The government declared that Nepali Currency will be fully convertible to Indian Currency at INR 100 for NPR 160, and the pegged system was introduced which has been carried till date.

The exchange rate system, also known as the current system, establishes the value of a nation’s currency against the currency of another nation. The exchange rate system is a critical macroeconomic policy issue, especially for small open economies like Nepal. With increasing globalization and global trade, a convenient exchange rate policy is needed to allow countries to convert their currency to another currency to conduct smooth international trade.

Nepal is located between the two countries, India and China. The north outlined with the restrictive Himalayan ranges, whereas the south is surrounded by an open plain terrain stretching across east to west causing greater Indian influence compared to Chinese influence. The geographical characteristic of the country has resulted in a mutual relationship between Nepal and India, with shared cultural heritage and close economic relationship that dates to thousands of years. Significant trade and investment linkages with India led to the dominance of the Indian Currency (IC), especially in the Terai region, while the circulation of Nepali currency was limited to the Kathmandu valley and the hilly region. In Nepal, both Indian Currency and Nepali Currency were legal tenders at some point and under the dual currency system the exchange rate was fixed on the basis of demand and supply by the private money changer.

History of pegging Nepali Currency

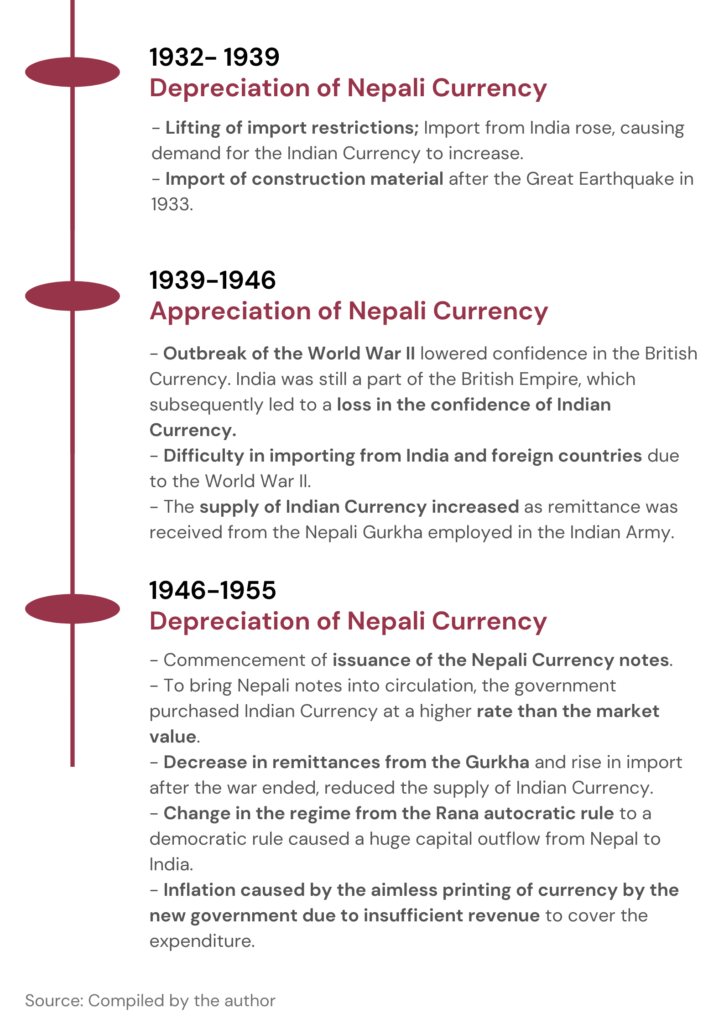

The dual currency exchange rate had been in existence for a very long period in Nepal. Since 1877, the dual exchange rate had been stable as the volume of import from India was limited to necessary goods like raw cotton, kerosene, textiles, salt, medicines etc. The period between 1932-1955 faced most fluctuations, as illustrated in the graphic below.

The surge in the import, especially from India during 1932-1939 led to a rise in the demand for the Indian Currency. Since the dual currency system rate was determined based on the demand and supply of each currency, an increase in the value of Indian Currency meant depreciation of the value of Nepali Currency.

In the period between 1939-1946, various events led to an increase in the supply of the Indian Currency, however the decrease in the demand of INR, depreciated the value of the currency.

The turmoil within Nepal during 1946-1955 led to a rise in the value of the Indian Currency, which further brought volatility in the exchange rate between the two countries.

Figure 1. History of dual currency in Nepal (from 1932-1955)

The dual currency system led to a partial IC-ization during 1932-1960 in Nepal. The Indian Currency was largely utilized to pay revenue to the government. This led to a higher demand for the Indian Currency within Nepal, resulting in the appreciation of the Indian Currency. On one hand, appreciation of the value of the Indian Currency implied that the government received higher total revenue value. While on the other hand, the appreciation of the Nepali Currency’s value meant a reduction in the value of the total revenue collected by the government in Indian Currency. Therefore, the government was more focused on preventing overvaluing of the Nepali Currency as its value appreciation meant reduction in the value of revenue collected by the government in INR.

