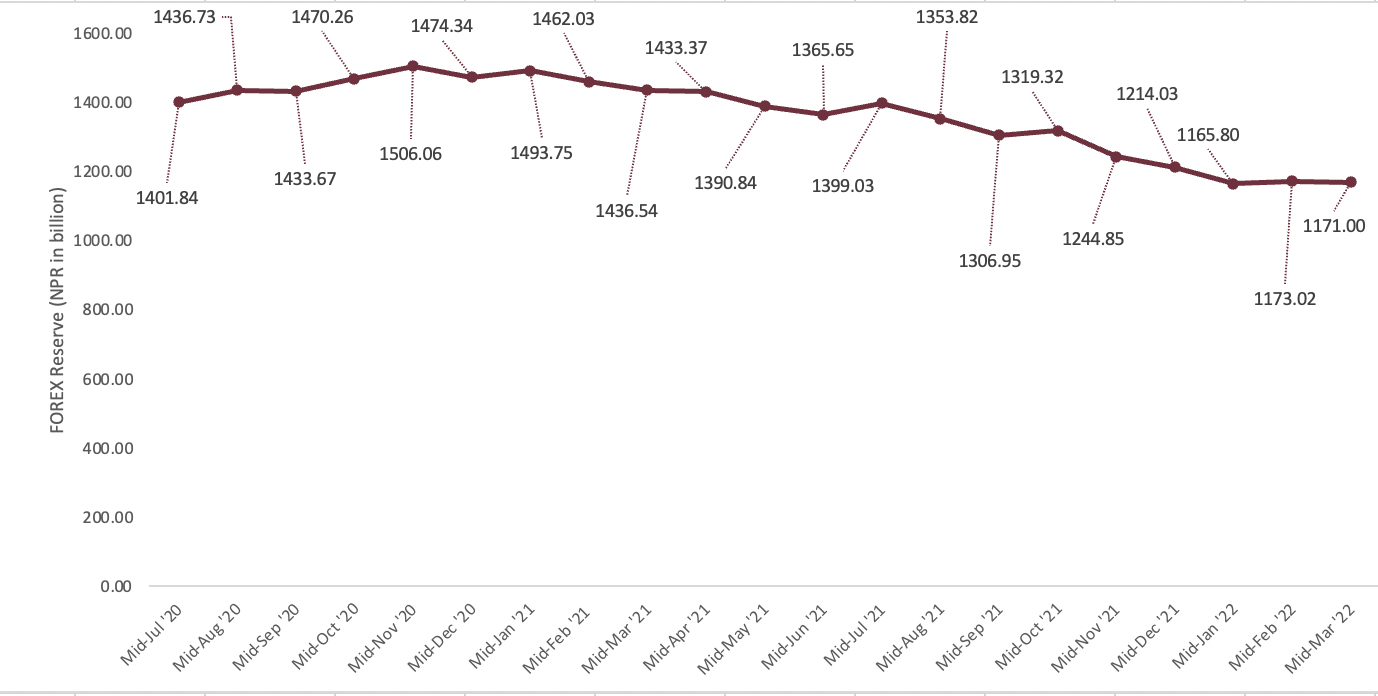

The Government of Nepal has officially banned the imports of 10 luxury or non-essential goods in response to the liquidity crunch and the depleting Foreign Exchange Reserve (FOREX). The gross foreign exchange reserve has decreased by 16.3% in the first eight months of the current fiscal year, 2021-2022. In mid-July, 2021 the gross foreign reserve was at NPR 1399.03 billion (USD 9.58 billion) which declined to NPR 1171 billion (USD 11.75 billion) by mid-March 2022. The decline in FOREX reserve can lead to the country being unable to finance import essential goods, which create shortage and inflation. The FOREX has been declining since mid-May 2021, which can be seen in the figure 1.

Figure 1: Trend of FOREX Reserve

Source: NRB current macroeconomic update and financial situation 2020-2021 and 2021-2022

The figure 1. illustrates that since the beginning of the current fiscal year 2021-2022, the reserve has seen a diminishing trend. The increase in the import is one of the factors that has caused the decline in the FOREX. Imports have risen exponentially, resulting in a massive outflow of foreign currency. In the first eight months of the current fiscal year, the imports have risen by 38.6%. The cost of imports had been rising, which was triggered by the rise in the price of goods in the international market due to factors such as suppressed demand during the pandemic, provoking a sudden surge in demand post-pandemic causing hike in prices of goods along with global supply crunch and shortage. Similarly, the soaring price of fuel in the international market induced by the Russia-Ukraine war continued to put strain on the foreign reserve. The fall in the inflow of main sources of foreign reserve such as remittances and depletion of tourism activities and resultant revenue generated further affected the reserve level. Thus, the government took the decision to implement the ban from April, 26 until the end of the current fiscal year i.e., mid-July 2022.

