On July 11, 2025, Biswo Nath Poudel, the newly appointed governor of Nepal Rastra Bank (NRB), announced the monetary policy for FY 2025/26 AD (2082/83 BS). A monetary policy is a policy created and adopted by the central bank through which it influences individuals, businesses, and the whole economy. The main objective of the monetary policy is to maintain price stability in the economy and maximize aggregate output and employment level. Besides this, the monetary policy also works to balance international trade, stabilize financial markets, and promote capital investment for economic growth.

The monetary policy for FY 2025/26 AD (2082/83 BS), in particular, is discretionary and expansionary in nature. Discretionary means that the policy is flexible, with the possibility of adapting to the economic situation. On the other hand, expansionary means that the central bank is aiming boost economic activities by injecting more money and reducing interest rates to increase spending and investment. Thus, this year’s policy aims to lower the cost of taking loans for the private sector and the government.

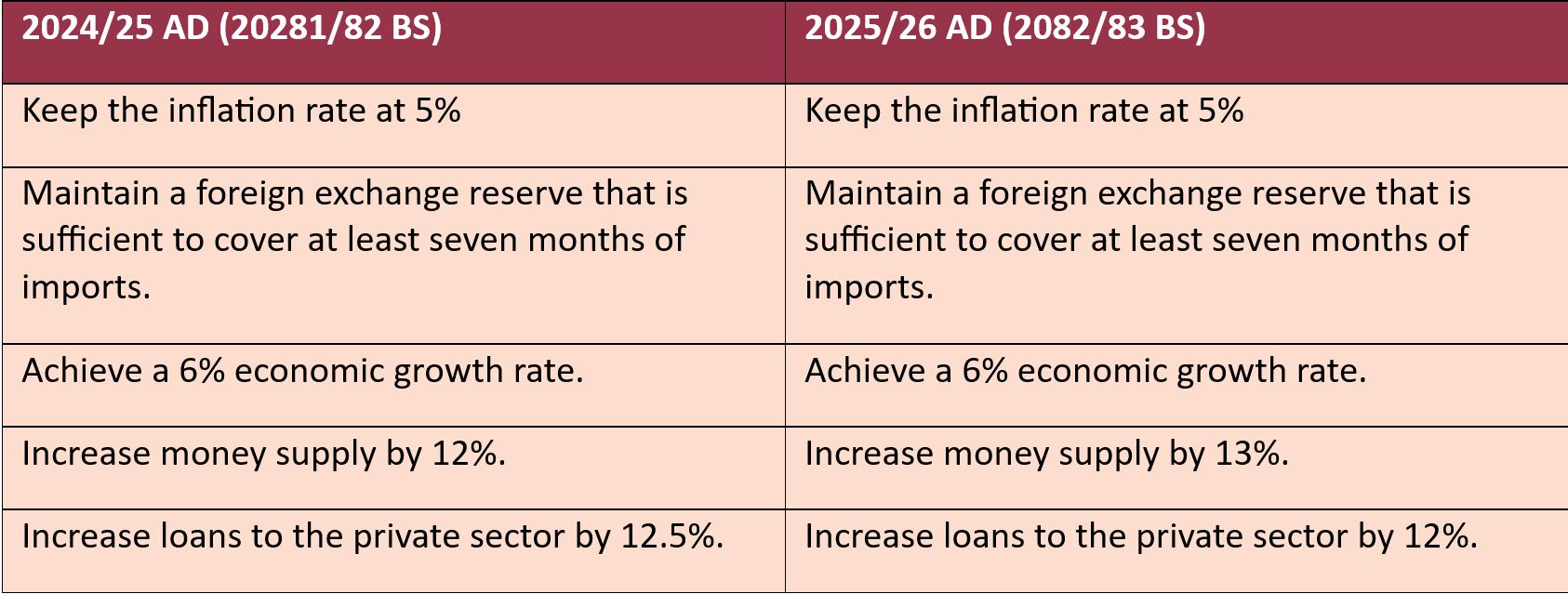

Main Targets of the Monetary Policy

The main targets of the current monetary policy are similar to those set in the last fiscal year, with a slight change in the growth rate of money supply and loans to the private sector.

