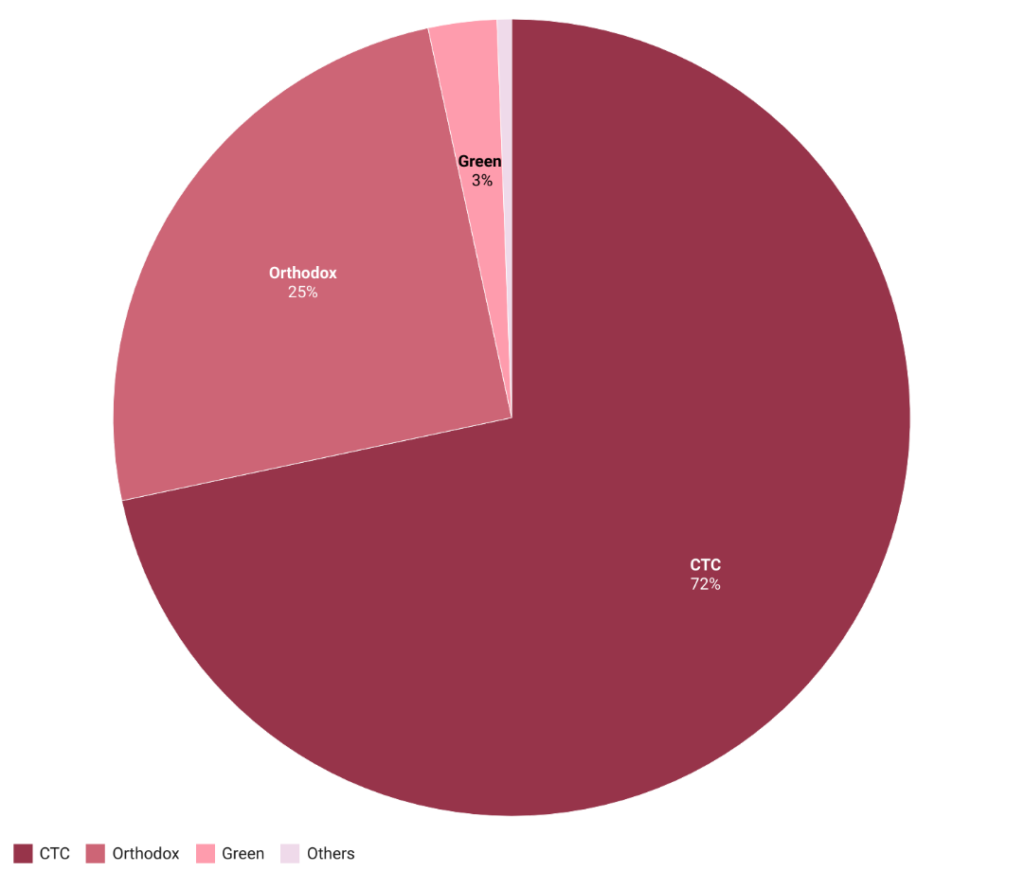

Tea holds a significant historical and global presence as one of the oldest and most favored beverages worldwide. The cultivation of tea in Nepal traces back to 1863 AD, when the Ilam district witnessed the inception of tea plantations under the initiative of the then Prime Minister Junga Bahadur Rana. The evolution of Nepal’s tea estates gained momentum following the dismantling of the Rana regime, which paved the way for private sector participation in the industry. Nepal’s tea production encompasses two primary types: CTC (Crush, Tear, Curl) and Orthodox tea. CTC tea, primarily cultivated in the lowlands of Jhapa district, predominantly caters to domestic market whereas Orthodox tea, classified as a specialty tea, is cultivated in the foothills of Ilam, Panchthar, Dhankuta, Morang, and other districts, enjoying exports beyond Nepal’s borders. GIS data reveals that Nepal possesses 1.8 million hectares of land suitable for orthodox tea cultivation, yet only 20,237 hectares are presently under cultivation.

