With the Article IV consultations targeted for Nepal, it is reassuring to learn that a transparent monitoring process is in place that has resulted in the five key areas where necessary interventions and effective implementations are required.

Background: Article IV Consultation

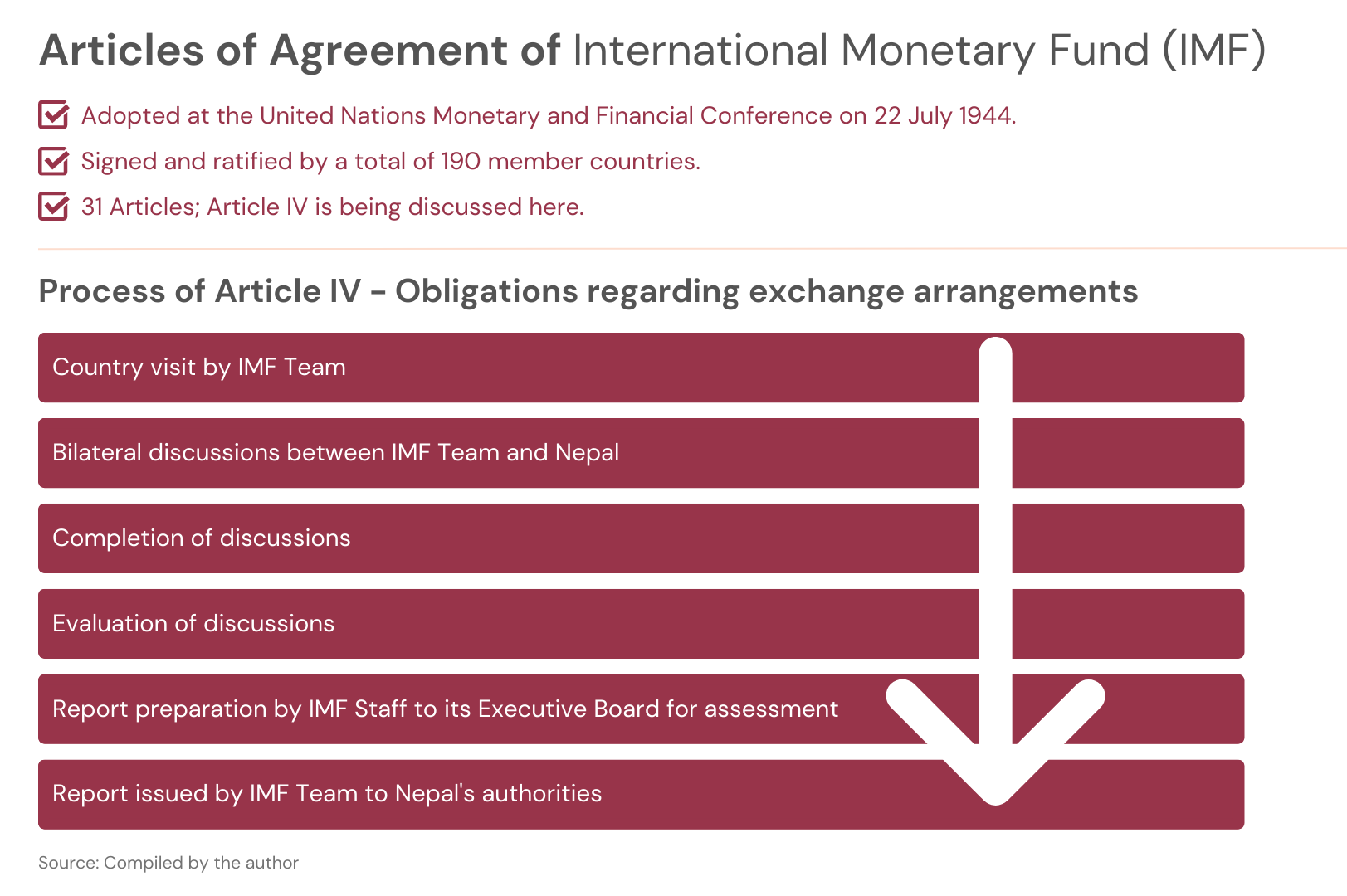

Usually every year, the International Monetary Fund (IMF) holds bilateral discussions with its member countries with the central motive of reviewing the overall economic developments in the country under Article IV of the IMF’s Articles of Agreement. These discussions center on issues about the exchange rate, monetary, fiscal, and regulatory policies to maintain economic stability, and overall macro-critical structural reforms needed in the country. Upon the completion of the discussions and evaluation, the IMF’s staff present a report to the executive board for assessment, which is then issued to the specific country’s authorities. This comprehensive process is known as Article IV Consultation (refer to figure 1).

Figure 1 Articles of Agreement of IMF

Against this background, the IMF concluded its 2023 Article IV Consultation with Nepal between 15 to 28 February 2023 and released its concluding statement (preliminary findings). The IMF team, led by Jarkko Turunen, met with the Right Honorable Prime Minister – Pushpa Kamal Dahal, Honorable Deputy Prime Minister and Minister of Finance – Bishnu Prasad Paudel, Nepal Rastra Bank (NRB) Governor – Maha Prasad Adhikari, National Planning Commission Vice-Chairman – Min Bahadur Shrestha, other senior government and Nepal Rastra Bank (NRB) officials, development partners and representatives of the business community.

