The Economic Activities Report 2020/21, a recently published report by the Nepal Rastra Bank (NRB) on the current situations of the different economic sectors and activities shows that the primary, secondary and tertiary economic sectors of the country are in a recovery stage.

Owing to policy efforts and improved availability of vaccines against COVID-19, the world economy, which contracted due to the restrictions imposed to control the pandemic, is beginning to recover. According to the International Monetary Fund, the world’s gross domestic product (GDP) was projected to grow by 5.9% in 2021, up from 3.1% in 2020. As the impact of the pandemic diminishes, economic activity in most countries, including Nepal has been improving with increasing employment opportunities. The Economic Activities Report 2020/21, a recently published report by the Nepal Rastra Bank (NRB) on the current situations of the different economic sectors and activities shows that the primary, secondary and tertiary economic sectors of the country are in a recovery stage. In the fiscal year 2020/21, the agriculture, industry and service sectors of Nepal grew by 2.6% and 5% and 4.4% respectively. Similarly, the contribution of agriculture, industry, and the service sector to the GDP of the country was 25.8%, 13.1% and 61.1% respectively. This article will present highlights of the key sectors discussed in the Economic Activity Report 2020/21.

Agriculture Sector

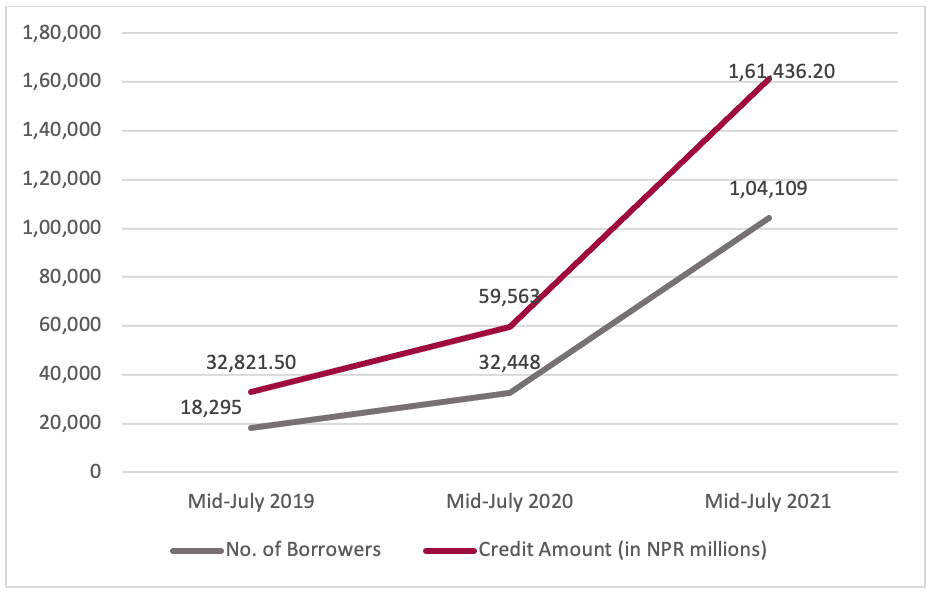

As per NRB’s Economic Activity Report, the total production of major agricultural crops, including food and cash crops, vegetables, fruits, and spices increased by 1.9% during FY 2020/21 after experiencing a decline of 1.3% in FY 2019/20. Out of the total agricultural crop production, paddy constituted the highest production i.e., 23.6%. Similarly, production of milk, meat, eggs, and fish also saw an increase in FY 2020/21. At the end of FY 2020/21, credit was extended to the agriculture sector by the country’s banks and financial institutions (BFIs) that amounted to NPR 276.35 billion, a 42% increase compared to the amount in mid-July 2019/20. Similarly, as of mid-July 2020/21, a total of NPR 161.43 billion had been disbursed to the agriculture sector as concessional loans. Figure 1 illustrates the rise in the number and amount concessional loans distributed in the agriculture sector over the past three years.

Figure 1 Concessional loans disbursed to the agriculture sector

Source: NRB, 2021

While production and credit improved in the sector, the sector continues to face the same obstacles in which include inability to ensure market and minimum prices of agricultural produce, manage agricultural inputs like fertilizers, expand reliable and sustainable irrigation facilities throughout the year, difficulty in proper arrangement and management of cold storage, and prevention of agricultural land fragmentation. Modernization, mechanization, and diversification of the agricultural sector along with research is still a challenge. Furthermore, the country’s agriculture sector also faces severe threats from climate change.