Potential impacts of the ban

Decrease in BOP deficit: The ban is placed to preserve the FOREX reserve as the import of these goods decreases with the restriction, the outflow of foreign currency will also fall. The decrease in import will also allow the Balance of Payment (BOP) deficit to decrease. With a decrease in the BOP deficit the domestic fund outflow would fall, providing Nepal with sufficient foreign reserves which would help stabilize the market liquidity.

Decline in government revenue: Out of the 10 imports restricted goods like jeeps, cars, and vans, including electric vehicles and motorcycles above 250 CC (cubic capacity) (excluding ambulance and vehicles carrying dead bodies) are also included in the list. In the fiscal year 2021/22, it is expected that the excise duty will account for 15% total revenue along with foreign trade accounted for 23% of the tax revenue. With the restriction of import on vehicles, the government revenue will experience an impact. In the fiscal year of 2016-2017, the pre-pandemic the government collected revenue worth NPR 20 billion (USD 165.289 million), under different headings without customs and excise duty levied on them. In the fiscal year 2020-2021, during the pandemic, total number of vehicles registered reached 3,987,267. The revenue collected through the import of vehicles has been a significant source of government revenue, with the import restriction on all types of vehicles it will have an impact on the future revenue collection.

The demand for two-wheeler vehicles have been on the rise after the lockdown. In the fiscal year 2020-21, Nepal imported two wheelers worth NPR 33.19 billion, which was 76.91% more compared to the fiscal year 2019-2020. The significant rise is believed to be due to citizens’ preference towards driving their private transport as a way to avoid contracting COVID-19. Despite such high demand for two-wheeler motorcycles, most sales in Nepal for motorcycle are related to two-wheeler motorcycle segment with an engine capacity of 125 CC to 250 CC The 250 CC above motorcycles have a minor amount of market share and only a handful businesses sell motorcycles with capacity above 250 CC The restriction of such motorcycles might not have such a drastic effect on businesses as the demand for such motorcycles is low and some businesses already have these motorcycles in stock. The restriction on import of 250 CC segment motorcycle may not be effective as their import is already limited due to low demand.

The restriction also includes all kinds of readymade liquor (excluding raw materials), cigarettes and tobacco products. These products are another substantial source of tax revenue. In 2017, the government collected NPR 29,907.6 million (USD 247.170 million) in revenue from just alcohol and beer. In the first eight months of the current fiscal year, Nepal imported readymade liquor worth NPR 14.972 million (USD 123.753 thousand). The restriction on the import of these goods not only affects the government revenue but also related businesses. It will have an effect on restaurants and hotels, which already have been suffering due to the pandemic. Hotels and restaurants are one of the purchasers of alcoholic beverages and with tourism slowly picking up since the lifting of restriction, the flow of foreign tourist is slowing rising in restaurants and hotels. Due to this, the demand for liquor is also expected to pick up, but with import restrictions on readymade liquor, it will become difficult to fulfill such demands and may discourage foreign visitor.

Outlook

According to the notice published in the Nepal Gazette, includes restriction in import of snacks like Lay’s potato chips and Kurkure, import of diamond and color TV set that over 32-inch in size, mobile set worth more than USD 600 along with all types of toys and playing cards.

While the implementation of restrictions is a needed strategy to provide ease on the depleting foreign reserve and be able to support the country’s essential import. The ban can have severe impacts on the government revenue and the business dependent upon the restricted goods. To lessen the impact of restricting on government’s revenue, it must improve the administrative capacity to avoid tax evasion brought by the existing loopholes so that revenue is collected in an efficient manner. Stakeholder consultation should be conducted by the government among the businesses affected by the ban, which would provide better understanding of the impact of the ban on their businesses and come up with solutions to ease the impacts of the ban for both parties.

Pragati Karki is a recent BBA graduate of the School of Business of the University of Kathmandu (KUSOM) with a major in finance. Her interests include financial analysis, risk assessment and accounting. Currently, she is working as beed fellow at beed management.