Migration Trend in Nepal

Every year, Nepalis are propelled to migrate to foreign countries due to lack of employment opportunities in Nepal and the possibility of higher paying jobs in the destination country. In fact, more than 1,700 Nepali people travel abroad for employment daily. According to the 2021 Census Data, a total of 2.2 million Nepalis are abroad, out of which 81.28% are male and 18.72% are female. In the past years, more and more labor permits have been issued and as of 2020, the Department of Foreign Employment (DoFE) has approved labor migration to 110 countries. The population migrating out of Nepal is relatively young in age, which is around the age of 25-35 years, posing implications for domestic jobs. While there are economic benefits of migration, the impacts and the consequence of migration need to be carefully evaluated on a micro and macro level to understand the overall impact on individuals and the country.

Migration’s Contribution to Growth

Economic Growth

Migration plays a pivotal role in the development of Nepal’s economic landscape. Migrant workers send money they earn in their countries of destination to their households in Nepal; this inflow of money is known as remittances. In Nepal, one in three households receives remittances that contribute significantly to the economic dynamics of a household. Inflow of remittances, which accounted for 10% of GDP in 1999/00, has grown significantly over the last two decades. In the fiscal year 2019/20, Nepal received remittances worth NPR 875 billion, constituting 23.3% of the country’s GDP.

The income generated from remittances has been instrumental in Nepal’s economic growth by contributing to alleviation of poverty at the household level and has significantly improved living standards of the population. A research conducted by NRB shows that households that receive remittances are 2.3% less likely to get caught in poverty than households that do not receive remittances. As a matter of fact, the probability of households slipping into poverty falls by 1.1% with every 10% increase in remittance inflows to households. Remittance receiving households experience improvement in household income and wealth, which allows them to invest in productive areas like health, education and infrastructure while also fostering entrepreneurship and consumption. In addition, a large portion of Nepal’s foreign exchange reserve is contributed by remittances. In the last five years, remittances have contributed an average of 54.6% to the total foreign exchange of the country.

Impact on Remittance Receiving Households

With one in three households in Nepal receiving remittance, migration’s positive impact on income and household decisions is significant. About 9.7% of the total remittances received by remittance receiving households is used on education and health. In fact, remittance has proved to increase the probability of school enrollment by 3.8% with a 25.3% increase in the education expenditure, improving access to educational opportunities. Remittance receiving households also show an increased spending on higher-priced medical care and a higher likelihood of visiting a doctor. A research paper on the impact of remittances on household health care expenditure finds that a 1% increase in overall remittances leads to a 0.099% increase in health care expenditure. Moreover, households with at least one migrant member spend 0.27% more on health care as compared to the households with no migrants.

Since remittance increases household income, it also increases accumulated income and savings of a family. Remittance receiving households use 25.3% of the total remittances to repay loans and 28% of the total remittance was saved. This implies that remittances have and could potentially free up credit constraints and increase available capital, allowing the female members of the migrant sending households to start a business, to invest in one, or to be self-employed.