Figure 1: Types of Tea Produced in Nepal

Source: National Tea and Coffee Development Board

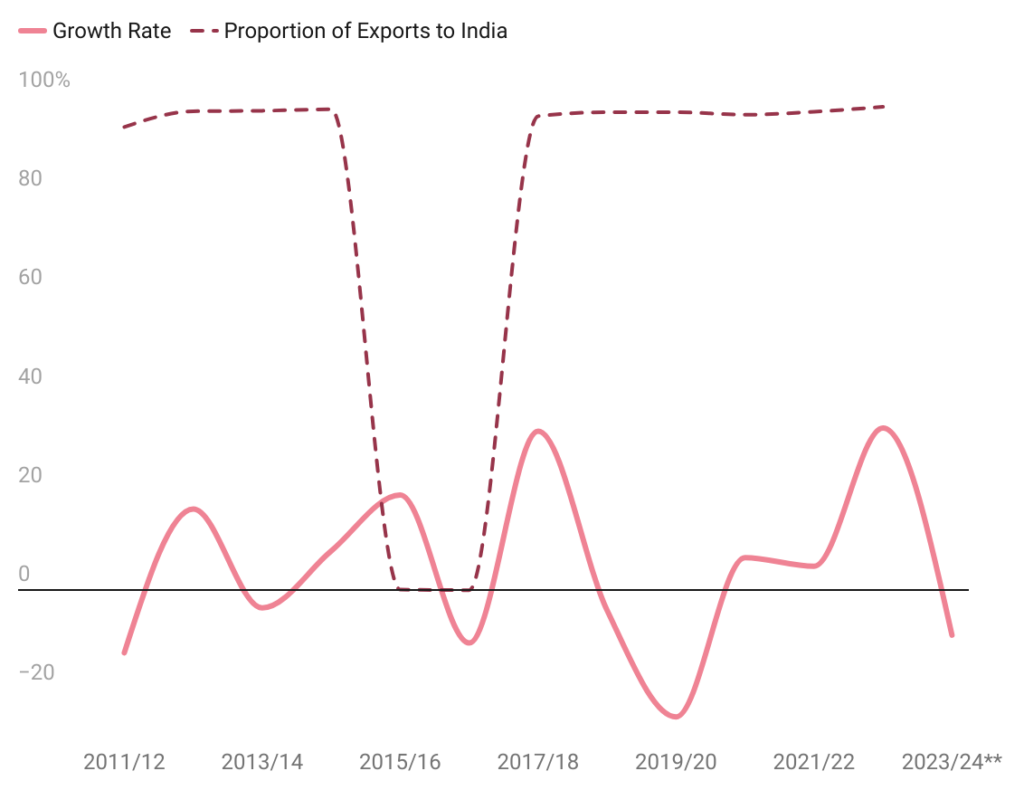

Nepal’s annual tea production exceeds 26,000 metric tons, comprising 6,500 tons of Orthodox tea and 18,000 tons of CTC tea, cultivated across 163 tea estates, and involving over 15,000 smallholder farmers. In the year 2022 AD, Nepal exported more than 17,000 tons of tea to various countries including India, the Russian Federation, Pakistan, Germany, among others. Notably, India has consistently been the recipient of over 95% of Nepali tea exports over several years.

The Nepal Trade Integration Strategy 2023 recognizes tea as a product with export potential, which was also underscored in both the NTIS 2010 and NTIS 2016. Despite this recognition and increased production, tea exports have experienced stagnant growth. While production has seen a nearly 60% rise over the past decade, exports have only increased by 45%, with an average annual growth rate of just 5% during this period. During the initial eight months of the fiscal year 2023/24, while most products listed in NTIS 2023, including agricultural products like ginger and lentils, experienced increased export volumes, the tea sector notably recorded a significant decline of 11.9%.

Figure 2: Annual Export Growth of Tea and Proportion of Total Tea Export to India

Source: Department of Customs

Challenges with Competing in Indian Market

Nepali tea, known for its unique flavors and grown in terrain akin to Darjeeling, has become a sought-after alternative to Indian tea in markets across North America and Europe. However, tensions have risen as Indian tea farmers from Darjeeling lobby for a ban on Nepali tea imports, claiming that Nepali farmers blend sub-par tea with Darjeeling tea and sell it under false labels. This led India’s parliamentary committee to suggest stringent certificate of origin requirements and imposing up to 100% anti-dumping measures on Nepali tea. However, Nepali tea is mostly sold to Indian merchants who then label and export it as Darjeeling tea. The Darjeeling tea in the market is four times the yield from the region’s 87 protected estates. To protect the identity of Nepali tea, Nepal has recently registered trademark of its orthodox tea in September 2019, 157 years after the nation started the tea plantation.