2023 Article IV Consultation: Where should Nepal’s focus be?

Following the conclusion of the 2023 Article IV Consultation, there are five key areas where Nepal should place its increased and immediate focus, which are:

- Effective monetary policy, but fiscal reforms required: The Government of Nepal (GoN) adopted a contractionary monetary policy last year, resulting in the much-needed stabilization of the economy. It contributed to lowering the inflation rate, which was soaring at around 8% at the time, to 7.26% in mid-January 2023. However, fiscal reforms have made limited progress. As a result, the IMF recommends fiscal reforms focusing on debt sustainability, banking regulations, and supervision, reduction of the cost of doing business, and elimination of barriers to FDI while enhancing good governance. This can result in sustainable growth over the medium term, which can then facilitate further economic expansion.

- Strong post-pandemic recovery, but real GDP growth to be improved: As per the last 2020 Article IV Mission to Nepal held between 5 to 17th January 2020, the economy of Nepal had been expanding at a rate, which was above the long-term average in the previous years. The reasons attributed to this growth were greater political stability, improved electricity supply, and reconstruction activities after the most devastating earthquake of 2015 and the COVID-19 pandemic. The real GDP growth rate for FY 2020/21 as per the central bank of Nepal, NRB, stood at 3.8% which was an increase from the earlier -2.4%.

Following this strong post-pandemic recovery, it was anticipated that the real GDP growth rate would accelerate. As of 15 July 2022, the Asian Development Bank (ADB) reported that Nepal’s economy had grown by 5.8% and would reach 5.0% in 2023. Likewise, the World Bank also stated that Nepal’s economic growth rate will reach 5.8% in 2022 as per its ‘Nepal Development Update (October 2022)’. This was additionally in alignment with the IMF’s projections of 4.2%, 5.0%, and 5.3% growth in 2022, 2023, and 2027, respectively in their ‘World Economic Outlook: Countering the cost-of-living crisis’. Further, as per the annual report released by the NRB, the preliminary estimate of the real GDP growth rate for FY 2021/22 stood at 5.5%. However, it is envisaged that the sluggish recovery of the tourism and agriculture sector, and the liquidity crunch, along with growing political instability, will harm Nepal’s growth profile. Consequently, the IMF forecasts that real GDP growth will moderate to 4.4% in FY 2022/23. Henceforth, there is a need for improving the real GDP growth for the upcoming FYs.

- Continued uncertainty and vulnerability, but priority spending required: With optimistic economic growth but signs of moderation at hand, the IMF team projects that Nepal remains subject to an unusually high level of uncertainty and vulnerability. The reasons are attributed to high and volatile global commodity prices, natural disasters, increased cost of living, deteriorating bank asset quality, and poor tax collections. As a result, there is a need to make room for priority spendings such as high-quality infrastructure spending, social spending, and more.

- Commitment to policies and reforms in the ECF-supported program required: The IMF approved the Extended Credit Facility (ECF) arrangement for Nepal – an amount of USD 395.9 million, with the first disbursement of USD 110 million in January 2022. The purpose of the first installment was to mitigate the effects of COVID-19 on health and major economic activities aimed at vulnerable groups, preserve macroeconomic and financial stability, and support a reform agenda that would lead to sustained growth and poverty reduction. Some of the key policy actions for the GoN were to increase revenues, public spending, financial sector regulation, fiscal transparency, and enhance governance while reducing corruption.

Following this, the second installment of USD 52 million was scheduled to be disbursed in May 2022, but it was delayed due to Nepal’s failure to meet its first tranche obligations in full. As a result, a staff-level agreement was reached in February 2023 between the GoN and the IMF, resulting in several policies and reforms that need to be completed for Nepal to receive the second tranche of ECF. Some of them include the formulation of a comprehensive revenue mobilization strategy, the improvement of public investment spending, the advancement of reforms on banking regulations and assets, and the strengthening of NRB governance.

- Ambitious structural reforms required: To safeguard macroeconomic and financial stability in the country, additional policies that are ambitious and focused on structural and sectoral reforms, leading to inclusive growth are imperative. For this, a greater and more immediate emphasis can be placed on reducing the cost of doing business, removing barriers to foreign direct investments, enhancing high-value agricultural production, information technology, clean energy, and tourism growth, financial instruments targeting migrant workers, and improving access to finance among many others.

Conclusion

At a time when the country’s macroeconomic situation appears bleak, the surveillance of the economies or the vigilant monitoring of the economic state conducted by the IMF has posited great importance. With the Article IV consultations targeted for Nepal, it is reassuring to learn that a transparent monitoring process is in place that has resulted in the five key areas where necessary interventions and effective implementations are required. This allows a multitude of stakeholders in Nepal (including government, private, development, civil society, and others) to oversee the issues and growth prospects, and address them promptly and in a concerted manner, thereby preventing economic turmoil and the possibility of global spillovers.

Nasala Maharjan is a Bachelor's in Business Administration (BBA Honors) graduate from Kathmandu University with a major in Finance. She is mostly interested in researching and writing about economic development and contemporary issues in Nepal. She joined Nepal Economic Forum (NEF) as a Research Fellow in 2019 and is currently a beed at beed management.