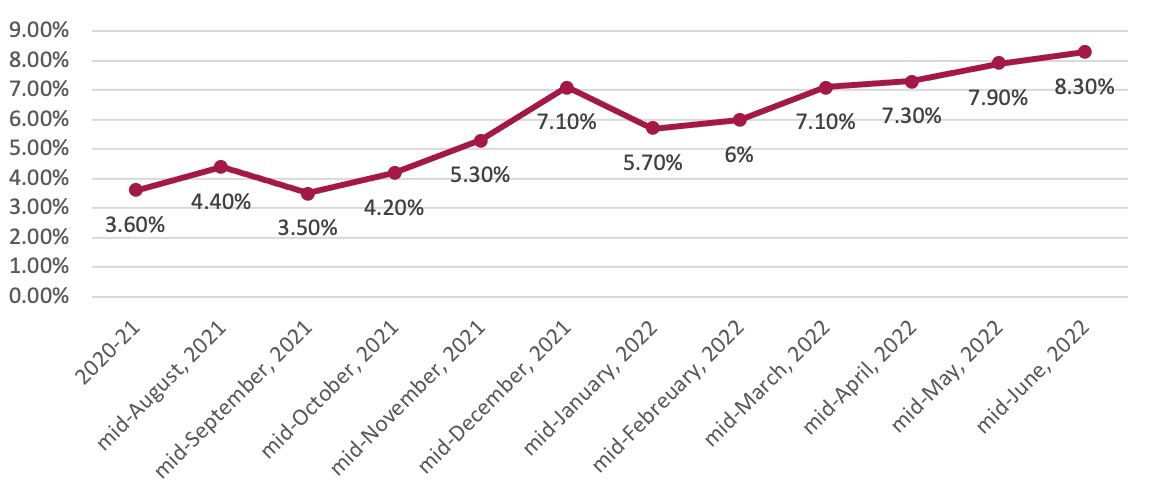

Nepal Rastra Bank (NRB) released the monetary policy for the FY 2022/23 keeping in mind the current macroeconomic scenario of the economy. Keeping in mind the lockdown imposed by the pandemic, the previous two monetary policies were expansionary in nature targeted for economic recovery by promoting consumption and production. However, due to the liberal nature of monetary policy and increasing price of petroleum products, inflation surged from 4.4% at the beginning of the fiscal year (mid-August, 2021) up to 8.6% towards to end of the previous fiscal year (mid-June, 2022).

Figure 1: Trend on inflation

Source: Monetary Policy 2022/23, Nepal Rastra Bank

Source: Monetary Policy 2022/23, Nepal Rastra Bank

In the same time period, credit expansion by Banks and Financial Institutions (BFIs) increased import leading to surge in the trade deficit, causing woes for policy maker. The trade deficit increased by 25% to NPR 1577 billion (USD 12.34 billion) which led to deterioration in the forex reserve to NPR 1176 billion (USD 9.20 billion). Such level of forex reserve can finance, import for less than 6.6-months while the NRB has set the target to maintain forex reserve to sustain 7-months of imports.

Given the deteriorating macroeconomic indicators which posed a threat to the stability of the domestic economy, the central bank has adopted a contractionary monetary policy. Such stance has been adopted to control the unstable economy fueled by a huge surge in imports-based consumption and the effect of the ongoing war between Russia and Ukraine. Therefore, the stance of the monetary policy has been cautiously tightened with the objective “to promote macroeconomic stability while maintaining price and external sector stability, and to support economic growth through increasing productivity by channelizing financial resources to productive sectors”.

Such stance has been adopted to achieve the government’s economic growth target of 8% and inflation target of 7% for the FY 2022/23.

