The government’s poor governance and slow revenue collection have resulted in dismal capital expenditure, which has further reduced the circulation of money in the market.

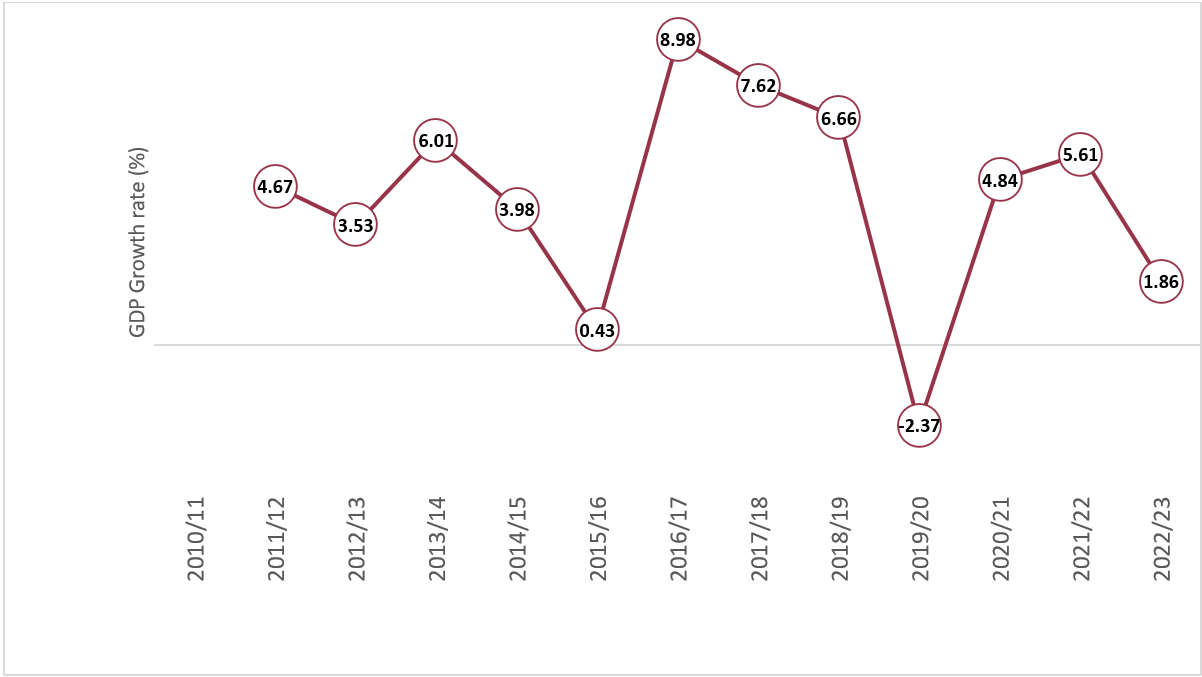

At the beginning of the current fiscal year 2022/23, the government had set an ambitious target of 8% economic growth. However, when the economy sputtered, reality set in, and during the budget’s midterm review, the growth forecast was cut in half, arriving at 4%. On May 2, 2023, the National Statistics Office (NSO) released the National Accounts Statistics, revealing a dismal state of Nepal’s economy. The Gross Domestic Product (GDP) growth rate at current prices for FY 2022/23 was estimated at 1.87%. This is the lowest since FY 2015/16 when it was at 0.43% following the earthquake and since the negative growth of -2.37% in FY 2019/20 caused by the COVID-19 pandemic. Likewise, this projection is much less than the 4.1% growth rate which was estimated by the World Bank and the Asian Development Bank (ADB). Based on the NSO’s forecast, Nepal’s GDP in 2022/23 is projected at NPR 5,381 billion (USD 41.18 billion). Likewise, the per capita GDP stood unchanged at USD 1399.

Figure 1: Nepal’s GDP Growth Rate at Current Prices

Source: NSO (2023)