Changes in the Interest Rate Corridor

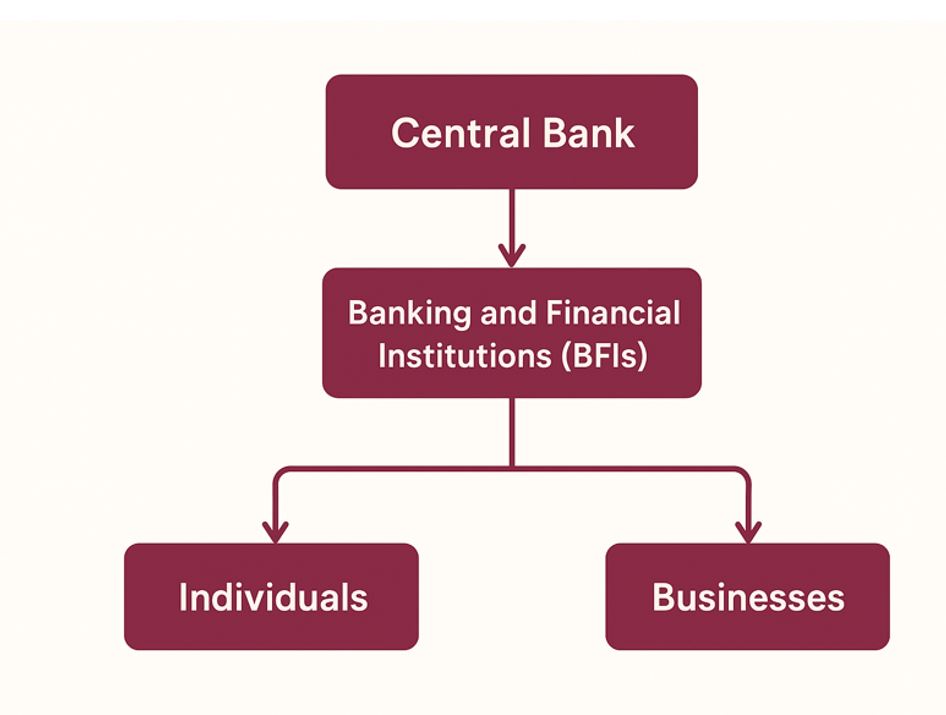

While the targets have remained similar, there are considerable changes in the interest rate corridor that determine the cost of capital held by BFIs. These changes, in turn, affect the interest rate that individuals and businesses receive on their deposits and must pay for their loans from BFIs. The flow of monetary policy effects is shown in Figure 1.