Consequences of Migration

Impact on Economy

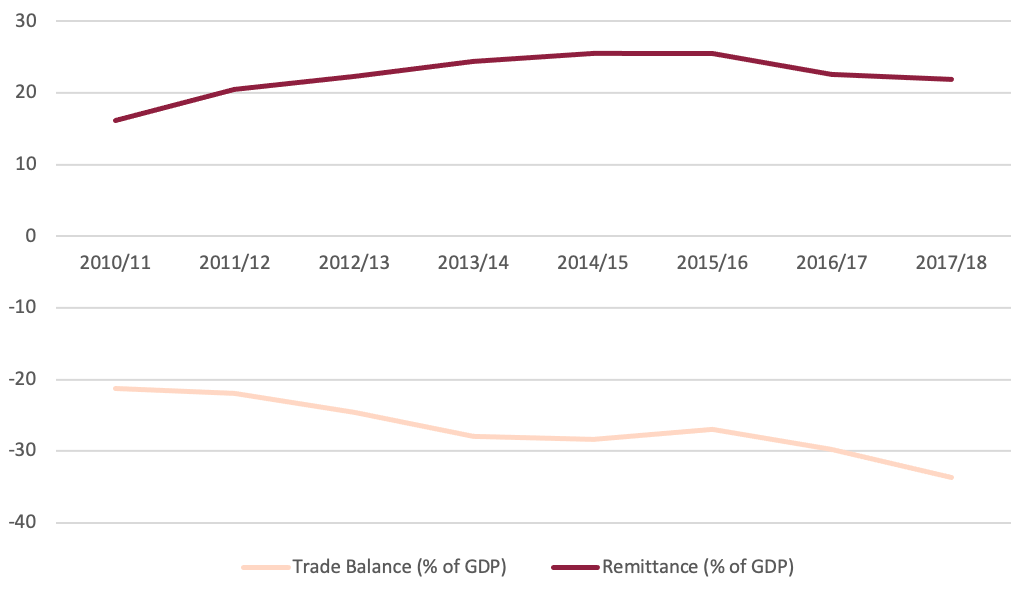

While remittance contributes greatly to increase household income and raising the standard of living, it also poses challenges that do not contribute to the economy. These implications disrupt long-term growth of the economy and requires careful course-correction through policies and regulations. For instance, although the trend is gradually changing, remittances are hardly used for capital formation. Remittance receiving household use 23.9% of the remittance for consumption of daily necessities such as food and clothes, while only 1.1% is used to invest in productive sectors. Therefore, in Nepal, increase in remittance inflow increases the demand for consumable goods, most of which are imported from Nepal. This might further deteriorate the trade balance of the country (Figure 1). A study by Nepal Rastra Bank suggests that in the long run, there is a positive unidirectional causation from remittance to import, and from remittance to trade deficit. Moreover, since only 1.1% of the remittances is used on capital formation, remittance inflow has no direct impact on the export of the country. This implies that remittances increase merchandise import and deteriorates trade balance.

Figure 1: Remittance vs. Trade Balance

Source: Remittance data from CBS National Accounts of Nepal 2021 (Base Year 2011), Trade Balance data from NRB Current Macroeconomic and Financial Situation

Furthermore, migration is an expensive process for most migrants, which hinders the financial circumstance of migrant workers as well as aspiring migrant workers in the short run. Aspiring migrant worker often times rely on recruitment agencies to facilitate the search, matching, and paperwork associated with the recruitment process. These recruitment agencies charge hefty fees, resulting in 72% of migrant workers obtaining loans to cover the high cost of migration. Since remittance receiving households use 25.3% of the total remittances to repay loans, the cost of migration directly impacts the remittance receiving households’ ability to save and contribute to capital formation. While migration from Nepal has unpacked multiple avenues, remittance receiving households continues to survive on low savings and contribute very little capital formation, which can be attributed to the high cost of out migration.

Impact on Women

Migration, for a family, is a transformative process that reshapes the family structure and changes household roles regarding domestic work, care, reproduction, and production activities. Since 81% of the total migrants of Nepal are men, it is important to understand the impact of outward migration of male individuals on the wives and other females of the household, also called women left behind. Outward migration of male members results in added household responsibilities on the women of the family, which puts an added pressure on women and hinders their ability to be involved in the labor market or to start a business, regardless of the available financial capital. A study on the effect of male migration on the employment patterns of women in Nepal finds that migration of men has a negative impact on women as it reinforces gender roles by pushing women out of the labor market while the male members send money as remittances. Women’s inability to participate in the labor market makes them financially dependent on the migrant male members of their household and migrant men, even though abroad are the ones making major household and financial decisions.

Conclusion

The opportunities brought by migration from Nepal are manifold, however, they are usually supplemented by their own set of challenges. More often than not, the benefits of migration at the macro level fail to penetrate and resolve the structural challenges existing in the Nepali society. In order to minimize the negative impacts of migration, policymakers should focus on building a flexible and conducive domestic market that supports domestic industries and jobs, while also creating an environment that allows women to enter and re-enter the labor force.

Aarya Rijal is a recent graduate with a B.A. in Economics from Union College, USA. Her key interests are in corporate finance, macroeconomics, and international economics. Before joining NEF, Aarya worked as a student data analyst and a research assistant at Union College. She is currently working as a fellow at NEF.