Growth and Composition of Nepal’s Economic Sectors

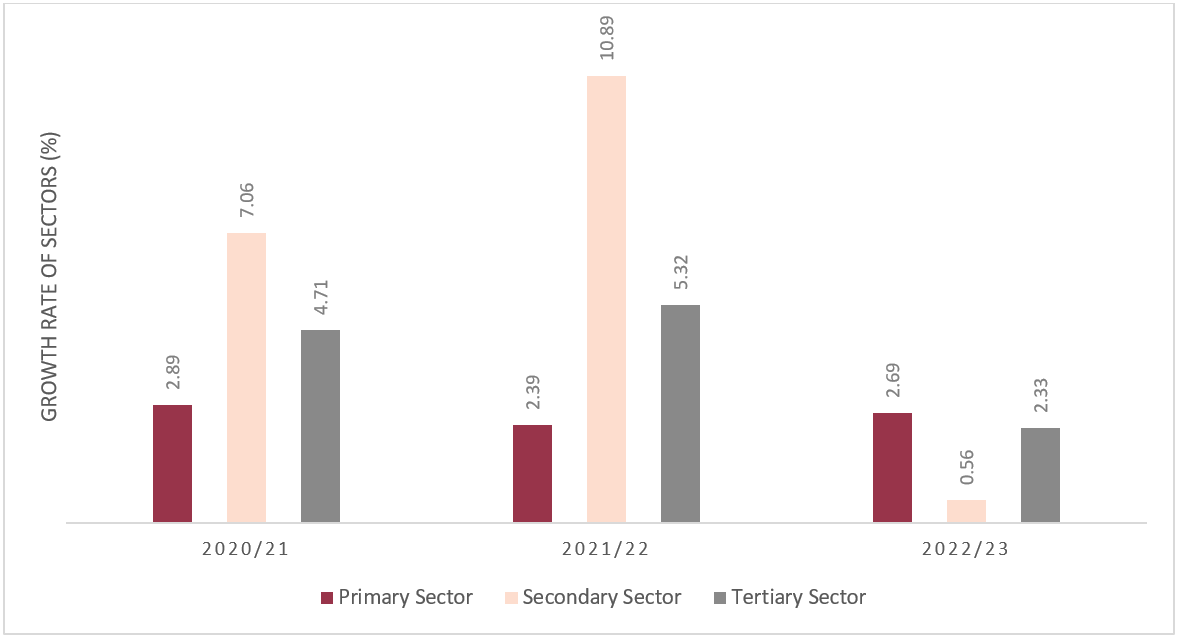

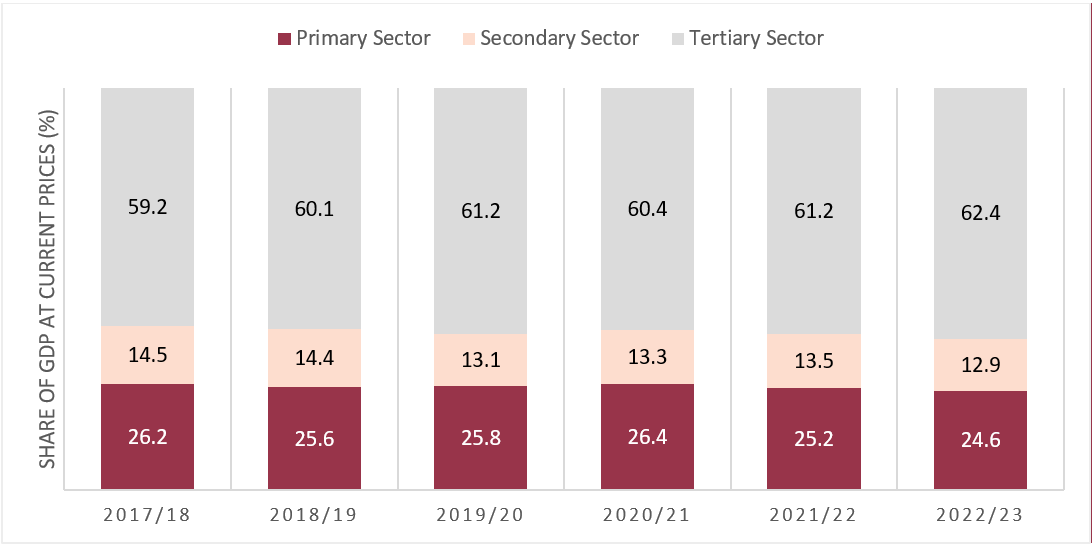

As per the national accounts statistics, the primary sector, i.e., agriculture is estimated to grow at a rate of 2.69% in FY 2022/23, a slight increase from 2.39% the previous year. Meanwhile, the growth of the secondary sector i.e., manufacturing, which was 10.89% in FY 2021/22, is predicted to slump to a mere 0.56% in FY 2022/23. Likewise, the tertiary or service sector is estimated to fall from 5.32% in 2022/23 to 2.33% in 2022/23. In terms of the economic sectors’ composition, the primary sector’s contribution to GDP is expected to be 24.6%, slightly lower than the previous year’s 25.2%. The secondary sector’s contribution is projected to decrease from 13.5% to 12.9% in 2022/23, while the service sector’s contribution is estimated to increase from 61.2% to 62.4%.

Figure 2: Growth of Economic Sectors at Basic Price

Source: NSO (2023)

Figure 3: Composition of Economic Sectors in GDP at Current Prices

Source: NSO (2023)

The Downturn of Nepal’s Major Economic Sectors

The slowdown in Nepal’s manufacturing, wholesale, and retail trade, transportation, mining, construction, and other sectors slowed this year’s overall economic growth. In comparison to a growth of 8.84% in FY 2021/22, the NSO forecasted that the mining sector would only grow by a modest 1.11% in FY 2022/23. Construction spending, which increased by 7.08% in the previous fiscal year, is predicted to decline by 2.62% this year. Similarly, compared to a growth of 7.46% in the previous fiscal year, the wholesale and retail trade sector, which contributes 15.39% to the country’s GDP, is forecasted to nose-dive by a negative 2.96% this fiscal year. Likewise, the growth of the manufacturing sector is expected to slow down by -2.04% in FY 2022–2023 as per the NSO. Nevertheless, the energy and tourism/hospitality sectors are predicted to experience a huge jump in FY 2022/23. The hospitality sector comprising accommodation and food services, which benefited from a slow but steady revival in the tourism industry and a rise in visitor numbers, is estimated to rise by 18.56%. Likewise, the energy industry, due to the increase in the production capacity of hydropower plants, is predicted to grow by 19.36%.

