The history of electric vehicles (EVs) can be traced back to 1834, predating fossil fuel vehicles when Thomas Davenport invented the first electric motor. This was followed by French physicist Gaston Planté’s development of the lead-acid battery in 1859. However, the ubiquity of cheap oil and limited environmental awareness hindered the advancement of EVs. Mass automobile manufacturing began in 1913 with Ford’s first moving assembly line. Then it shifted from the US to countries like Japan in the 1930s, South Korea in the 1950s, and China in the 1980s. There was a brief revival of interest in EVs due to the energy crisis in the early 1970s when developed countries faced fuel shortages and high prices due to an embargo by the Organization of Arab Petroleum Exporting Countries (OAEPC) in 1972. But the modern era of electric vehicles began only in 2003, marked by the release of the Toyota Prius, the first mass-produced hybrid car, followed by Tesla’s long-range electric vehicles in 2006.

Advent of Chinese EVs

While Western nations pioneered initial EV development, China took the lead later with its strategic, government-backed ‘Project EV 863’. The project aimed to advance EV technologies and establish global leadership in the field by developing key components like batteries and motors through government investments and academic-industry collaborations. This resulted in Chinese companies like Contemporary Amperex Technology Co. Limited (CATL) making substantial advancements in battery technology, reinforced by auto-manufacturers such as BYD and NIO. These automakers incorporated state-of-the-art features through innovative technologies in the Advanced Driver Assistance Systems (ADAS) consisting of safety and driving efficiency using sensors, cameras, and automation to assist drivers in real-time. While initially, Chinese companies faced hurdles, such as low adoption rates and limited expertise, these were overcome through subsidies and significant government financing in automobile research, manufacturing, and charging infrastructure. Since 2015, in particular, China’s electric vehicle industry has boomed rapidly to become a global leader, fueled by strategic government support, continuous innovation, large-scale production, and massive exports. Fast forward to 2023, EVs made up one in five global car sales, with China leading as the largest manufacturer and consumer. With this, China is now redefining the future of mobility around the globe including in Nepal.