Industry Sector

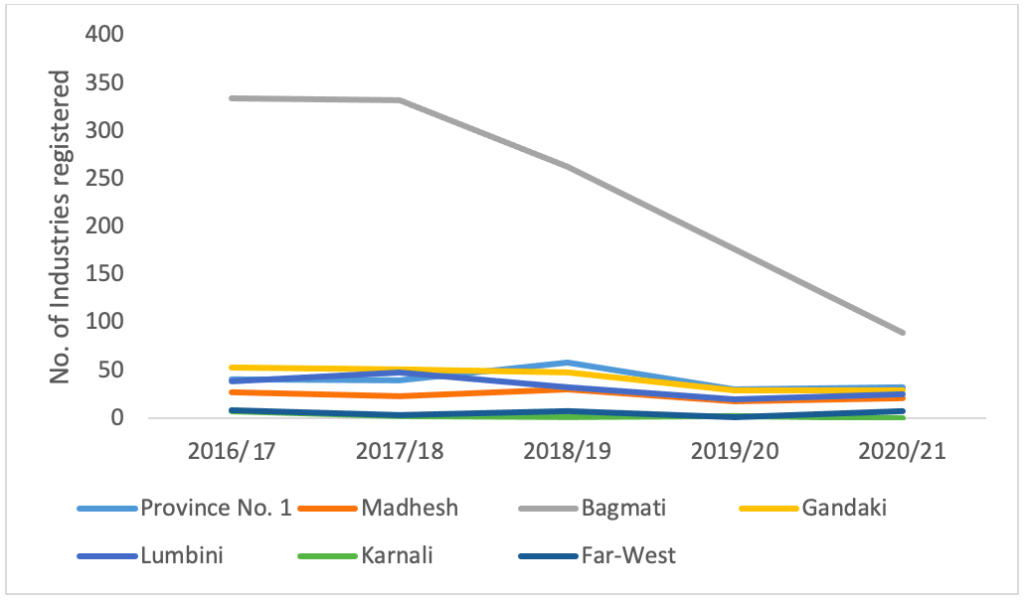

According to the data from the Department of Industry, 203 industries were added in the country in FY 2020/21. A total of 8,453 industries with domestic and foreign investment was registered in the country as of mid-July 2021 (refer to Figure 2.). Out of these, 1,214 were large, 1,908 were medium and 5,331 were small scale industries. These industries had generated employment for 628,712 individuals by the end of FY 2020/21. Similarly, 46,340 Micro, Small and Medium Enterprises have been registered at the district level. Moreover, a total of 183 Foreign Direct Investment (FDI) proposals with a total investment of NPR 32.20 billion was approved in FY 2020/21.

Figure 2. New industries registered in each province

Source: Department of Industries, 2021

With regard to the capacity utilization of industries that dwindled in the past two years due to the COVID-19 pandemic, the average capacity utilization of the industries during FY 2020/21 jumped a mere 3.8 percentage points to 52.2%, from 48.4% in FY 2019/20. Among the industries covered in the report, the concrete industry is the only industry operating at full capacity. Similarly, credit extended by Banks and Financial Institutions (BFIs) to the industrial sector increased by 20.9% to NPR 1367.75 billion in mid-July 2021 compared to mid-July 2020. Out of the total credit disbursed by BFIs, 32.8% has been disbursed to the industrial sector.

However, the industrial sector encounters major challenges due to fluctuations and instability in the political, economic, and natural environment. Ensuring the availability of skilled manpower by retaining semi-skilled and skilled manpower in the country itself, facilitating the establishment of industries and reducing the cost of establishment is quite a challenge. Similarly, development and expansion of industrial infrastructure, increasing production of indigenous industrial raw materials, making industrial supply chain effectiveness, attracting FDIs and creating an investment friendly environment remain unaddressed. Moreover, minimizing the potential disruption to the supply and demand with the third wave of the COVID-19 underway would also pose as a challenge.

Service Sector

The service sector has been hit the hardest by the COVID-19 pandemic. The tourism and public transport sectors have been most affected while the real estate, financial services and other sectors have been less affected. Although the service sector comprises of numerous sub-sectors, this article reviews the tourism, real estate, and financial services.

Tourism: During FY 2020/21, the number of tourist arrivals decreased by 91.5% compared to FY 2019/20 with only 68,726 tourists arriving. However, by mid-July 2021, the number of hotels and lodges had increased by 9.4% with the number of beds increasing by 4.5% compared to the previous year. Nevertheless, the average occupancy of hotels stood at 32%.

Real Estate: During the review year, the number of real estate registrations increased by 8.5% to 539,872 compared to 497,713 in FY 2029/20. Similarly, revenue from real estate registrations increased by a whopping 74.6% to NPR 47.89 billion in FY 2020/21. Such revenue had declined by 11.0% in FY 2019/20. Likewise, as the construction sector gradually returned to normal after a decline during the COVID-19 lockdowns, house/building, and land map passes, which decreased by 37.1% in the previous year, increased by 11.5% in FY 2020/21.

Financial Services: As of mid-July 2021, a total of 10,684 BFI branches were in operation. Total deposits collected by the BFIs increased by 20.5% to NPR 47.39 billion by mid-July 2021 compared to a 24.3% increase in the previous year. Loans extended by the BFIs increased by 28.1% to NPR 41.69 billion by mid-July 2021. Furthermore, the Credit to Deposit ratio stood at 88.0% as of mid-July 2021, up from 82.8% in mid-July 2020.

With looming impacts of the COVID-19, reviving the service sector would be one of the biggest challenges in Nepal with the outbreak of the new COVID-19 variants igniting a third wave.

Way Forward

Increasing income levels has propelled the internal demand to surge as well, which can be taken as a huge opportunity for all the sectors of the economy. Improved power generation and supply, development of transportation, infrastructure and information technology, and programs encouraging youth participation in agriculture along with the easing of financial access would bring wide opportunities for the agriculture sector. Similarly, policies to facilitate and encourage the establishment of industries is a must to offset the high imports. Development of infrastructure and expansion of financial access while ensuring balanced distribution of financial resources would support the service sector to revive. Furthermore, channeling financial resources to areas that are comparatively more productive and create employment would be required to overcome the many challenges in the various sectors of Nepal’s economy. While the economy is on the road to recovery, the new variants of the coronavirus may deter the pace. The future course of the country’s economy would heavily be determined by the policies and programs adopted by the current government and the effectiveness of vaccinations.

Sugam Nanda Bajracharya is an MBA graduate from Stamford International University. Currently, he is working as a Beed at Beed management and a Research Associate at Nepal Economic Forum. Sugam works actively with the private sector and development partners on topics related to trade, sectoral studies, economic policy research, policy and strategy development.