The sovereign credit rating is an assessment of the creditworthiness of a sovereign entity. This is used by investors to assess the risks associated with international bonds issued by the country along with providing a general idea about investment environment of the country. Currently, 132 out of 193 sovereign countries have a credit rating assessed by either one of the three major credit rating agencies: Standard & Poor’s, Fitch, and Moody’s.

Nepal does not have a sovereign credit rating yet, but the country did attempt to obtain one in 2019. The Government of Nepal hoped to establish a sovereign credit rating before the Investment Summit 2019 but could not obtain one due to time constraints.

Benefits of a sovereign credit rating in Nepal

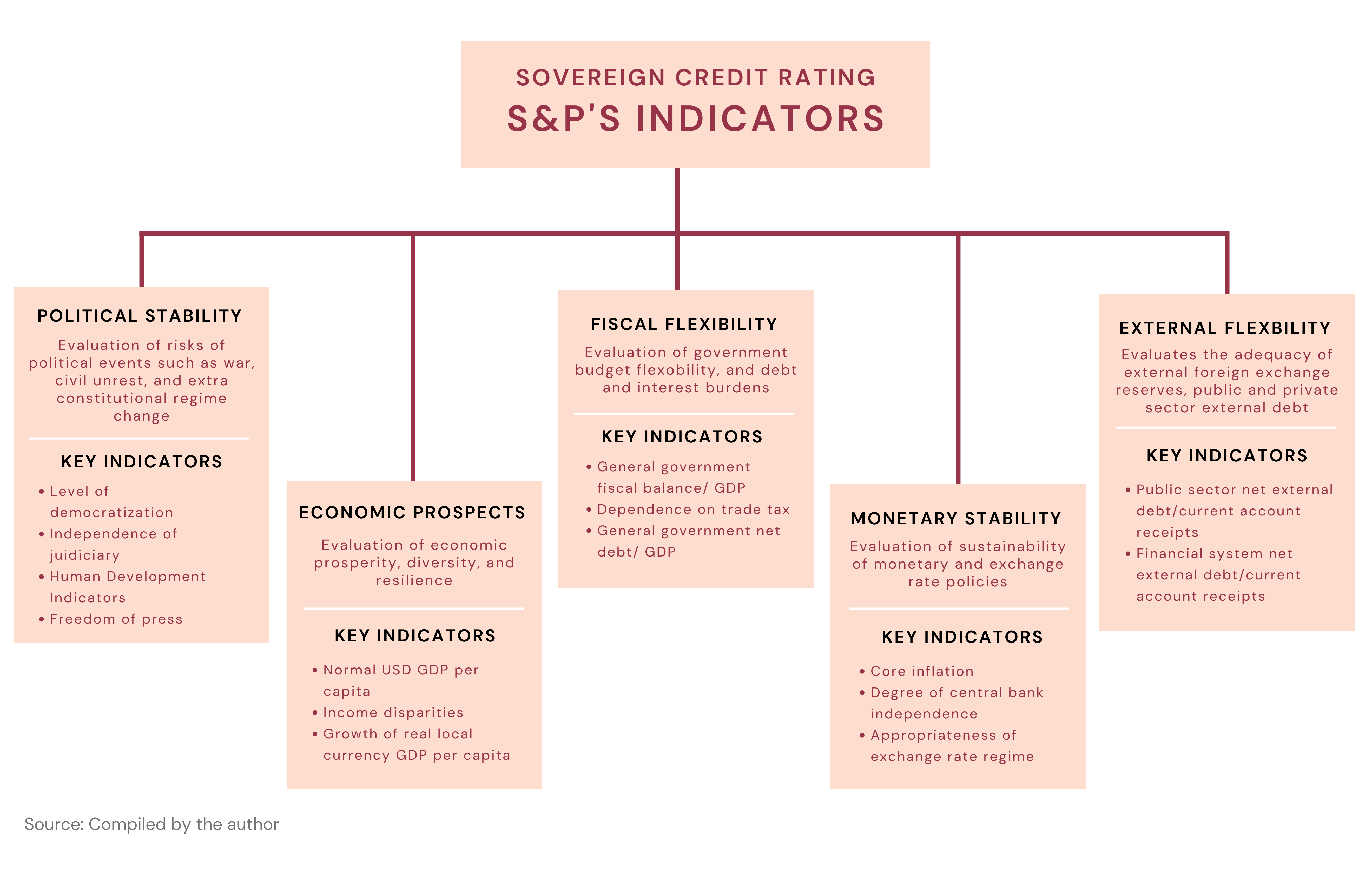

Figure 1. S&P’s Sovereign Credit Rating – Determinants and Key Indicators

Securing a good sovereign credit rating makes it easier to issue bonds in the international market at a cheaper interest rate and lower cost of issuance. The sovereign credit rating also helps access performance-based aid, and concessional loans offered by Development Financial Institutions (DFI).

Nepal’s outstanding debt accounted for 40.16% of the country’s GDP in 2020, which is not very high. This puts Nepal in a position to raise funds for development of social and physical infrastructure by issuing foreign bonds. Further, the issuance of foreign bonds can help aid in foreign currency management since foreign bonds are issued in foreign currencies. Given that the sovereign credit ratings evaluate the political and economic situation as well, private investors will have greater confidence in the stability of returns their investments in Nepal could provide. The Government of Nepal’s desire to introduce sovereign credit rating just prior to the investment summit highlights its importance in attracting investments into the country. Simply having a shadow credit rating would help Nepal identify areas of policy and governance it can improve on to receive a better sovereign credit rating.

