Introduction

Liquidity is the availability of cash or near money assets that the Banks and Financial Institutions (BFIs) hold to satisfy the demand for cash for their depositor or borrower. The depositors park their excess funds in banks for future use, while borrowers are cash deficit units who need funds for various financial and economic activities in the economy. An economy is said to be in a liquidity crisis if the BFIs are unable to satisfy the demand for cash from their customers.

Nepali economy has experienced a liquidity crunch since the beginning of the current financial year. Even with repeated policy measures undertaken by the Nepal Rastra Bank (NRB) to ease the liquidity pressure, the economy continues to feel the prolonged crunch. To further unpack the issue, this article aims to explore factors leading to liquidity crunch and project a way forward.

The current liquidity crunch doesn’t mean that BFIs don’t have enough liquidity to satisfy cash demanded by the depositors, as net liquidity of BFIs stands at 21.78%, which is above the regulatory requirement as mandated by Nepal Rastra Bank. However, the current crisis is different, it is the inability of banks to meet the demand for funds by borrowers as business activities expanded post-pandemic.

Background

In the first eight months of the current financial, the credit disbursed by BFIs increased by 10.5% to NPR 4.60 trillion (USD 38 billions), while deposit increased by 4.1% to NPR 4.85 trillion (USD 40 billions) in the review period. Thus, increasing demand of funds as compared to supply has contributed to the tight liquidity situation in the economy. The lending rate increased to 8.98% from 6.84% in the same period in the previous year, highlighting the excess pressure on liquidity.

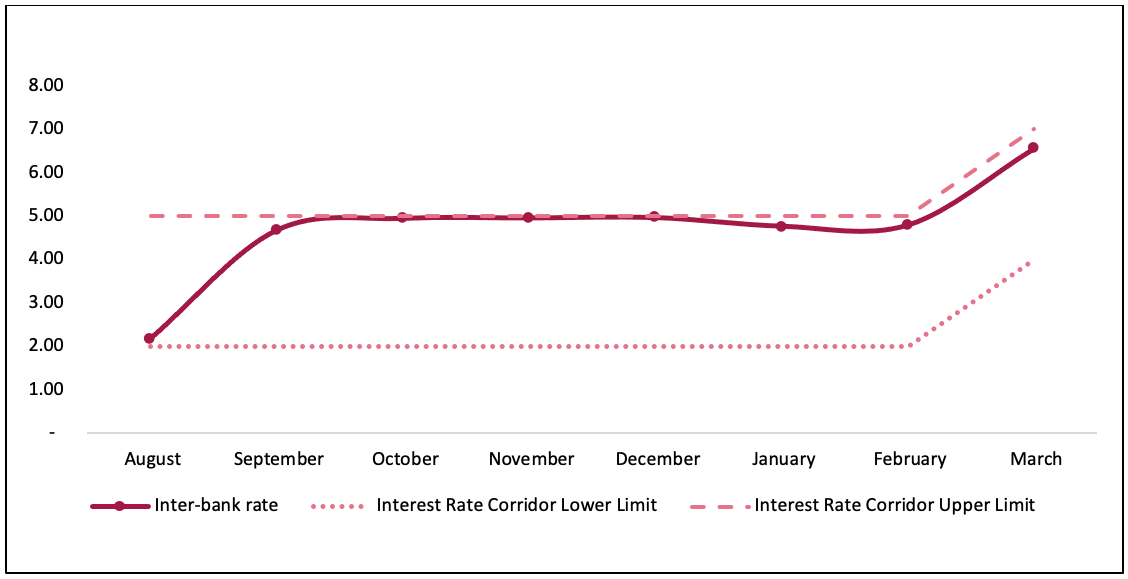

It led to rise in the Credit-to-Deposit ratio to 90.87%, which is above the upper limit (90%) as directed by the Nepal Rastra Bank. Additionally, the interbank rate has risen to 6.56% and has consistently been above its upper limit, thereby showing persistent pressure on bank fund and shortage of liquidity.

Figure 1: Trend – Interbank interest rate in FY 2021/22

Source: Current Macroeconomic and Financial Situation Tables – (Based on Eight Months data from 2021-22), NRB

Determinants of liquidity and understanding the liquidity crunch

The continuing liquidity crunch is a recurring event in the Nepali economy and can be attributed to the multidimensional structural problems existing in the economy, as discussed below. Such problems are related to the source of liquidity for the banking system, hence are detrimental to the supply of liquidity in the economy.