Adding to the complexity, Nepal faces challenges in quality testing as it lacks its own labs and must send tea samples to India, which leaves it in their hands to determine the quality of Nepali tea. Nepali exporters face rigorous standards when exporting to India while they claim that they reach requirements to other countries like Japan, USA, and the International Certification of Environmental Standards. This situation underscores the intricate challenges Nepali exporters face, from political challenges and contending with low prices, highlighting the disparities in the tea trade dynamics between India and Nepal. The potential repercussions of these ongoing and anticipated challenges pose a significant risk to the Nepali tea industry, endangering the jobs of over 75,000 Nepalis employed directly or indirectly within the sector. Hence, it is imperative to proactively explore alternative markets for Nepali tea.

Emerging Opportunities from China

As challenges continue to mount on one side, new avenues for potential opportunities are emerging. The Chinese government has extended a significant opportunity by opening its borders to Nepali tea for entry into the Chinese market. Furthermore, the Chinese government provides duty-free access to 98% of Nepali products entering their market, including tea, thereby offering a favorable environment for trade. Recently, Nepali tea made its debut in the autonomous region of Xizang through the Gyirong land port, marking the first instance of Nepali tea entering China via land. This development represents a significant milestone in Nepali tea trade, as it reduces transportation costs for Nepali traders.

There is a noticeable increase in the demand for Nepali tea in China, leading to significant growth in the export of both orthodox and CTC tea. The surge in demand for Nepali tea in China can be attributed to the accolades garnered by Nepali teas, including gold medals won in the Second Tea Quality Competition. These achievements have propelled Nepali teas into the limelight, gaining popularity across various regions in China. Moreover, there are speculations that the demand for Nepali tea will continue to rise, fueled by an increasing number of Chinese traders visiting the tea fields of the Ilam district adding on the possibilities that the introduction of trade via overland routes for the first time is opening up for them. While India currently offers Rs. 650 per kg and European countries Rs. 900 per kg for Nepali tea, the same batch of tea can fetch up to Rs. 3500 per kg in the Chinese market. This significant price difference highlights the immense opportunities for Nepal to redirect its trade routes to the lucrative Chinese tea market.

Challenges in Diversifying Tea Market

Despite the considerable opportunities, trading tea with our northern neighbor is not without its challenges. While demand has shown an upward trend, the sustainability of this demand remains uncertain, given China’s status as the world’s largest tea producer. To maintain and enhance demand, Nepali traders must take proactive measures to position Nepali tea uniquely in the Chinese market through innovative branding and packaging strategies. A case study by The Araniko Project underscores the importance of creating a compelling identity for Himalayan tea that resonates with Chinese consumers, highlighting innovative packaging needs beyond traditional plastic or paper woven bags. This poses a unique challenge in fulfilling the requirements of Chinese markets, encompassing aspects such as meeting quality standards and developing a distinctive branding strategy that resonates with Chinese consumers.

Additionally, Nepali tea faces scrutiny from destination markets due to concerns about pesticide residues level in tea, as indicated by a recent report from SAWTEE. Although the new trademark for Nepali orthodox tea emphasizes 100% organic production criteria, many tea factories applying for the trademark have encountered difficulties in obtaining the logo. This highlights procedural lapses and a lack of technical know-how among Nepali tea producers that need to be addressed to meet international standards and ensure market acceptance.

Way Forward for Revitalizing Declining Tea Exports

Most Nepali tea is exported in bulk to international markets, where it undergoes packaging, branding, and sale under the importer’s label. This practice significantly impacts Nepali farmers, as they receive only a fraction of the actual market price for their tea. Nepali traders must shift from these practices to adding maximum value to their products before export. This will enhance income generation and safeguards the authenticity of Nepali tea. Moreover, customizing products to cater to diverse market segments and leveraging storytelling marketing alongside tea tourism initiatives, as demonstrated by Nepal Tea Collective, can significantly expand customer bases across international markets.

Addressing consumer awareness gaps regarding the health benefits of Nepali specialty tea, coupled with efforts to increase domestic consumption are key steps towards sustaining Nepal’s tea industry. Nepal can also capitalize on huge production potential given its favorable terrain, climate, and environment by cultivating the barren lands and naked hills that are suitable for tea plantations. Therefore, embracing these strategies can bolster the resilience and competitiveness of Nepal’s tea export sector, ensuring a prosperous future for the industry and its stakeholders.

This working article serves as part of the ongoing Nepal-China 101 research study being carried out by Nepal Economic Forum.

Sushant Dhakal is an MBA candidate at Kathmandu University School of Management, driven by a deep interest in development economics, game theory, trade dynamics, and financial modeling. With a strong desire to make a positive impact on his nation, he is currently involved as a research intern at the Nepal Economic Forum.