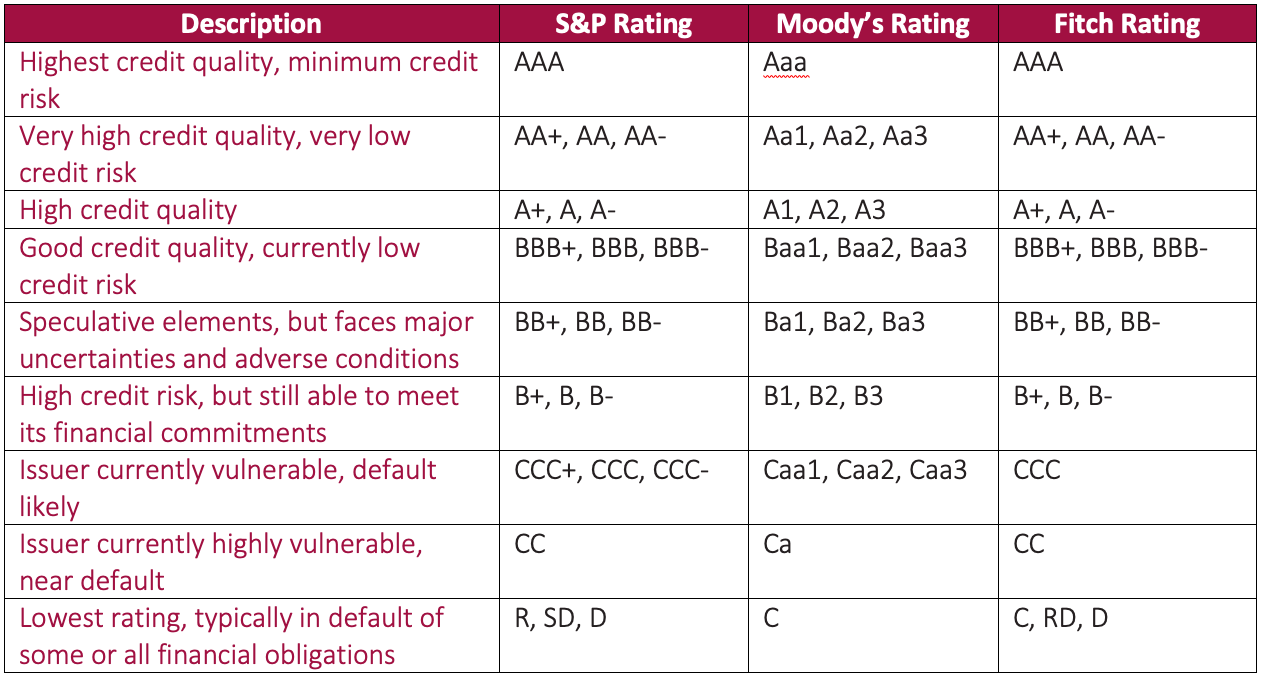

Figure 2: Description of credit ratings awarded by Top 3 rating agencies

Source – Data extracted from multiple sources; compiled by the author

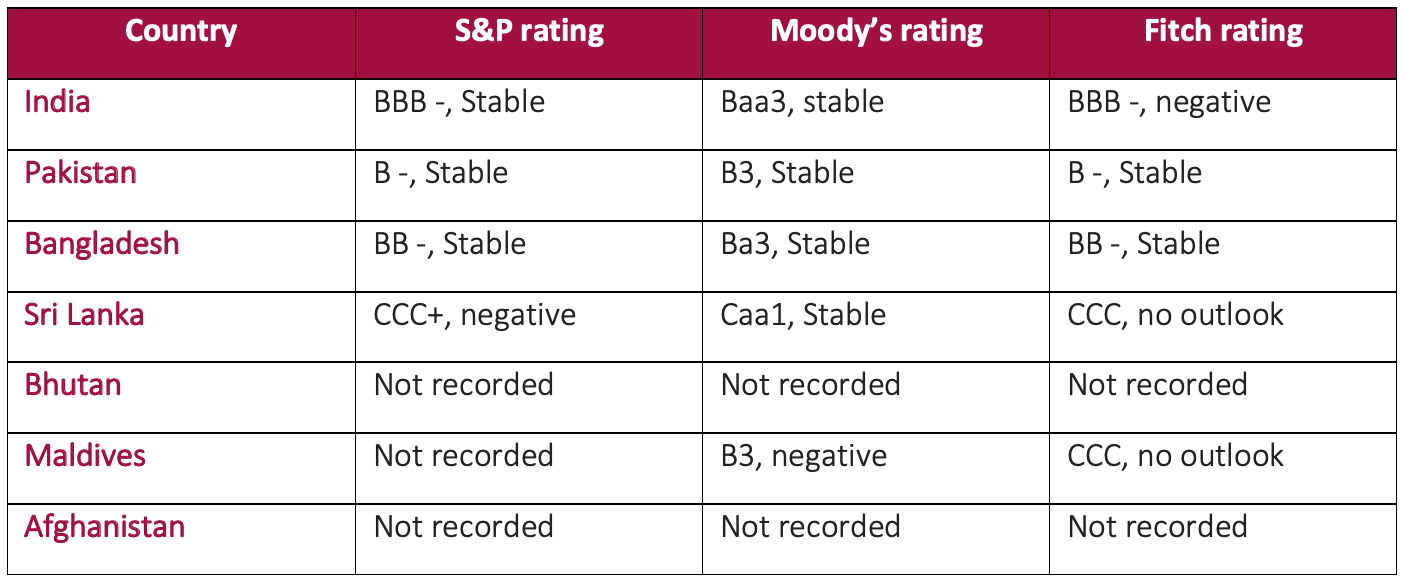

The World Bank’s 2013 working paper on the sovereign shadow rating of unrated countries showed that Nepal would have a rating of CCC with a positive outlook, meaning that Nepal is vulnerable and will likely default. Regionally, this would put Nepal in the same rating category as Sri Lanka. The sovereign credit ratings of the South Asian countries are presented in figure 3.

Figure 3: Sovereign credit rating of South Asian countries

Source – Trading Economics

What could Nepal’s credit rating be based on?

As seen in Figure 1, the sovereign credit rating is evaluated in terms of key indicators under different categories. Some of the factors that determine sovereign credit used by S&P are examined below to monitor the change in indicators since 2013.