Figure 1. Flow of Monetary Policy Effects

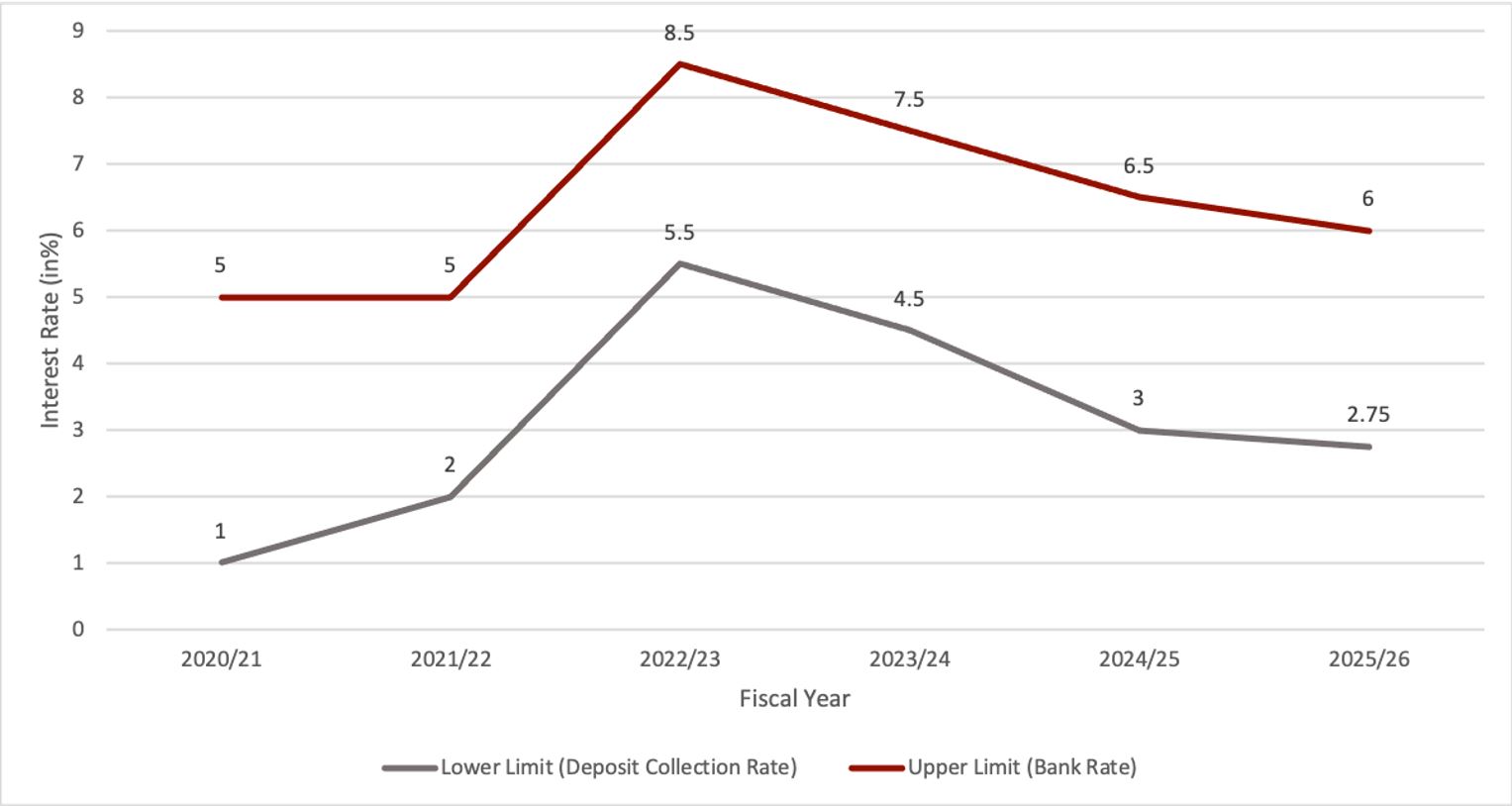

As shown in Figure 2, NRB lowered both the lower and upper limit of the interest rate corridor to encourage spending and investment. The lower limit decreased from 3% last year to 2.75%. This rate, also known as the deposit collection rate, is the interest rate that BFIs can earn on their deposits in the central bank. Meanwhile the upper limit decreased from 6.5% last year to 6%. This rate, also known as the bank rate, is the interest rate that BFIs need to pay on loans taken from the central bank. The lower deposit collection rate discourages BFIs from depositing at the central bank, whereas the lower bank rate encourages BFIs to take more loans from the central bank. This aims to increase the money supply in the banking sector, which would provide cheap and easy access to loans for individuals and businesses.

Figure 2. Trend of the Interest Rate Corridor From 2021/22 AD to 2025/26 AD

Investment Promotion and Foreign Exchange Market Changes

In terms of the foreign exchange market, this year’s monetary policy includes various promises to facilitate and attract foreign direct investment (FDI). It states that the process of investing in Nepal and taking profits from these investments will be made simpler for foreign investors. However, it does not include specific provisions to corroborate these statements.

Meanwhile, the policy also states that the central bank has sufficient foreign exchange reserves to cover imports for 18.2 months. As a result of this, the policy includes a provision to allow a Nepali national to exchange up to USD 3000 per foreign visit to countries other than India. This is a USD 500 increment compared to last year.

Regulations for Banks and Financial Institutions

To fulfill the aim of making it easier to take loans for individuals and businesses, this year’s policy includes various provisions in relation to BFIs. Firstly, the policy allows finance companies classified as “C” class, which comply with international regulatory standards (Basel I, II, and III), to expand their deposit collection and loan disbursement activities beyond previous limits. Previously, these institutions were restricted to collecting deposits up to 15 times their core capital, which is the essential financial reserve acting as a buffer to ensure stability and cover potential losses.

Secondly, the policy includes borrower-friendly measures to increase access to credit. Within this, the policy relaxes blacklisting regulations related to cheque dishonor cases, helping genuine borrowers avoid harsh consequences. Additionally, BFIs are now authorized to implement lending policies based on customers’ credit scores, enabling more flexible loan approvals.

On the other hand, the policy announced plans to introduce “Neo Banks,” or digital-only banks, to bypass certain stages of traditional banking infrastructure and transition directly to digital finance. To support this transition, NRB is also developing a centralized Know Your Customer (KYC) system linked to the National ID, allowing a single update to be shared across all banks. This will simplify access to credit and digital wallets, especially for rural populations lacking traditional documentation.

Furthermore, to strengthen the financial market and regulation of BFIs, the monetary policy also includes provisions to identify Domestic Systemically Important Banks (DSIBs) and Systemically Important Payment Systems (SIPSs). This forward-looking plan aims to identify important financial institutions.

