The Government of Nepal (GoN) announced the budget of NPR 1.793 trillion (USD 14.7 billion) for the upcoming fiscal year 2022-23.

The Government of Nepal (GoN) announced the budget of NPR 1.793 trillion (USD 14.7 billion) for the upcoming fiscal year 2022-23. As the state of the economy seems to be grim due to high inflation, increasing balance of payment deficit, and draining foreign exchange reserve, the International Monetary Fund (IMF) forecasts the economy to grow by 4.1% in the current fiscal year. The budget sets the target to achieve economic growth of 8% in the fiscal year 2022-23 by doubling exports and reducing imports by 20% the fiscal year 2022-23. The budget aims to control inflation by 7% and generate meaningful employment by enhancing domestic production. The objective of the budget is to achieve a self-reliant economy by prioritizing agriculture, industrial development, expansion of hydroelectricity and transmission lines, and promoting foreign investment and tourism.

Comparison

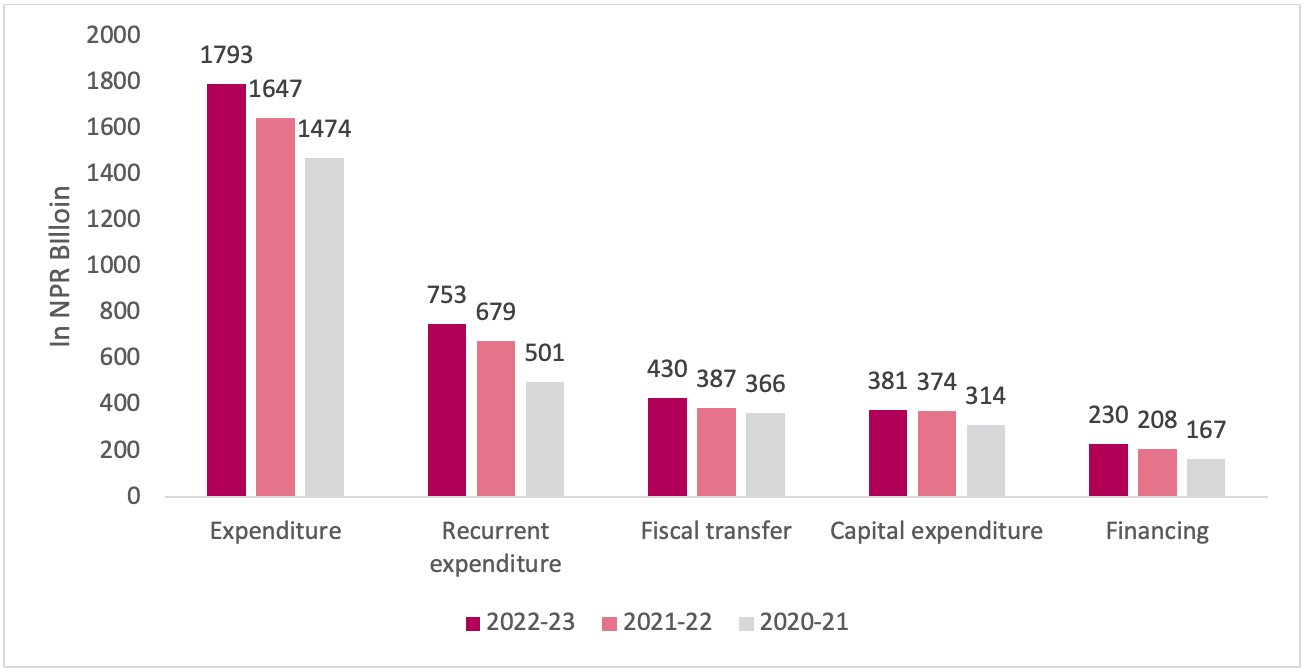

Figure 1. Government Expenditure

Source: Ministry of Finance, Government of Nepal

The GoN has allocated NPR 1.793 trillion (USD 14.7 billion) for the fiscal year 2022-23 which is an increase of 5.5% as compared to the fiscal year 2021-22. The recurrent expenditure has received 42% of the total expenditure. The amount allocated to fiscal transfer has increased by 11.11%, while the allocation for financing has increased by 10.5%. However, NPR 381 billion (USD 3.12 billion) has been allocated for capital expenditure which is just 1.8% more than the amount allocated in the previous fiscal year.