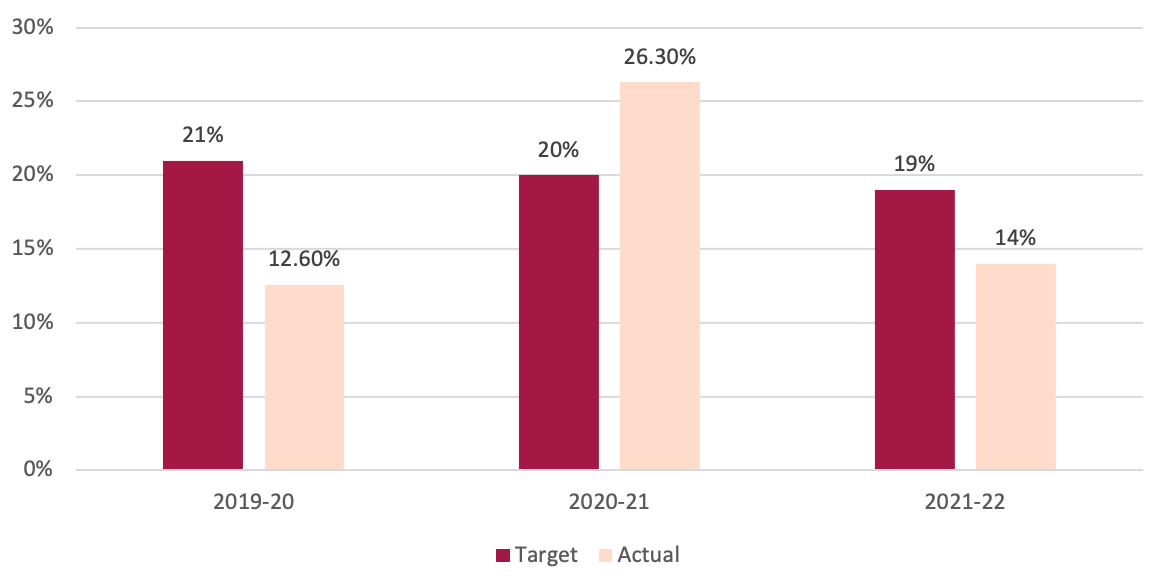

Credit Creation

To achieve the economic growth target as envisioned by the budget of 2022/23, NRB will be expanding credit to support expansion of economic activities. The monetary policy has targeted credit towards private sector to grow 12.6%, where it was 19% in the previous monetary policy. The reduction in credit creation can be explained by inadequate growth in deposits in BFIs. A lower credit growth will affect the growth of BFIs and their profitability in the upcoming fiscal year. Additionally, it will limit credit given to the private sector to finance imports, thereby limiting trade deficit.

Figure 2: Trend on Private sector credit growth

Source: Monetary Policy 2022-23. Nepal Rastra Bank

Source: Monetary Policy 2022-23. Nepal Rastra Bank

The actual credit growth in the private sector was lower than the target in FY 2019-20 due to the halt in economic activity owing to the onset of the pandemic. Actual credit growth to private sector crossed its target in FY 2020-21, as economic activities began to recover following the relaxation in lockdown. However, in FY 2021-22 credit growth remained lower than the target due to inadequate liquidity in the banking system.

Similarly, in line with targeted credit growth, the growth rate of broad money supply has been set to 12%, whereas it was 18% in the previous monetary policy. A decrease in growth of money supply has been formulated to control increasing inflation to curtail it within the target set by the budget.

Liquidity

To promote public trust by protecting public deposits in BFIs, the monetary policy has increased the minimum requirement of liquid assets that the BFIs must hold. The Cash Reserve Ratio (CRR), which is the minimum cash that BFIs must maintain as deposit at NRB, has been increased from 3% to 4% of the total deposit base of a bank. Similarly, the Statutory Liquidity Ratio (SLR), which is the minimum liquid assets that BFIs much hold as government security, has been increased to 12% for commercial banks and 10% for development banks and financial institution.

Such increase in mandatory liquidity reserve to be maintained by BFIs will increase cost for BFIs, as these assets bear no or low returns to BFIs. Furthermore, it will reduce loanable funds that BFIs can lend, thereby limiting liquidity in the economy.