Table 1: Contribution and Growth Rate Forecast of Industries in 2022/23

| Industrial Classification | Contribution to GDP (%) | Growth Rate (%) |

| Agriculture, forestry, and fishing | 24.12 | 2.73 |

| Mining and quarrying | 0.51 | 1.11 |

| Manufacturing | 5.32 | -2.04 |

| Electricity, gas, steam, and air conditioning supply | 1.64 | 19.36 |

| Water supply; sewerage, waste management, and remediation activities | 0.46 | 2.16 |

| Construction | 5.52 | -2.62 |

| Wholesale and retail trade; repair of motor vehicles and motorcycles | 15.39 | -2.96 |

| Transportation and storage | 6.79 | 1.14 |

| Accommodation and food service activities | 1.98 | 18.56 |

| Information and communication | 1.97 | 4.07 |

| Financial and insurance activities | 7.37 | 7.29 |

| Real estate activities | 8.37 | 2.17 |

| Professional, scientific, and technical activities | 0.97 | 4.30 |

| Administrative and support service activities | 0.72 | 5.01 |

| Public administration and defense; compulsory social security | 8.15 | 5.30 |

| Education | 8.22 | 4.07 |

| Human health and social work activities | 1.92 | 6.51 |

| Arts, entertainment, and recreation; Other service activities | 0.59 | 5.21 |

Source: NSO (2023)

Reasons for the Current Economic Downturn

Consumer spending, which is a crucial measure of a healthy economy, is slowing down. This is partly due to inflationary pressures, which indicate a weakening economy that has dampened the market’s enthusiasm. The prices of essential commodities, such as rice, lentils, dairy products, edible oil, and vegetables, have since surged. In addition, transportation fares and fuel prices have increased. In mid-March 2023, the y-o-y consumer price inflation stood at 7.44% compared to 7.14% a year ago. While non-food and service inflation increased to 8.87%, food, and beverage inflation remained at 5.64%. Despite the new government taking office, the economy has been affected by a credit crunch, a slowdown in the real estate market, a falling stock market, and rising unemployment. The liquidity crunch in Nepal’s banking sector, combined with the central bank’s monetary policy aimed at controlling credit expansion, had a significant impact on businesses. These factors resulted in soaring interest rates, making it difficult for industries to repay their debts or encourage businesses to borrow money to expand operations. Banks were also restricted in giving credit to unproductive sectors, such as real estate and the secondary stock market, further affecting the flow of money in the market.

The government’s poor governance and slow revenue collection have resulted in dismal capital expenditure, which has further reduced the circulation of money in the market. The import ban, which was implemented last year to preserve foreign exchange reserves, along with the requirement of a 100% cash margin for Letters of Credit, has also affected consumption. As a result, the government’s revenue collection, which is largely dependent on import taxes, has been severely impacted. This has led to the government’s inability to pay contractors working on infrastructure developments, who, in turn, were not able to pay their suppliers and employees, resulting in lower demand and consumption in the economy. Foreign direct investment also hit a record low, falling sharply to NPR 1.17 billion (USD 8.94 million) in the first eight months of the FY 2022/23 from NPR 16.30 billion (USD 124.61 million) during the same period of the previous fiscal year.

With the majority of Nepal’s economic sectors experiencing a slowdown, the country is essentially compelled to finance its expenses through external borrowings with conditionality, which might push the country into a vicious cycle of borrowing more to pay off the existing external debt.

Outlook

The easing of import restrictions, the gradual lowering of interest rates, the decreasing cost of inputs like fuel, the relaxation of real estate and housing restrictions, and the positive outlook for tourism and the inflow of remittances – all point to a possible acceleration of economic activity in the years to come. The key to combating the current economic crisis will be improving domestic resource mobilization, timely capital budget execution by the government, and enacting strong policy adjustments to increase private sector confidence. Furthermore, given the severity of the crisis, political stability and collaboration among political parties on reviving the sluggish economy, creating jobs, and freeing up public spending is extremely important.

Sugam Nanda Bajracharya is an MBA graduate from Stamford International University. Currently, he is working as a Beed at Beed management and a Research Associate at Nepal Economic Forum. Sugam works actively with the private sector and development partners on topics related to trade, sectoral studies, economic policy research, policy and strategy development.