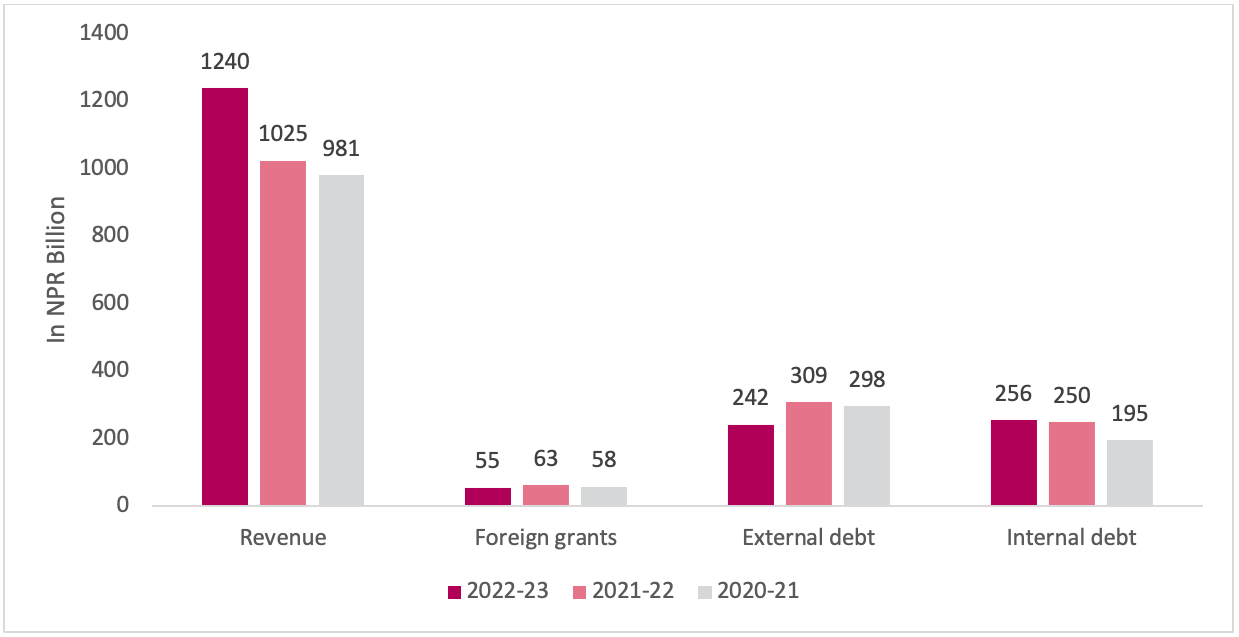

Figure 2. Government Resources

Source: Ministry of Finance, Government of Nepal

GoN aims to collect NPR 1.240 trillion (USD 10.16 billion), through tax (92%) and non-tax (8%) sources. In light of increasing external debt, the GoN attempts to reduce reliance on external debt by decreasing it by 21% as compared to the previous fiscal year. To compensate for decreasing reliance on external debt, GoN is preferring internal sources to finance its expenditure as internal debt collection has increased by 31% in the last three years.

Key points from the budget

Agriculture

The Government of Nepal (GoN) has allocated a budget of NPR 55.97 billion (USD 458 million)to the Ministry of Agriculture and Livestock Development, which is an NPR 10 billion (USD 82 million) as compared to the last fiscal year. The major focus is to transform the agriculture sector through modernization and commercialization by effective implementation of the ‘Prime Minister Agriculture Modernization Project’ (PMAMP). GoN has announced a national campaign to achieve self-reliance in agricultural production. GoN aims to reduce the import of basic agricultural products by 30% in the fiscal year 2022-23. For this, various policy measures have been announced which include: developing cold storage facility, NPR 500 billion (USD 4.09 billion) refinance funds at a subsidized rate, loan waiver to farmers, and minimum support price on milk.