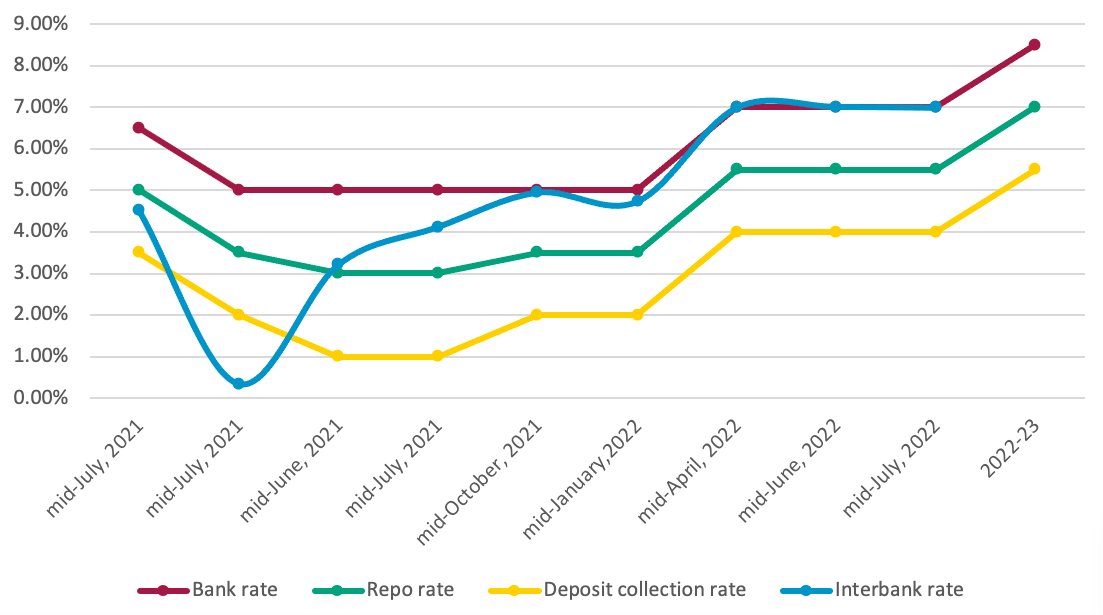

Interest Rate Corridor

Interbank rate will continue as operational target and it will be maintained within the range of the Interest Rate Corridor (IRC). The upper and lower limit of IRC are bank rate and deposit collection rate, respectively. A change in IRC affects the interest rate at which BFIs lend money to borrowers. To limit the credit going into unproductive sector, the monetary policy has increased operational target of the IRC by 1.5%. Bank rate, policy rate (repo rate) and deposit collection rate has been increased to 8.5%, 7% and 5.5% respectively. Such rates were 7%, 5.5% and 4% in the previous fiscal year.

Figure 3: Trend on Interest Rate Corridor

Source: Monetary Policy 2022-23, Nepal Rastra Bank

The interbank rate remained high and on par with an upper limit of the interest rate corridor, i.e., bank rake, reflecting excessive pressure on domestic liquidity in the banking system.

NRB has made provision to intervene via Open Market Operation (OMO) only if interbank interest rate fluctuates by more than 2% of the targeted policy rate (repo rate). Similarly, NRB will absorb liquidity via a deposit collection mechanism only if the interbank interest rate decreases by more than 3% of the policy rate (repo rate).

The increase in policy rates will increase the rate at which business and consumer can avail credit from BFIs. It will increase costs for import-based consumption, thereby curtailing import and inflation in the economy.

Refinance and Concessional Loans

As economic activities are recovering from the lows of a pandemic, the refinance facility and concessional loans given by NRB for industries affected by COVID-19 pandemic will be gradually rolled backed. The outstanding amount of refinance provided by NRB reached NPR 114.97 billion (USD 900 million) and total concessional loans remained at NPR 215.91 billion (USD 1.69 billion) till mid-June, 2022. The monetary policy has confined such subsidized facility to agriculture, exports and sectors which are yet to recover from the adverse effect of the pandemic.