Savings

The level of savings in the economy contributes directly to deposits in the banking system and hence to the supply of loanable funds to BFIs. An estimate by the International Labor Organization predicts that around 1.6 million to 2 million people in Nepal will either lose their jobs or have jobs that pay lower wages, leading to an increase in unemployment and the decline in income, translating into lower savings in the economy. According to the Economic Survey 2020-21, the Gross National Savings of 31.4% of GDP in FY 2020-21, while it was 42.1% of GDP in FY 2019-20. Therefore, due to deteriorating national savings, banks’ deposits were not able to keep pace with the demand for credit causing liquidity shortage.

Government spending

The government expenditure plan has the potential to increase liquidity in the market as government spending is channelized through BFIs via deposits, thereby contributing to the supply of funds to BFIs but it can only happen if the plan is realized in reality. For example, in FY 2020-21 the government planned to spend NPR 1.47 trillion (USD 12.2 billions), but according to the NRB statistics, total government expenditure amounted to NPR 1.18 trillion (USD 9.8 billions) only, thus showing the inability of the government to spend as planned. Additionally, in FY 2021-22, the government has managed to spend 27.45% of the allocated capital budget. So, the government’s inability to mobilize funds in the economy has contributed to a prolonged liquidity crisis in Nepal.

Remittance

Remittance has a positive impact on the domestic liquidity position as they are directly deposited in the domestic banking system, thereby increasing the ability of banks to mobilize funds in the economy. Though the flow of remittances decreased by 1.7% in the current financial year, it had increased by 8.7% in the same period of the previous year. Furthermore, almost half of the remittances sent to Nepal are through informal channels. A major portion of remittances are not channelized through the banking sector combined with decreasing official inflow has contributed to a reduced ability of BFIs to mobilize funds in the economy which has led to a liquidity crunch.

Forex

The availability of foreign exchange reserves with the Central Bank increase’s ability to stabilize market liquidity. Nepal Rastra Bank injected liquidity worth NPR 147.14 billion (USD 1.22 billion) through a net sale of USD 1.22 billion from foreign exchange reserves, increasing liquidity in the economy. However, in the same period, the foreign exchange reserve decreased by 18.5% to USD 9.58 billion as trade deficit increased by 34.5% in FY 2021-22, thereby limiting the ability of the central bank to stabilize the liquidity position.

Balance of Payment

The increasing Balance of Payment (BOP) deficit has become a concern for the economy as the deficit increased to NPR 258.64 billion (USD 2.1 billion), whereas BOP was in surplus of NPR 68.01 billion (USD 562 million) in the same period the previous year. An increasing BOP deficit implies leakage of domestic funds to the foreign economy, as payments made to businesses abroad for imports are not offset by earnings made through exports. Therefore, increasing trade deficit that drains out the liquidity from the economy, leading to a shortage in liquidity.

NRB liquidity injection and its constraints

Nepal Rastra Bank, the Central Bank of Nepal has injected a total of NPR 5070.76 billion in liquidity by using monetary policy instruments like repo, and Standing Liquidity Facility (SLF). Despite the injection of large amounts of money to stabilize pressure on liquidity, the problem persists. However, the central bank is limited in its ability to inject liquidity as demanded due to increasing inflation and trade deficit.

The central bank is responsible for maintaining price and external sector stability in the economy. According to NRB statistics, inflation increased to 7.14% in the current fiscal year, surpassing Government of Nepal’s projection of 6.5% while trade deficit rose to NPR 1.16 trillion (USD 9.6 billion). To limit the adverse impacts of increasing inflation and trade deficit, Nepal Rastra Bank has limitations on injecting liquidity to fulfill the increasing demand for liquidity in the economy.

Outlook

The liquidity crunch within the Nepali economy were exacerbated ever since the economic activities expanded after the COVID-19 induced lockdowns. Given the existence of structural problems in the economy, the policymakers should focus on long-term solutions which include formalizing the informal economy and increasing access to banking and financial services to better mobilize unaccounted funds and transactions into the banking system.

Meanwhile, increasing government expenditure can improve liquidity conditions immediately, as it will mobilize idle funds from the government treasury into the economy, thereby increasing liquidity. Additionally, Nepal Rastra Bank can restrict flow of funds to unproductive sectors, as it increases inflation without increasing economic activity. Thus, diverting funds to productive sector will contribute to unfulfilled demand for funds, thereby easing pressure on market liquidity.

Ashish holds a Masters in Economics from the Jawaharlal Nehru University (JNU) in New Delhi. He has worked as an Intern at the Center for Policy Analysis, New Delhi and is interested in the field of economic development and research.