For political stability, level of democratization, corruption, and human development are key determinants. In the Democracy Index 2021, published by the Economist Intelligence Unit, Nepal ranked 101 with a score of 4.41 out of 10. Nepal had a score of 4.77 out of 10 in 2013. In both 2013 and 2021, Nepal’s score fell under the hybrid regime category of the Democracy Index, which includes countries with election irregularities. Despite that, a slight improvement of score shows positive change in democracy over the years. In the Corruption Perception Index, Nepal has shown a slight improvement with a score of 31 out of 100 in 2013 and 33 out of 100 in 2021. Nepal ranked 116 out of 177 countries in 2013 and 117 out of 180 countries in 2021. Further, Nepal’s Human Development Index value for 2019 is 0.602 ranking 142 out of 189 countries, which is an improvement from the score of 0.537 in 2010.

Economic prospect is evaluated largely in terms of projected nominal USD GDP per capita. The nominal USD GDP per capita of Nepal is forecasted to reach USD 1580.37 by 2026. Nepal’s nominal USD GDP per capita has increased to USD 1155.14 in 2020, compared to USD 823.36 in 2013. Within this indicator, income disparities can be measured by the Gini Coefficient with figures closer to zero meaning perfect equality. Nepal scored 32.8 in 2010, as measured by the World Bank, which reached 39.5 in 2018, showing a declining level of income inequality.

Key performance indicators for fiscal flexibility cover the projected ratio of government fiscal balance to GDP as well as reliance on trade taxes. The ratio of government fiscal balance to GDP was -3.21% in fiscal year 2012/13, which has grown to -7.59% in 2019/20. The dependence on trade tax has decreased to 17.68% of total tax revenue in 2019/20 compared to 21.96% in 2012/13. Further, the projected ratios of general government debt to GDP, and general government gross interest payments to general government revenues can also be used to assess fiscal flexibility. There has been an increase in government debt to GDP ratio from 27.97% in 2012/13 to 36.27% in 2019/20. The ratio of government interest payment to revenue has seen a slight increase from 0.25% in 2012/13 to 0.32% in 2019/20.

The monetary stability is determined in terms of projected core inflation rate based on consumer prices. The consumer price inflation rate was 9.9% in 2012/13. The new monetary policy aimed to contain inflation at 6.5% in 2021/22. However, with the ongoing rise in fuel prices and increased strain on supply chain post-lockdown, Nepal’s inflation has reached 7.14% in March 2022. Since the current inflation is caused by factors beyond Nepal’s control, the country has performed well in this category. The independence of the central bank is also important for monetary stability. The recent suspension of the Governor of Nepal Rastra Bank by the Finance Minister might cast doubt on the independence of the central bank from political interference.

Furthermore, Nepal has climbed 14 places higher in the global risk rankings since 2018 and 24 places higher compared to the past five years in the Euromoney Country Risk Index. The index is an alternative rating that relies on experts to assess a country’s risk and is often used as a live indicator of sovereign risk. This could also indicate that Nepal is in a position to receive a better rating.

Outlook

Even though Nepal shows improvement in a few aspects of the indicators under the sovereign credit rating, the improvements are minor and performance on other indicators has worsened. In this regard, Nepal could get a higher rating of CCC+ as per S&P’s standards, but would still likely remain in the category of vulnerable and likely to default on its foreign bonds. Nepal can draw learnings from other South Asian countries and devise policies that are targeted towards the improvement of specific indicators.

Despite Nepal receiving a low sovereign credit rating, having any credit rating could be better than having none. This is because investors can adjust their interest rate requirement to compensate for the higher risks. This will ensure Nepal still gets the funding that it requires, albeit at high cost. Alternatively, Nepal could propose for a shadow credit rating from any of the credit rating agencies to assess where it stands in terms of its default risks. At the very least, Nepal can monitor areas of governance and policies on which it can improve from the shadow credit rating, leading to a better credit rating in the future.

Sneha Shrestha is an ACCA affiliate with interests in business valuation, financial planning, mergers and acquisition, and strategy consulting. She has previously worked in audit and accounting for few years before joining Beed. She is currently working as a beed fellow at beed management.