Productive sector lending

As stated in the objective of the monetary policy, emphasis will be given towards mobilizing low-cost credit to the productive sector. Productive sector is the sector in which more than 7% of the total raw materials used are from domestic sources. BFIs extending credit up to NPR 20 million (USD 156 thousand) to productive sector can charge a maximum of 2% above the base rate.

The Micro Small and Medium (MSME) enterprise having to repay loans up to NPR 50 million (USD 391 thousand) will not be charged an extra penal interest rate upon repayment of due loans up to mid-October 2022. Similarly, MFIs can charge a maximum of 2% above base rate while extending credit to local cooperative groups.

Capital Requirement

In the previous monetary policy, NRB had introduced provision of CD ratio (Credit-to-Deposit) of 90% to be maintained by BFIs. It increased the capacity of BFIs to provide credit for economic recovery, however, due to increasing pressure on liquidity many BFIs crossed the 90% mark. To ease the pressure on CD ratio, the monetary policy has allowed bonds and debenture to be included as deposits while calculating the CD ratio. It will release some liquidity in the banking system which can be used for lending purposes.

The counter cyclical buffer, suspended during the onset of the pandemic to release extra loanable fund for lending will be reimposed starting next fiscal year. The exact amount will be decided later by the NRB in its working directive. Additionally, Micro Financial Institutions (MFIs) will be allowed to issue bonds to raise capital for lending. The maximum value of bonds issued can at maximum can be equal to the amount of capital held by MFIs.

Remittances

NRB has mandated that migrant workers demanding foreign exchange need to have a bank account denominated in Nepali currency. Such account has to be linked with the remittance receiving account so as to promote the formal inflow of remittance. The facilities received by such account will be reviewed so that additional facility can be provided to migrant workers sending remittance through the formal banking sector. Such provision will promote the formal inflow of remittances, which will ease pressure on depleting forex reserves and help restore balance payment deficit.

Capital market and real state

The single obliger, margin lending, which was limited to 4/12 rule has been relaxed. Now margin lending limit has been changed to 12/12 i.e., any individual can avail credit up to NPR 120 million (USD 939 thousand) from one or more financial institution. It will ease the process with which stock market investors can avail credit to invest in NEPSE, thereby it is expected that NEPSE index to rise in the future.

The Loan to Value (LTV) ratio, which a borrower can borrow for construction of the new house, has been tightened. Earlier, the LTV was 40% for house buyers in Kathmandu and 50% outside Kathmandu. This has been reduced to 30% and 40%, respectively. It will limit funds directed towards the real estate sector, thereby releasing funds to be directed towards productive sector.

Outlook

As the macroeconomic indicators deteriorated in the past, it has increased uncertainty regarding the prospect of a full economic recovery. The monetary policy has adopted cautionary tightening by raising interest rate to promote macroeconomic stability while maintaining price and external sector stability. The liquidity condition is expected to stay tight as credit growth targets have been revised downwards to control for increasing trade deficit and inflation. The stance adopted will be able to control inflation within the target envisioned in the budget, but achieving economic growth rate of 8% in the upcoming fiscal year can become challenging.

Special emphasis has been given to channelize financial resource to the productive sector to enhance productive capacity of the economy with the aim of reducing reliance on imports. Promoting development of productive sector will contribute towards generating employment and achieve sustainable economic growth in the long run. Therefore, the monetary policy has acknowledged the tradeoff between economic growth and stability and has prioritized economic stability with special focus on the productive sector for enhancing the productive capacity of the economy to achieve sustainable economic development.

Compiled by Ashish Gupta, Aspiring beed at Beed Management.

Ashish holds a Masters in Economics from the Jawaharlal Nehru University (JNU) in New Delhi. He has worked as an Intern at the Center for Policy Analysis, New Delhi and is interested in the field of economic development and research.