Policies for the Private Sector, Capital Market, and Real Estate

For the fiscal year 2082/83 BS (2025/26 AD), the monetary policy has introduced various measures to boost private sector activity and strengthen financial markets as well. To encourage lending, NRB has raised the individual limit from NPR 150 million to NPR 250 million for loans backed by collateral of shares. This expansion of the loan limit helps investors access more funds through regulated financial channels, thereby stimulating capital market activity. Additionally, the new monetary policy allows banks to invest in debentures (bonds) issued by infrastructure-focused institutions, such as those developing roads, energy, and industrial parks. These measures collectively aim to boost capital market activity, promote investment, support infrastructure development, and strengthen market confidence. However, these steps require careful monitoring as they also heighten exposure to market volatility.

Meanwhile, in the housing sector, NRB has increased the maximum loan limit for private residential construction or purchase from NPR 20 million to NPR 30 million. First-time homebuyers can now borrow up to 80% of a property’s value, while others can borrow up to 70%. These changes make home loans more affordable, encouraging more people to buy or build homes, and thereby boost the housing and construction industries.

Policies for Priority Sectors

NRB has also introduced targeted lending measures in the new monetary policy to support recovery, growth, and financial inclusion. To support communities in earthquake-affected districts like Jajarkot and Rukum, the policy now allows borrowers to reschedule or restructure commercial loans by paying only 10% of the interest due, thereby easing repayment burdens.

To boost tourism and commerce along key corridors, businesses along the Postal or Mid-Hill Highway and hotels or restaurants can now access subsidized loans up to NPR 30 million. However, to qualify for this benefit, hotels and restaurants must have a Department of Food Technology and Quality Control (DFTQC) Logo. Such loans will be classified as designated sector loans and will be provided at an interest rate premium capped at 2% above the base rate, which is lower than usual.

In agriculture, BFIs can now lend up to NPR 1 million using self-assessment of borrowers’ collateral, which can include agricultural produce, arable land, or assets related to agricultural businesses. Additionally, the policy specifies that during the “grace period” of these loans, a period when borrowers are given to pay the loan without paying principal and interest, banks are required to set aside only a minimal amount as a “loan-loss provision.” This is a reserve of money banks keep to cover potential losses if borrowers fail to repay. By keeping this provision low during the grace period, the policy reduces the financial burden on banks, encouraging them to offer these loans. Overall, this measure aims to support farmers and small businesses by making credit more accessible while ensuring banks can manage risks effectively.

Moreover, to aid youths going for foreign employment, the monetary policy allows banks to provide them with loans up to NPR 300,000 for men and NPR 500,000 for women. According to the new policy, these loans will also be counted as deprived sector loans.

Furthermore, through the monetary policy, NRB has launched a Regulatory Sandbox to let fintech startups test new products without immediate regulatory constraints. This is part of its nationwide “With Borrowers: NRB” campaign to strengthen rural outreach and expand financial inclusion.

Conclusion

Nepal’s economy is well-positioned to benefit from the current banking system’s high liquidity and low interest rates. However, despite controlled inflation and sufficient foreign exchange reserves, lending by banks and financial institutions has fallen short of their potential. To address this, the NRB has developed the monetary policy to stimulate economic growth and promote capital investment from both the private sector and the government. With lower interest rates, increased credit ceilings, and improved liquidity, the new monetary policy creates a more conducive environment for investment and consumption. These measures provide first-time homebuyers with greater financial flexibility, offer entrepreneurs and farmers enhanced access to capital, and foster optimism for economic recovery and increased activity across these sectors.

Heykha Rai holds a Bachelor’s in Economics from Kathmandu University and serves as a Research Fellow at the Nepal Economic Forum. With a keen interest in international economics and economic history, she contributes insightful research to advance economic discourse. Passionate about policy analysis and development strategies, Heykha is dedicated to fostering informed economic decision-making in Nepal. Pawan Raj Dallakoti holds a BA in Liberal Arts with a concentration in Japanese Business and the Global Economy from Doshisha University, Japan. He also studied for a year at the School of Political Science and Economics, Waseda University as an exchange student. He is currently a Research Fellow at the Nepal Economic Forum (NEF). Prior to joining NEF, he interned at the National Policy Forum (NPF) and the SAARC Secretariat. His research interests lie in evidence-based policymaking in agriculture, energy, and environment.