Industry and Production

‘Prime Minister’s Nepali Production and Promotion Program’ will be launched to increase domestic production by promoting export-oriented industry. A budget of NPR 3.45 billion (USD 28.2 million) has been allocated for the program to promote ‘Own Production, Own Consumption’ and for other private sector initiatives which include, Make in Nepal and Made in Nepal. GoN has increased export subsidy from 5% to 8% in a bid to double exports in the next fiscal year. The program aims to restore the foreign trade balance in five years. Further, a budget of NPR 3.79 billion (USD 31 million) has been allocated for industrial infrastructure development. The GoN’s strategy for export promotion and import substitution will support Five-Year Plan (2019-2024) to increase the contribution of manufacturing to 18% of GDP, which currently stands at 14.3%.

Infrastructure

A total of NPR 161.56 billion (USD 1.3 billion) has been allocated for infrastructure development, which is NPR 2 billion (USD 16.4 million) less compared to the previous fiscal year. Combined with a total capital expenditure of NPR 380 billion (USD 3.11 billion), GoN push for economic revival through capital formation will expand the productive capacity of the economy. GoN will mobilize resources by issuing Green Bonds to invest in large and transformative infrastructure. It will encourage domestic production and encourage Foreign Direct Investment resulting in sustainable economic growth.

Tourism and Aviation

The GoN aims to attract one million tourists in the upcoming fiscal year. The budget allocated a total of NPR 9.38 billion (USD 76.9 million) for the tourism sector with an additional NPR 900 million (USD 7.3 million) for the ‘Tourism Infrastructure Development Program’. It includes financial help by providing concessional loans to businesses affected by COVID-19. An additional NPR 12.2 billion (USD 100 million) has been allocated for the aviation sector which will aid tourism. A new terminal at Tribhuvan International Airport will be built to reduce congestion while the GoN will bring two newly inaugurated Gautam Buddha International Airport and Pokhara Regional Airport into operation.

Foreign Direct Investment

To promote Foreign Direct Investment (FDI), the GoN has reduced the lower limit of FDI allowed in Nepal. The limit has been reduced to NPR 20 million (USD 163,934) which was NPR 100 million (USD 819,672). Further, investment up to NPR 100 million (USD 819,672) will be channeled through an automatic route. The policy is expected to enhance the Investment Environment of Nepal and fill up the enlarging Investment-Savings gap which currently stands at 28.1%. Additionally, the policy will facilitate Non-Resident-Nepali and other foreign investors to invest in Nepal. Currently, 16.3% of the FDI is directed to the manufacturing sector, a policy measure to direct FDI towards manufacturing activities will assist the agenda to reduce reliance on imports.

Hydropower and Electricity

A budget of NPR 1 billion (USD 8.2 million) has been allocated for the completion of the Upper Arun Hydropower Project. A total of NPR 43.95 billion (USD 360 million) has been added for the construction of transmission and substations. The GoN aims to add 415-megawatt hydropower capacity in the current fiscal year. Such projects will facilitate the participation of private players in the electricity trade. Moreover, to promote the use of electric vehicles, charging stations will be installed at 50 locations throughout the country. Further, industries consuming electricity worth more than 100 million (USD 819,672) will get a rebate of up to 15% on their electricity bill.

Health

Health and Education have been prioritized to increase Human Development Index (HDI) to 0.65, which currently stands at 0.602. As cases of COVID-19 have dropped, the budget allocation to the Ministry of Health and Population has decreased by 16% to NPR 103.09 billion (USD 845 million). A budget of NPR 10 billion (USD 82 million) has been allocated to construct hospitals at 655 local levels. A sum of NPR 5,000 will be given to the 25 most backward regions of the country to improve nutritional status. Further, GoN will provide financial support for the treatment of cancer and kidney transplant.

Education

The budget has allocated NPR 196.4 billion (USD 1.6 billion) to the Ministry of Education, Science and Technology, which is an increase of 9% as compared to the previous fiscal year. The GoN will promote the “Education with Skill Program” to promote education with skill, skill with labor, labor with employment, employment with production, and production with the market. Further, a budget of NPR 8.88 billion (USD 72.7 million) has been allocated to upgrade 1.2 thousand schools under the “Presidential Education Improvement Program”.