During the period between 1955-1960, daily fluctuation of the exchange rate was observed. The period saw the enactment of the Nepal Rastra Bank Act of 1955 and after its establishment, various attempts stabilizing the exchange rate through programs and policies were made. An active policy to stabilize the exchange rate was introduced which emphasized the circulation of Nepali Currency and eliminated the use of Indian Currency in Nepal. The dual currency system ended under the Nepal Currency and Expansion Act of 1957.

The government declared that Nepali Currency will be fully convertible to Indian Currency at INR 100 for NPR 160, and the pegged system was introduced which has been carried till date.

Current Scenario

Nepal has maintained the pegged system through a controlled supply of Indian Currency. When the demand for Indian Currency increases, it causes the value of INR to become greater than the pegged rate. To ensure that the exchange rate is maintained at NPR 160 to INR 100, the supply of the Indian Currency needs to increase. The supply of the Indian Currency is controlled by NRB with the help of its foreign exchange reserve. These foreign exchange reserves are maintained by the earnings collected through tourism, exports and remittances, which NRB uses to purchase Indian Currency to increase supply within the Nepali economy.

Nepal Rastra Bank (NRB) introduced the pegged system with the intention to stabilize the Nepali Currency and maintain its value in the international market by pairing it with a comparatively powerful regional currency i.e. Indian Currency. Indian Currency is relatively powerful and stable due to its high demand and supply in the international market. The stability provided by the currency system also builds confidence among investors, which helps bring Foreign Direct Investment (FDI) into the country. Furthermore, the pegged system has made trade easier as stability was brought by the fixed rate which created a smooth cross transaction.

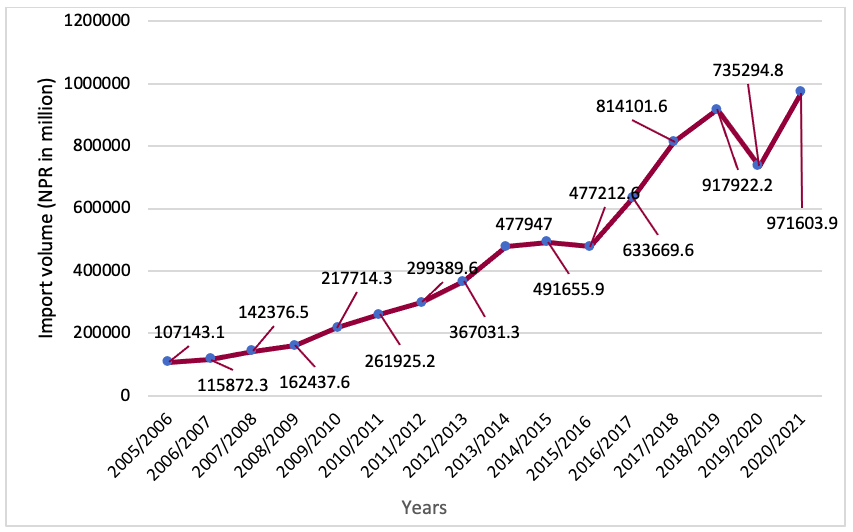

The stability brought by the pegged system has resulted in an increased reliance on India. The import from India has been rising, which can be seen in Figure 1. From 2006 to 2021 the import from India increased by a Compound Annual Growth Rate (CAGR) of 15.83%.

Figure 2: Import volume from India to Nepal between 2005-2021

Source: NRB Annual Report, Current Macroeconomic Updates

As discussed, the pegged system implies a dependency on the Indian economy. Any shock in the Indian economy impacts Nepal equally. For instance, the demonetization of the Indian Currency brought volatility across sectors, as Nepal faced a shortage of Indian Currency. As a result, the economy of Nepal was impacted since trade between the two countries became difficult.

Nepali Currency pegged with the Indian Currency subsequently influence the value of the Nepali Currency against the US dollar. The value of the US dollar is important for any country as it is a widely accepted global currency, and can be used for any international trade. Additionally, 90% of the forex trades include the US dollar. Therefore, when the value of Indian Currency weakens against US dollar due factors such as inflation, rise in oil prices, uncertainty brought by war – the value of Nepali Currency also depreciates. Recently the Indian Currency’s value against the US dollar has been depreciating, which has caused the Nepali Currency to depreciate as well.

While the pegged currency system greatly benefits the Nepali economy, it is accompanied by challenge with regard to the management of the foreign exchange reserve. Foreign exchange reserve is crucial in a pegged currency system, as it acts as a safety net for the central bank in times of crises, when national currency devalues. Balance of payment deficit directly influences the foreign exchange reserve, which induces liquidity crisis in the domestic market.

Future possibilities

Although Nepal’s Gross Domestic Product (GDP) formation has changed since the introduction of the pegged currency system in 1960, only seven adjustments have been made to the Nepal’s exchange rate policy. Despite the drawbacks of the pegged system, it has protected Nepal from volatility and inflation. Nepal lacks a notable position in the international trade, which leads to a low demand for the Nepali Currency. To take advantage of the pegged system, Nepal must focus on developing an export sector to strengthen the value of the Nepali Currency and maintain the foreign exchange reserves.

Pragati Karki is a recent BBA graduate of the School of Business of the University of Kathmandu (KUSOM) with a major in finance. Her interests include financial analysis, risk assessment and accounting. Currently, she is working as beed fellow at beed management.