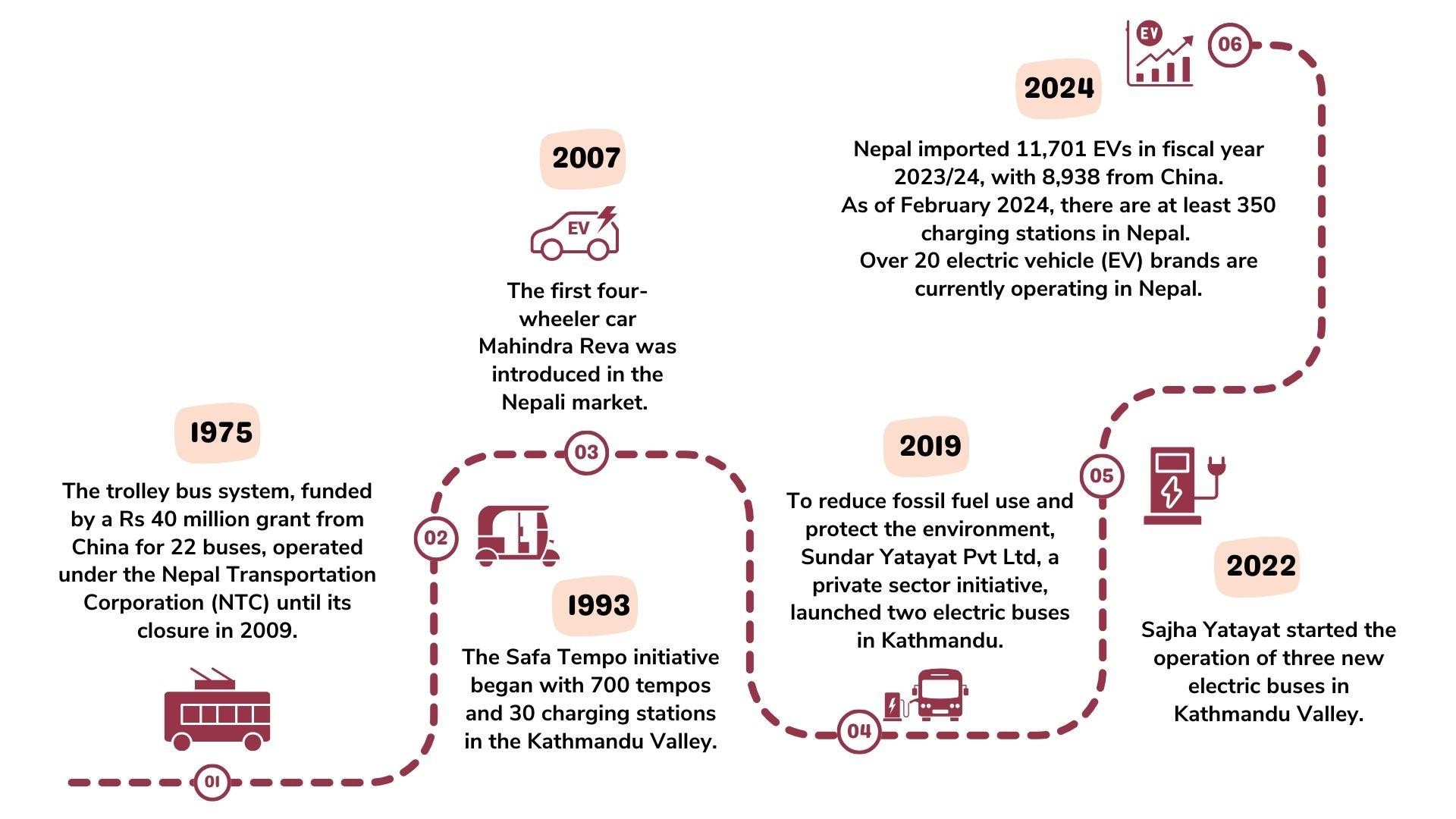

Figure 1. Timeline of the Evolution of EVs in Nepal

Nepal’s EV Landscape

Nepal has always been an early adaptor of technologies and global trends. Whenever new cuisines or fashions emerged, Nepalis are among the first ones to adopt them. This was also true for Internal Combustion Engines (ICEs), whether it is the 1939 Mercedes model or Toyota Corona in 1969. Now, this very adaptive nature has been replicated in the rapid emergence of EVs in Nepal.

Electric vehicles were first introduced in Nepal in 1975 with trolley buses operating in the Kathmandu Valley. The trolley buses were donated by the Chinese government to Nepal but ceased operations entirely in 2009 due to insufficient maintenance and financial challenges. Subsequently, another major development was in 1993 when the battery-powered safa tempo replaced the diesel-run Vikram tempo as a means of clean public transport. The Global Resource Institute (GRI) helped manufacture the first seven safa tempos that were bought and further developed by the Nepal Electric Vehicle Industry (NEVI). However, EVs for private usage only began to gain traction in Nepal in the late 2000s, with the Indian brand Mahindra introducing its Reva model as one of the first private EV entrants to the market. Meanwhile, one of the first Chinese EVs to enter Nepal was BYD’s e6 model which was used for presidential transportation.

In Nepal, initial customer concerns about EV adoption centered on issues like limited range, underperformance, and operational challenges. These concerns also made importers reluctant to take the plunge. To address this, in 2021, TATA started by displaying their EVs at the Nepal Automobiles Dealers Association (NADA) auto show to gauge consumer interest and build confidence. Slowly, the initial hesitation gradually petered out as Nepali customers recognized the advantages of EVs.

Currently, EV imports in Nepal come from a diverse range of countries including India, China, South Korea, the U.S., the U.K., and Indonesia. Chinese EVs in the Nepali market feature brands such as BYD, Derry, Dongfeng, Changan, Great Wall Motors, Neta, Skywell, NIO, and Chery. These EV brands are competing with models like the Tata Nexon, Hyundai Kona, Kia Niro, Mahindra SUV 400, etc. Recently, Tesla officially entered Nepal through a dealership agreement, offering reduced prices, improved support infrastructure, and an initial import of 50 vehicles expected by February 2025. Nepali corporate houses are also increasingly collaborating with Chinese manufacturers to bring in new brands. For example, MAW Enterprises recently introduced Seres, a Chinese brand making strides in Europe, while the Chaudhary Group has dealerships of four Chinese EVs including microbuses (NETA, KYC Changan, King Long, and XPeng) in its portfolio. Additionally, recent promotional efforts, such as Omoda’s co-sponsorship of the Nepal Premier League (NPL) and BYD’s sponsorship of the international balloon festival in Pokhara, have strengthened their market presence. These developments highlight the rising influence of Chinese automakers in shaping Nepal’s passenger vehicle market.