Key developments in the budget

Tax hike on imports

The GoN has increased customs duty and excise rates on imports, ranging from consumer goods to luxury goods and heavy industry products. Custom duty on various agricultural products such as corn, betel nuts, tobacco, fruits, and spices has been increased. Excise duty on an electric vehicle with a capacity of more than 300 kilowatts has been increased from 40% to 60%. Similarly, the tax on the import of iron, metals, wood, leather, plastic, and plastic products, chemicals, has been hiked. Customs duties on imported meat products, chocolate, and seafood have also been increased. Exercise duty on luxury items such as motorcycles with a capacity of more than 250 ccs and television bigger than 48 inches will also be increased. The increase in tax and duties on imported products will exert upward inflation pressure.

Tax relief

GoN will give tax rebates to small and medium enterprises in a bid to provide financial support in the aftermath of the pandemic. Enterprises with income up to NPR 3 million (USD 24,590) will get a 75% rebate on tax and enterprises with income from NPR 3 million (USD 24,590) to NPR 10 million(USD 81,967) will get a 50% rebate on their tax. The scheme is expected to support Micro, Small and Medium Enterprise (MSME) which has not yet recovered to full capacity. The revival of the MSME sector will contribute to generating employment.

Cooperatives

GoN will promote “The mantra of Cooperatives: Self-Sufficient Economy”, to integrate cooperative institutions into the economic development of Nepal. At least 50% of the cooperative funds will be invested in production activities. Under the initiative, GoN will provide a 5% grant to projects worth more than 200 million (USD 1.6 million).

Labor and Employment

The budget has allocated NPR 7.05 billion (USD 57.8 million) under the ‘Prime Minister Employment Program’. The program aims to provide at least 0.2 million employments in the agriculture and productive sector. In the fiscal year 2020-21, the GoN was only able to employ 0.1 million applicants under the scheme.

Income tax ceiling

The GoN has widened the income tax ceiling by NPR 100,000 (USD 820). Now the individual has to pay 1% tax for income up to NPR 500,000 (USD 4,100). The same tax applies to married couples for whom the ceiling is NPR 600,000 (USD 4,920).

Cash transfer for elderly citizens

The government of Nepal has reduced the minimum age that is eligible for direct cash transfer. Now citizens aged 68 years old and above can avail the benefit of NPR 4,000 (USD 33). Earlier the minimum age limit was 70 years old.

Incubation centers

The budget has acknowledged the importance of research and development (R&D) as a total of NPR 260 million (USD 2.1 million) has been allocated to establish “Business Incubation Centers” in all provinces.

Outlook

Given that Nepal will graduate to become a developing country by 2026, the budget has provisions to make the maximum use of the existing concessions given to Nepal as a Least Developed Country. The policy of export promotion and import substitution by incentivizing the private sector will enhance industrial capacity. Support for agriculture will help in achieving a self-reliant economy and improve food security in Nepal. Such policies will be generating employment and help in poverty alleviation. Thereby provision in the budget will assist in utilizing the existing potential and enable the economy to realize high and sustainable growth.

However, despite inflation hitting 7.28% due to high crude oil prices, the expenditure plan of the budget, along with a hike in tax and duty for imported commodities and adjustment of income tax slab will additionally put pressure on inflation. The price of the essential commodity imported into Nepal is expected to be high in the upcoming year. Thus, GoN’s target to contain inflation by 7% in the next fiscal year may be difficult to achieve which may further translate into an inability to achieve the growth target.

Although the intention of the budget is in the right direction, GoN’s target to reduce reliance on imports by 20% in the next fiscal year seems unrealistic as imports increased by 69% in the first 10 months of the current fiscal year. The budget has not addressed the problems in remittance flow and its effective utilization through formal financial channels. A policy measure can be formulated to channelize remittance through formal channel for the investment productive sector.

Compiled by Ashish Gupta, Aspiring beed at Beed Management.

Ashish holds a Masters in Economics from the Jawaharlal Nehru University (JNU) in New Delhi. He has worked as an Intern at the Center for Policy Analysis, New Delhi and is interested in the field of economic development and research.