning outstanding debt that will only increase without investment in productive sector.

Figure 2 – Sources of Fund in Budget 2081/82 (2024/25) in NPR Billion

Source: Budget Speech 2024/25, Ministry of Finance, Government of Nepal

Key Highlights of the Budget

Agriculture

The government has allocated the budget of NPR 57.29 billion for the Ministry of Agriculture and Livestock Development with focus on commercializing agriculture and increasing production and productivity. The government has also declared the decade 2081-91 BS as the decade of investment in agriculture sector. Different programs and initiatives are announced to identify markets of agricultural products and take active participation of government in setting price and creating market. The government has also allocated NPR 2.98 billion for the Prime Minister Agriculture Modernization Project. Furthermore, the government has planned to provide subsidies in credit and tax and loan waivers to encourage commercialization of agricultural goods and market access.

Energy

The budget has targeted to add further 900MW electricity in national grid and increase the per capita consumption of electricity to 450 units. To become self-reliant on electricity during dry season, the government has planned to build six different hydroelectricity projects. This will encourage the private sector to participate in developing electricity transmission lines. The government has developed programs to replace fossil fuels with renewable energy in line with the aim to reach zero carbon emissions by 2045. However, the government has increased the tax on electric vehicles (EVs) by an average of 10% which can be counterproductive to achieve this goal in time. The budget also highlights the construction of Budhigandaki and Upper Arun hydel projects to boost electricity export to Bangladesh. The government of Nepal has allocated NPR 87.55 billion for Ministry of Energy, Water Resources, and Irrigation.

Information Technology

The government has also declared the decade of 2081-91 BS as the decade of information technology and planned to develop Nepal as hub of information technology. This will enable the sector to generate employment for 1.5 million people directly and indirectly and export IT services worth NPR 3 trillion in ten years. It was NPR 67 billion in 2022. The government has also allocated NPR 590 million to reform Digital Nepal Framework (DNF). Under DNF, the government has planned to build an organization to assess and implement it. The government has aimed to reduce the digital divide through various programs like IT parks, strengthening data center, promoting domestic software usage, and increasing the access of broadband services. The government is also planning to provide a rebate on tax to information technology companies in reinvested profit.

Tourism

The Ministry of Tourism has been allocated a budget of NPR 11.91 billion. The government is planning to bring open door services to tourists and has planned to attract 1.6 million tourists next year. The destination profile will be created after identifying new and existing destinations. Different roadshows, fairs, and promotion activities will be launched in major tourist destination in India and China to attract tourists. The direct transportation services from border cities of Nepal to Pashupatinath, Swargadwari and Muktinath will be started in partnership with private sector to promote pilgrimage tourism which will attract Indian pilgrims. The great Himalayan trail, Mundhum trail and Guerrilla trail will be developed to attract trekkers. The government has also planned to operate paragliding, parachute, skydiving, ultralight and other courageous tourism activities through airports that are not in operation currently. This will enable the utilization of unused resources and attract adventure tourism in Nepal. The government has further planned to develop Janakpur as wedding hub and Lumbini as birthing hub to promote destination weddings, especially from across the border. The effective execution of these plan and initiatives will attract more tourists which will help Nepal earn more foreign exchange.

Entrepreneurship and Industrial Development

The government has proposed the Gandaki Economic Triangle project assessing the economic potential and achieving integrated development of Bharatpur-Butwal-Pokhara area. This will enable the participation of the private sector in industrial reform and employment generation in these areas. The government has planned to develop different industries in this region to promote domestic production and industries. The government has also planned to develop Nepal Startup Board and set up a startup fund of NPR 1 billion to encourage youth participation in entrepreneurship and foster innovation climate. government is also planning to initiate Sovereign Welfare Fund to channel the remittances in productive sector. Non-Resident Nepalis (NRNs) on homeland program will be initiated to facilitate the utilization of fund created by NRNs productively.

Tax Reforms and Changes

The government has reduced the excise duty on raw materials of drugs, induction stove, thread, helmet, incense sticks, sanitary pads, cashew nuts, and spring sheet to promote domestic industries. To attract foreign investments in the financial sector, the government has reduced the income tax on interests earned by foreign banks subsidiaries. The government has decreased the tax on steel milk cans and the milk from farms that produce more than 1000 liters of milk daily by 15% to 1%. The value added tax (VAT) is withdrawn from fruits and vegetables like potatoes, onions, and apples. The excise duty on liquors, beer, tobacco, and cigarettes is increased. The green tax has been imposed on fossil fuels like petroleum products and coal. The government has continued to levy taxes on EVs based on their kilowatt (KW) capacity but have increased both excise and custom duty on it. The government has imposed 5% excise and 5% custom duty on EVs with capacity of 50 KW which previously was tax-free. The government has also increased excise and custom duty on EVs with capacity of more than 50 KW.

Outlook and Expectations

Programs in the budget are oriented towards its primary objectives i.e., of increasing productivity and production. The budget shows some efforts in enhancing domestic industries by fostering investment climate in the nation and increasing the participation of youth in entrepreneurship and start-up with programs like development of start-up funds, tax exemptions on reinvestment, and initiation of an economic triangle.

The capital expenditure of Nepal in previous years have remained dismal. The government has spent only 41.67% of allocated capital expenditure in this fiscal year as on May 30, 2024, as reported by the Financial Comptroller General Office. Without optimum capital spending, the ballooning debt is likely to affect the long-term economic growth of the country. The question remains on how long the debt funded budget will sustain with low capital expenditure.

The target of curbing inflation to 5.5% seems unlikely with the hike in taxes. Even though the government has slashed tax on raw materials on some goods to encourage domestic production, those goods and services are imported after adding maximum value. The imposition of green tax on fossil fuels, increase in tax of EVs, liquors, luxury items and tourism are likely to increase the prices in domestic market.

However, the budget still has some contradictory points and is not in line with the government’s long-term goal. For instance, the decision to withdraw duties on certain commodities like onion and potatoes will likely increase their imports, reducing competitiveness of domestic farmers and ultimately discouraging them. This contradicts the government’s plan to be self-sufficient on agricultural goods. Similarly, the increase in tax of electronic vehicles contradicts the government’s goal to become zero carbon nation by 2045 AD.

It appears likely that the government will have to adjust the budget through mid-term fiscal policy review due to inability to meet its established targets. Thus, it is imminent for the governments in future to assess the situation and bring forth more realistic and balanced budget.

Sushant Dhakal is an MBA candidate at Kathmandu University School of Management, driven by a deep interest in development economics, game theory, trade dynamics, and financial modeling. With a strong desire to make a positive impact on his nation, he is currently involved as a research intern at the Nepal Economic Forum.