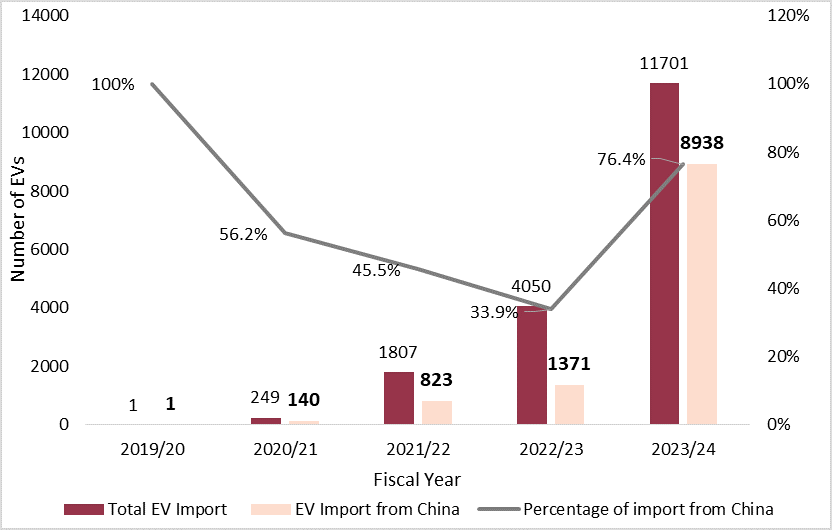

In terms of data, in the first four months of fiscal year 2024/25, 3,487 EVs worth NPR 8.37 billion were imported in Nepal. Figure 2 depicts the trend in the import of electric cars, jeeps, and vans from China and the world from the fiscal year 2019/20 to 2023/24. As depicted in the chart, the import of EVs was minimal in 2019/20 and 2020/21 due to the coronavirus pandemic and subsequent import ban on cars. However, the imports skyrocketed by almost 200% in the last two fiscal years. In FY 2023/24, the total imports were 11,701 EVs, with 8,938 (76.4%) from China, while there were 2763 EV imports from other countries. Moreover, Chinese EV imports dominated the entire automobile market in general as total EV imports accounted for one-third of all automobile imports of the nation.

This rapid rise in Chinese EV imports, especially in the last two years, can be attributed to the complete reopening of the Tatopani border in May 2023, which was long disrupted following the 2015 earthquake and the 2020 coronavirus pandemic. The growing preference of Nepali consumers for Chinese EVs is mainly due to its affordability, advanced in-built technology such as ADAS powered by technologies like Artificial Intelligence (AI), sleek design, and enhanced comfort compared to other EVs. Nepal’s EV market has also been significantly bolstered by enhanced power generation capacity with the end of load shedding in 2018. Additionally, over the past few years, there has been a notable improvement in the number of charging stations in different parts of the country with more than 100 established until date.

Figure 2. Total EV Imports (Electric Cars, Jeeps, and Vans) in the Last Five Fiscal Years

Source: Nepal Foreign Trade Statistics, Department of Customs

The Environmental Factor

The growth of EVs is vital for Nepal as it helps reduce pollution, remarkably improving public health and overall quality of life for its citizens. Currently, vehicular emissions contribute significantly to Nepal’s total man-made emissions. In the Kathmandu Valley alone, vehicles are responsible for about 38% of PM10 emissions (particulate matter with a diameter of 10 micrometers or smaller). Thus, due to the fact that, unlike fossil-fuel-based vehicles, EVs do not produce carbon dioxide (CO2), one of the major greenhouse gases (GHGs), the adoption of greener transportation options are required in Nepal. Moreover, EVs in Nepal are powered by renewable sources like hydropower, which is domestically generated and can contribute to saving foreign currency in the long term, unlike petroleum products. In addition, as EVs run via an electric motor, they produce less sound and significantly reduce noise pollution. The transition to EVs is also crucial for meeting Nepal’s Nationally Determined Contribution (NDC) targets, which were set by the government after the country became a signatory of the Paris agreement on climate change. The NDC aims for 25% of private and 20% of public four-wheelers to be electric by 2025, and 90% of private and 60% of public four-wheelers by 2030. However, despite the promises of EVs, challenges such as high battery replacement costs and waste management remain significant concerns. Batteries require replacement based on brand and usage and improper disposal could have negative environmental effects.

Future of EVs in Nepal

The future of EVs in Nepal appears promising given the economic and environmental factors, with industry experts predicting the average annual sales growth to be around 15-20%. This has been preluded by the success of Chinese EVs due to their competitive pricing, unique advanced features, and continuous innovation and marketing efforts. As many countries, including China and India, have targets to phase out fossil fuels, it is a good time for Nepal to bring progressive change to the EV industry. Nepal can emulate the best practices of neighboring China where half of all sold cars are now electric or hybrid. These policy changes can be in the form of subsidies, EV-friendly urban planning, battery waste management, public awareness, and promoting healthy competition among EVs.

Sagar Jung Karki works as beed at beed management, having previously interned at the Institute for Integrated Development Studies (IIDS). His core areas of interest include international business, trade, entrepreneurship, and digitalization. He holds an MSc in International Business from the University of the West of England. As a global-minded individual, Sagar aspires to become a pracademic, contributing positively to the world. Kriti works as an intern at Nepal Economic Forum and am currently in her final year of pursuing a Bachelor in Development Studies at National College. Her keen interest lies in energy management and storytelling, where she seeks to merge analytical thinking with creative communication to drive meaningful impact.